Solar, wind, and other forms of renewable energy (RE) excluding hydro and nuclear power accounted for 30 percent of total power generating capacity and about 14 percent of total power generated in 2022-23. RE was the second largest after coal in terms of both, power generation capacity and power generation. In the coming decades, the share of RE capacity and power generation is expected to increase exponentially. This shift away from coal towards RE for power generation is presented by the media and academia as a transition to a lower-cost system that will reduce and eventually eliminate emission of carbon and other local pollutants and also serve as a means to reduce electricity tariffs and renew Indian power utilities (distribution companies or Discoms). The underlying argument is that once Discoms replace the expensive long-term power purchase agreements (PPAs) for coal-based power with short-term, flexible and low-cost PPAs for RE-generated electricity, not only will it reduce electricity tariff benefitting consumers but also wipe out financial woes of Discoms. Basic electricity economics and market-oriented Discom restructuring efforts may undermine these expectations.

Electricity economics

The economics of electricity is shaped by the laws of physics. Laws of electromagnetism that capture the physics behind the generation of electricity limit storage, transmission and flexibility. Since storage and flexibility (available in primary energy forms such as oil) are complex, electricity must be seen as a heterogeneous good in time and space. In plain language, this means that one cannot say that ‘electricity is electricity’ in the same way we would say that ‘milk is milk’. In India electricity generated during peak demand time of 6 am or 6 pm is more valuable than electricity generated at 12 am or 12 pm when demand is low. Electricity generated by solar panels in Delhi which is a large and concentrated load centre has a different value from electricity generated by similar solar panels in a desert in Rajasthan. In both cases, the short-run marginal cost of electricity generated is close to zero but the marginal value of electricity generated in Delhi is much higher. Electricity that can be switched off and on at will has greater value than electricity that cannot be switched on and off easily. The same is true at the upstream end where different primary sources such as coal and solar produce different goods with different heterogeneity and marginal value. These attributes are not taken into account in evaluating the relative merits of electricity with different marginal values and costs. This contributes to the narrative that the low-carbon transition is also a transition towards a low-cost system.

Electricity generated by solar panels in Delhi which is a large and concentrated load centre has a different value from electricity generated by similar solar panels in a desert in Rajasthan.

Poor Economics

If RE power developers are reliant exclusively on market forces to recover all their costs, they are very likely to lose money. The case of decentralised (off-grid) solar power generation projects operating in rural areas of India validates this claim. Even in cases where the project receives capital funding in the form of a grant or aid, the tariff for stand-alone solar power with storage is comparable or higher than that for diesel-based generation. Dharnai village in the district of Jehanabad in Bihar was declared to be energy independent in 2014 when a 100-kW (kilowatt) solar micro-grid project set up by Green Peace started supplying electricity to over 2000 people in the village. Today the power station is a “makeshift” cattle shed. The solar energy micro-grid introduced in the remote islands of Sundarbans by the Government of West Bengal in partnership with the private sector was hailed as an example for the rest of the country a decade ago is now abandoned. Most of the rural poor households shifted to dependable and convenient grid-based electricity in both cases. The poor economics of stand-alone solar projects that do not have the backup of grid-based electricity or the strength of financial aid and the economics of the poor that place greater value on convenience and cost explain why less than 3 percent of solar projects operating in India are off-grid projects. Grid-connected projects free-ride on the system designed for conventional power that has sufficient capacity to meet the highest (peak) demand and is also flexible enough to change output of generation in response to changes in demand.

The fate of off-grid RE projects suggests that the transition to low-carbon electricity is not a move towards a lower-cost system. It also shows that recovering the additional costs involved in RE power systems from the taxpayer or the ratepayer (electricity consumer) is likely to be difficult in India. In Europe and California where the share of RE power is high, the higher costs are passed on to consumer bills which have been going up even though wholesale market prices have been going down. This has resulted in a gap between market prices and underlying costs and a gap between wholesale market prices and consumer prices.

Pricing or taxing carbon improves the economics of RE power but in India, RE power generation remains policy-driven. RE developers receive support through capital subsidies, viability gap funding, feed-in-tariffs, waiver of transmission charges, “must-run” status and other government support mechanisms. The low tariff quoted in RE auctions in India reflects both the low cost of capital and the low and negligible marginal cost of producing solar energy. Unlike conventional generators, RE generators are neither expected to be flexible enough to meet changing demand nor are they expected to maintain sufficient capacity to meet peak demand. This means that RE generators do not have to price these attributes in their tariff calculations. Must-run status allows RE power to get on and off the grid as per convenience irrespective of changes in demand at the retail end. As RE developers are not reliant on the market, they can ignore the weak ‘market’ signals that say that there is unwanted capacity in the system resulting in curtailment of RE power.

The low tariff quoted in RE auctions in India reflects both the low cost of capital and the low and negligible marginal cost of producing solar energy.

Most importantly the introduction of levelised cost of energy (LCOE) as the metric to decide the competitiveness of power generation from different primary sources of energy has favoured RE power. LCOE is essentially the expected real total cost (capital plus operating costs) per MWh (megawatt hour) produced over the generating unit’s expected life. The use of LCOE comparisons emerged during the period when electric generating plants were subject to cost-of-service regulation in developed country electricity markets. LCOE comparisons are a misleading metric for comparing intermittent and dispatchable generating technologies because they fail to take into account differences in the production profiles of intermittent and dispatchable generating technologies and the associated large variations in the market value of the electricity they supply.

Discom economics

In 2022-22 the accumulated loss of Distribution companies was over INR5 trillion and the net negative net worth was over INR553 billion. Most of the financial restructuring programmes launched by successive governments have focussed on pushing Discoms to embrace market forces and reduce losses. The restructuring initiatives in the last decade began with the Ujwal Discom Assurance Yojana (UDHAY) programme in 2015 that restricted Discom access to advance short-term debt from banks to finance losses arising from the ACS-ARR gap. The ‘reforms-based and results-linked, revamped distribution sector’ (RRRD) scheme launched in 2021 sought to reduce AT&C (aggregate technical & commercial losses) of Discoms to pan-India levels of 12-15 percent by 2024-25 and to reduce ACS-ARR gap to zero by 2024-25. Late payment surcharge (LPS) imposed on Discoms that have not paid dues one month after the due date of payment or two and half months after the presentation of power bill, whichever is later, now attract regulation of power as laid down in the LPS rules, 2022. Regulation of power could mean, at the extreme, complete withdrawal of power supply by generating companies and phased reduction in access to transmission. Discoms that are mandated to purchase electricity generated from RE sources will incur higher costs such as investments in back-up and storage and investment in transmission lines. As the volume of RE power in the system grows, the tension between policy-driven RE and market-driven Discom reforms could grow. This could effectively make Discoms non-renewable.

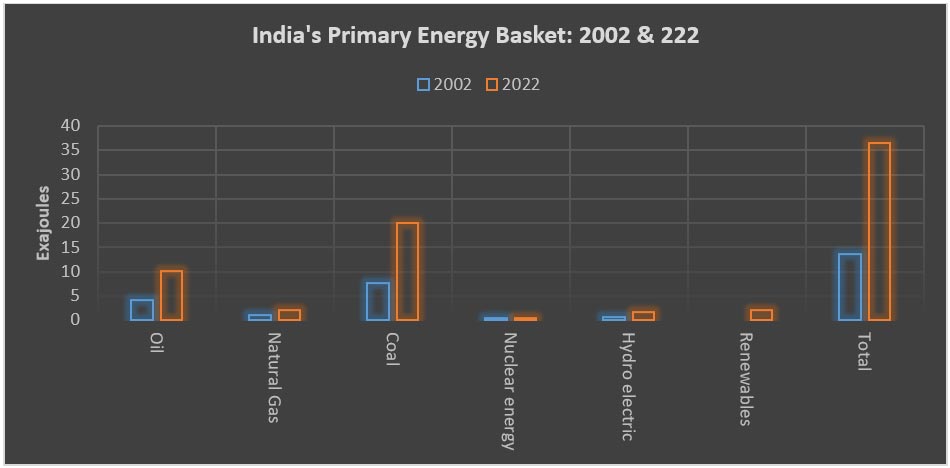

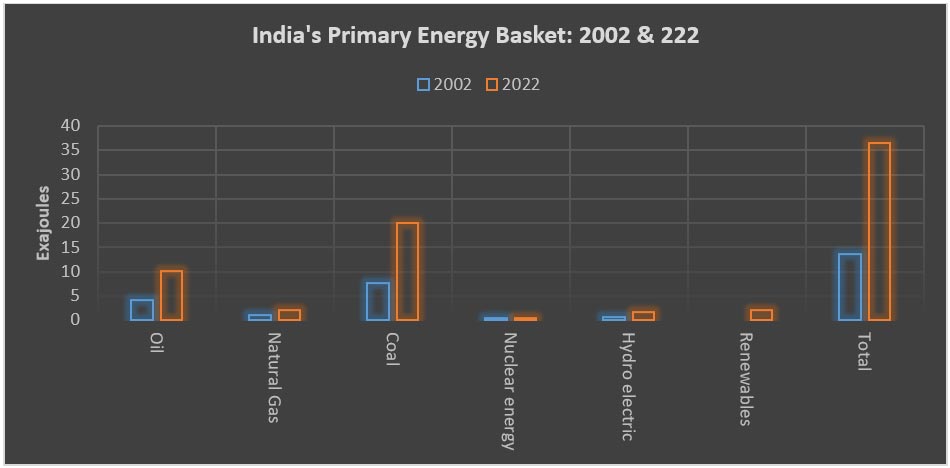

Source: Statistical Review of World Energy 2003 & 2023

Lydia Powell is a Distinguished Fellow at the Observer Research Foundation.

Akhilesh Sati is a Program Manager at the Observer Research Foundation.

Vinod Kumar Tomar is a Assistant Manager at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV

.png)

.png)