-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Alexis Crow and Samir Saran, “The Geopolitics of Energy Transition: A Guide for Policymakers, Executives, and Investors,” ORF Special Report No. 174, December 2021, Observer Research Foundation

Introduction

As the price of natural gas reached record highs in the UK and Europe—trading at the equivalent of $200 per barrel of oil,[1] and as economic activity in China has been curtailed by the country’s power supply crunch, central bankers and policymakers from across the globe are forced to confront significant challenges to price stability, with a focus on shielding households and businesses from an increase to the cost of transport and basic goods, while monitoring the potential for price pressure and supply chain bottlenecks to upend the global economic recovery. This is important at this time, for the ripple effects of disruptions to energy markets could amplify social and political fissures that are visible across the global landscape, and which might portend complex domestic politics as many countries head into elections in 2022.

Surging demand for natural gas—and shortages and bottlenecks to supply—have resulted in a corollary demand for oil products (referred to as gas-to-oil switching), thus driving up the price of WTI crude to seven-year highs.[2] The skyrocketing commodity price environment has led one observer to point to the “revenge of the old economy”, according to which the collective noble efforts to move toward a cleaner, greener future fuelled by renewable energy have been stymied by a recent past of inadequate investment into the capacity and infrastructure of the hydrocarbons that power our economies.[3]

Thus, even as COP26 has drawn to a close, and as policymakers, business leaders, and investors have left Glasgow with firm commitments to ostensibly advance the decarbonisation agenda, we are reminded of the extent to which our entire energy infrastructure still hinges upon the use of fossil fuels. This includes oil used for transport or power generation, or natural gas (or coal) for power generation, as well as natural gas deployed as “bridge fuel” to support the growth of renewable energy, including wind, solar, and hydrogen. This is effectively captured by what transpired in Germany earlier this year. In the first six months of 2021, the country increased its coal-based generation, which contributed 27 percent of the country’s electricity demand.[4] The need to resort to coal-fired power generation is not unique to the case of Germany: the US has also posted the first annual increase in coal use for power generation since 2014.[1] The combination of an asynchronous economic recovery, attendant shocks to demand, curtailments of supply, and surging prices in natural gas are contributing factors to rich income countries’ pivoting toward the use of coal. This illustrates one stark reality: hydrocarbons continue to underpin our global energy infrastructure.[5] For all the talk of “stranded assets” and potential “dinosaurs of investment”,[6] hydrocarbons still compose the lion’s share of energy consumption on a global basis.[7]

What are the lessons to be learned from the recent power crunches? And what are the potential macro, socio-economic, and geopolitical implications as we navigate the energy transition? Amidst so much uncertainty and volatility, where are the opportunities for accord, as well as bright spots for investment?

Humility is also requisite as governments confront their energy interdependence with one another: again, despite record growth in renewable energy capacity,[8] and surging climate financing, countries within the European Union are poignantly aware of their dependence upon natural gas imports—whether from Russia, Norway, or the US. And even despite its own domestic shale and conventional oil and gas production, the US continues to import hydrocarbons from countries such as Canada, Colombia, and Saudi Arabia. Similarly, even despite trade tensions, resource ties still bind China with Australia, with the latter having exported a record volume of natural gas to China in 2020.[9] Thus, geopolitics remains at the very heart of the changing energy landscape. The inverse is also entirely true.

In the past, resource ties have been a source of tension; but, as we shall see, such bonds also have the potential to become a geopolitical salve, provided that the relationship is designed to be mutually beneficial to both parties. As we navigate the path toward net zero, and by seeking balance and diversification, our continued energy interdependence can actually spur opportunities for cooperation amongst policymakers, and for long-term investment and profit generation for enterprises and economies around the world.

Geopolitics and fossil fuels: tension and salve

The quest for resources to fuel industrial growth, military campaigns, and transport and urbanisation lies at the very heart of geopolitics. In considering the relationship between energy and geopolitics, the existence of resources is often associated with tension, be it in the form of border disputes, armed conflict, trade disputes resulting in embargoes, or interstate conflict or war. Access to strategic reserves of coal in Romania was a pivotal part of the campaign on the Western front during the Second World War. During the 1970s, energy-importing countries experienced the oil shocks related to the OPEC crises in the wake of the Arab-Israeli War, the Yom Kippur War, and the Iranian Revolution.[10] Indeed, research shows that if a resource-rich country has an endowment of oil along its border with an “oil-less” country, then the probability of conflict between these two countries is higher than if there were no oil at all.[11] Recent data also indicates that the presence of onshore oil might even portend a higher rate of conflict than the presence of offshore oil, as the potential for production and output to be seized by rebel groups is far higher on land than it is in deep-sea projects.[12]

And yet, while asymmetric access to resources might spur tensions between countries, it can also be a geopolitical salve, by underpinning ties of trade, development, and civic diplomacy and even employment. Japan’s quest for resources to fuel its extraordinary manufacturing era from the 1960s onwards resulted in a mutual export of ODA (overseas development assistance) to southeast Asian countries such as Vietnam. One might also argue that Israel’s relatively recent discoveries of natural gas—and successive exports to Egypt—have also underpinned a normalisation of relations with Cairo, — a diplomatic rebalancing which has also been a key facet of improving relations between Israel and the UAE.

A crude awakening: our enduring energy interdependence, and continued reliance upon fossil fuels

Such positive examples of resource ties are swiftly forgotten in times of crises. The underlying conditions that led to positive benefits to the political relationship in these two instances are also ignored. And so it is with the present power crunches ricocheting across the globe. With the asynchronous reopenings of economies in the wake of the COVID-19 pandemic—and amidst ongoing disruptions to supply (be it from underinvestment in hydrocarbons, weather-related events such as flooding, pandemic-induced stoppages to production, or port congestion)— we are reminded not only the extent to which our economies depend upon fossil fuels for power generation and for transport, but also, of the extent to which many countries remain deeply interlinked in patterns of energy interdependence.

The European dilemma regarding natural gas supply from the Russian Federation is instructive, but it must also be recognised that energy interdependence cuts both ways. As long as Russian gas is a competitive source for energy, then energy-hungry European manufacturing powers will need to engage with the leadership in Moscow; equally, as long as Europe has access to alternative sources of fossil fuels – even if not as cheap – Russia will need to retain an understanding of European red lines. This is what interdependence means. This insight is equally applicable to the energy interconnections of the future: China can be a useful partner in the energy transition, even if it is not the only one.

Indeed, for some policymakers, part of the allure of developing domestic renewable energy capacity was that it ostensibly would lead toward more enhanced energy independence. Ostensibly, extraordinary efforts in diplomacy might not be needed in such a green future, as countries would, in theory, no longer be reliant upon conflict-ridden territories to secure energy supply. Even in a net-zero future, this is perhaps to view the world through rose-coloured glasses: for the development of wind, solar, and hydrogen energy—or indeed techniques of greater energy efficiency—at an affordable cost is intrinsically related with garnering supplies, inputs, R&D, and human capital from different jurisdictions. Overly halcyon scenario-planning for domestic renewable energy capacity development often fails to incorporate these facts.

The shift from fossil fuel-based to renewable energy capacity does not end interdependence; it merely pushes interdependence to a different part of the energy mix. The dependence now shifts from hydrocarbons to metals and from ores to rare earths. Countries in Africa, Asia, Americas and Australia are likely to emerge as global mineral hubs, and the routes to ship these new commodities might pave new geostrategic highways.

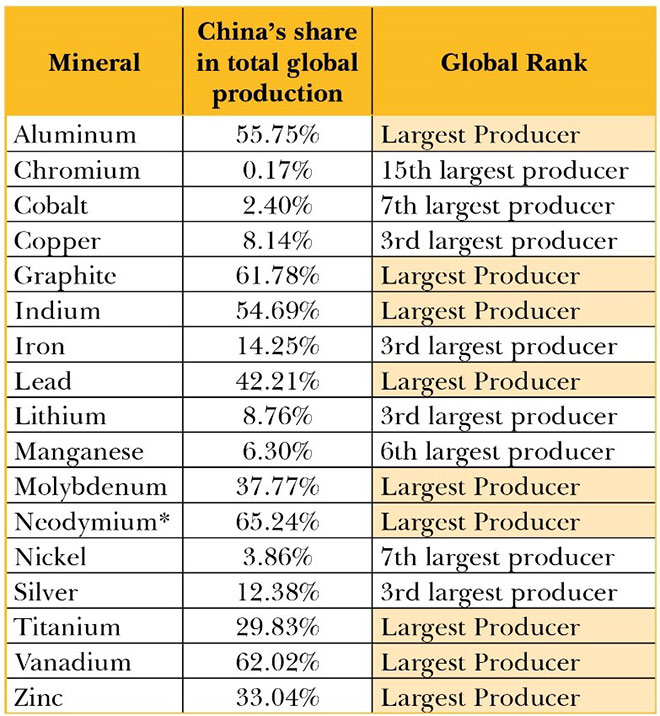

In recent years, control over the production of rare earths has become a familiar site for geopolitical tension. In 2021, the Biden administration in the United States ordered a review of the country’s critical mineral supply chain; the recommendations included prioritising development financing for “international investments in projects that will increase production capacity for critical products, including critical minerals”.[13] The administration’s concern is readily understandable, as shown in Table 1.

Table 1: China’s share in the rare earths supply chain

*Disaggregated data for neodymium was not available; the data for Rare Earth Concentrates (REO) has been used since neodymium is a rare earth metal.

Yet it is not just production of rare earths that will be relevant, but also the locations of their processing and other forms of value addition. These might emerge as the equivalent of present-day refineries and petroleum complexes, and their distribution potential linked to key consumption centres might lead to the birth of new geostrategic lynchpins such as the Straits of Malacca and of Hormuz. The notion that domestic renewable energy production would free countries from the intricacies of dependence is misguided – and a seminal mistake if it was to be the basis of new energy order.

Sunset on Malthus?

Part of the reason why the aspiration of energy independence retains its sheen is that our energy economics and policymaking continues to be suffused with a Malthusian legacy.[14] Said another way, the spectre of scarcity continues to inform the way we think about energy and resources. The fear that “there will never be enough” renders misgivings about dependence—or else outright denial. A sense of energy insecurity –no matter how much it is brushed under the rug might also prompt a premature and imprudent vaunt into a disorderly energy transition, with a disproportionate focus on bolstering capacity at home. Such a policy would have little regard for the fact that climate change has been branded as humanity’s largest negative externality: in order to mitigate the situation, global actions ought to be in concert. Humility is thus needed not only in recognising the endurance of hydrocarbons within the energy mix, but also, but it is also implicit in our interconnectedness as we navigate the green transition. For the rich income countries, part of this humility also requires understanding the various ways in which the energy transition has the potential to deepen the chasm between the ‘haves’ and the ‘have nots’.

The haves and the have-nots: is the energy transition deepening the chasm?

The energy transition has the potential to create a deeper chasm between the standings of the ‘haves’ and the ‘have nots’ in the global macroeconomic environment. First, if we consider the traditional trajectory of industrial growth—that is, from agrarian activity to textile production, and then from heavy industry to light manufacturing, eventually segueing to services-oriented economies—the case can be made that for developing countries earlier on the maturity curve (such as Vietnam and India), stringent measures toward decarbonisation might actually thwart what would otherwise unfold as a full evolution of robust domestic industry. For the ‘price takers’ and for commodity-hungry countries, this might take the shape of premature restrictions on access to or use of resources to fuel domestic manufacturing activity.

And for the ‘price makers’—that is, commodity-rich exporting countries—the case can also be made that swift or unrealistic moves toward decarbonisation might rob oil and gas exporters from a significant base of output as well as a source of gross national income. In a country in which resource wealth underpins GDP, export activity, employment (both directly related to exploration, extraction and production of natural resources, as well as indirectly, via civil service salaries), national income, and sovereign and pension funds, the potential for social fissures to either manifest or to be exacerbated is clear.

It should be noted that history indicates that access or proximity to natural resources is not perfectly correlated with a trajectory of sustainable economic growth—hence the “Dutch resource curse”. Research from Brazil also indicates that oil endowments within a province or a municipality do not necessarily result in improved livelihoods for members of that community.[15] Indeed, even in a lofty commodity price environment, such as at present, windfalls potentially reaped from higher export prices of oil and gas do not always translate into higher incomes for households within the exporting country.[16]

This tension between environmental and the development agendas within emerging markets and developed economies (EMDEs) is also evident in the debate surrounding the potential carbon border adjustment tax (CBAT), as well as recent agreements on deforestation in COP26.

Home game: mitigating the domestic bias of climate finance

An effective, secure energy transition is currently undermined by the “domestic preference” evident within the realm of climate finance. In recent years of tracking climate finance flows, data from one leading industry body evidences that 76 percent of capital is invested in the same country in which it is sourced.[17] Thus, despite various commitments and guarantees from bodies such as the G7 or the G20, a significant challenge remains regarding the ability for much-needed climate finance to cross borders.[18] Certainly, a long-running trend of a domestic bias for investment is not limited to climate and infrastructure investments. Rather, it extends across sectors and asset classes, including real estate, energy, private equity, and venture capital. Whilst managing ‘sticky capital’ and the prospect of generating long-term returns, and building up enterprise and asset values, investors might harbor an inclination to place their money close to home—in other words, “where home-country risks are well-understood.”[19]

As these authors have highlighted previously, playing close to home in infrastructure investing may not always be the least risky option.[20] And yet, we have already motioned that the dawning age of renewables is not one of energy independence, but of a new kind of interdependence. Policymakers operating under the illusion of energy sovereignty are otherwise missing out on the opportunity to cultivate positive structures of interdependence which could potentially support their own geo-strategic aims – such links, might, in turn, spur opportunities for private investment.

Thus, we might witness a shift in incentivisation for private finance and the climate problem: such that sticky capital not only supplies the domestic market, but that it is directed outwards as well, perhaps even towards the geographies where host countries of finance might find mutually beneficial resource ties – such as the model of Japan and ODA in Southeast Asia, discussed earlier. As argued above, interdependence can be a salve for geopolitics as long as both sides gain in the energy or in the development equation. Such a value exchange – or what Michael Oakeshott refers to as an “enterprise association” – rests upon an understanding of interdependence – again, something that has been jettisoned in the lack of humility in the energy transition (something which is mirrored in the “domestic bias” of climate capital).

Such misconceptions have the potential to divert policymakers from a future of true sustainability, which involves the creation of resilience through diversification. Redirecting long-term flows of investment—including private capital—towards emerging market/developing economies will not necessarily be easy. Large sources of private capital in the global north – whether institutional capital or banks – will need a fresh set of incentives to invest in the energy supply chains of the future.[21]

Moreover, recognising that these investments will likely be in new minerals, new processes, and new geographies, it is clear that old regulatory risk models may no longer be suitable. New market mechanisms to help enable a level playing field of investment in new energy materials are needed—which might take inspiration from the industry bodies which have developed over time in support of oil markets around the globe.

Conclusion: The Green Marshall Plan

The scale of the rebalancing required – of investment, attention, and financial flows – is vast. If anything, it should be compared to the Marshall Plan. That enormous effort, after all, had both pragmatic and idealistic motivations. On the one hand, it was necessary to assist a Europe devastated by war; on the other, it was essential that a liberal community be built that was strong and resilient in the face of the Soviet challenge. There are similar overlaps today between the realist search for security and the idealist requirements of climate action. A Green Marshall Plan has the potential to both stabilise international relations and create the diversification and resilience necessary to allow for durable interdependence during the energy transition.

For the energy transition to act as a geopolitical salve rather than as a source of discord, a Green Marshall Plan must have four characteristics.

First, it should be genuinely global in character. A global net-zero approach would understand that some regions might take longer on the fossil fuel transition because of the specifics of their development or their energy landscape. Nor should geographical factors be ignored: An archipelago like Indonesia will take longer to transition to solar energy and away from natural gas than a continental country.

Second, legacy energy infrastructure will need attention to help enable the success of the Green Marshall Plan, to make it implementable, and to scale it. As is evident in energy consumption patterns across the globe, fossil fuels remain a part of the energy mix, and a way of working toward a balanced and global green transition. Nor can sectors like mining be ignored: the Green Marshall Plan will likely have to go into a “dirty” sector, invest in new ways of mining and new materials to mine.

Third, the Green Marshall Plan is not just about blue-sky research into the possibilities of the future. It is about increasing investment in nuts-and-bolts manufacturing in underserved geographies as well – whether energy efficiency in the Asian steel producers of the future or new cobalt mining technologies in sub-Saharan Africa today. It is about enabling development of critical frontier technologies, as well as swiftly and sustainably spreading a green ‘know-how’ which is globally benchmarked.

And fourth, the Green Marshall Plan should embed energy resilience at its heart. Areas which have sped up their energy transition are those where it is seen as assisting in energy security. As these authors argued, dependence on a single source or vendor is antithetical to achieving long-term and sustainable energy security. As such, the strategic mapping of a secure energy future cannot exclude a China, with its strong presence in the rare earths supply chain, or a Russia with reserves of natural gas, or the countries of the Gulf, abundant in oil and gas reserves. Again, humility as well as diversification might render each actor a more responsible and empathetic participant in the global energy transition.

What we are recommending is an all-inclusive future. That will require the leaders of key nations to invest political capital in a new institutional framework that supports the energy landscape of the future. The International Energy Agency, OPEC, commodity exchanges and others defined and shaped the hydrocarbon world. The global energy transition requires new frameworks, organisations and political arrangements to underwrite our common journey ahead, which reflect the needs of multiple stakeholders, in both the private and public spheres. The G7’s B3W, the European Union’s Global Gateway, and the Indo-French International Solar Alliance all point to one imperative: of green arrangements underwriting green transitions. The world needs a new institutional structure: one that keeps the lights on in the 21st century.

Dr Alexis Crow is Visiting Fellow at ORF.

Dr Samir Saran is President of ORF.

Endnotes

[1] Today in Energy; Annual U.S. coal-fired electricity generation will increase for the first time since 2014.

[1] David Sheppard and Tommy Stubbington, “Record gas prices hit bonds as investors fear wider damage,” Financial Times, October 6, 2021.

[2] Stephanie Kelly, “Oil prices reach multi-year highs on tight supply,” Reuters, October 26, 2021.

[3] Jeff Currie, “The revenge of the old economy,” Financial Times, October 21, 2021.

[4] “Germany: Coal tops wind as primary electricity source,” DW, October 13, 2021.

[5] See also, Vivan Sharan and Samir Saran, “India’s Coal Transition: A Market Case for Decarbonisation,” ORF Issue Brief No. 505, November 2021, Observer Research Foundation.

[6] Steve Fuller, “Are fossil fuel companies a dinosaur of an investment?” Ellsworth American, February 14, 2015.

[7] “Statistical Review of World Energy,” 70th Edition, 2021, p. 12.

[8] Elizabeth Ingram, “World adds record new renewable energy capacity in 2020,” Renewable Energy World, June 4, 2021.

[9] Damon Evans, “Australian LNG exports to China hit record,” Energy Voice, August 8, 2021.

[10] Daniel Yergin, The Prize: The Epic Quest for Oil, Money & Power (US: Simon & Schuster, 1990).

[11] Francesco Caselli, Massimo Morelli and Dominic Rohner, “Asymmetric oil: Fuel for conflict,” VOX EU, July 19, 2013.

[12] Andrea Tesei, Jørgen Juel Andersen and Frode Martin Nordvik, “Oil price shocks and conflict escalation: Location matters,” VOX EU, October 26, 2021.

[13] “FACT SHEET: Biden-Harris Administration Announces Supply Chain Disruptions Task Force to Address Short-Term Supply Chain Discontinuities,” The White House Statements and Releases, June 8, 2021.

[14] For an excellent discussion of how Malthus continues to cast a long shadow on economics in advanced economies, see J.K. Galbraith, The Affluent Society (US: Houghton Mifflin, 1958).

[15] Francesco Caselli and Guy Michaels, “Oil windfalls and living standards: New evidence from Brazil,” VOX EU, January 20, 2010.

[16] Bryan Harris, “Brazil’s GDP surges back to pre-pandemic levels,” Financial Times, June 1, 2021.

[17] CPI 2019, 2020, 2021.

[18] Sophie Yeo, “Where climate cash is flowing and why it’s not enough,” Nature, September 17, 2019.

[19] Barbara Buchner, Alex Clark, Angela Falconer et al., “Global Landscape of Climate Finance 2019,” Climate Policy Initiative, November 2019.

[20] Alexis Crow and Samir Saran, “Geopolitics and investment in emerging markets after COVID-19,” World Economic Forum, September 25, 2020.

[21] IANS, “Modi’s supply chain mantra: trusted source, transparency and time frame,” Business Standard, November 1, 2021.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Dr Alexis Crow is Partner and Chief Economist of PwC US. A global economist who focuses on geopolitics and long-term investing, she works with the ...

Read More +

Samir Saran is the President of the Observer Research Foundation (ORF), India’s premier think tank, headquartered in New Delhi with affiliates in North America and ...

Read More +