INTRODUCTION

India-Nepal relations have remained relatively strong over the years due to various factors such as geographical proximity, similar cultural and religious identities, and more importantly, economic cooperation. India was one of the first countries to assist Nepal in its development agenda , setting up the countr y's first development cooperation mission in 1952. Initial investments and assistance were provided for hard infrastructure projects such as roadways and airports. Since then, assistance has been extended to various other sectors including development of hydropower, hospitals and healthcare facilities, educational institutions, and railways. India has also helped in transfer of technology and protection of heritage sites in Nepal. The Indo- Nepalese development partnership was renewed in 2003 through small development projects. Conceived as low-investment and short-gestation projects, these were initiated to improve the social and physical grassroots infrastructure in Nepal.

A considerable portion of India's development assistance to Nepal has been in the hydropower sector, which is the country's primary source of electricity. As a result of the assistance, Nepal constructed the 20-megawatt (MW) Trishuli Hydropower Project in the 1970s and the Devighat Hydropower Project in 1983. Other projects such as Surajpur Power Project, Katya Power Project and the Pushrekhola Project have also received assistance from India. LOCs from India have been extended to many of these power plants for improvement and maintenance. As a component of the Small Development Projects (SDP) programme, micro-hydroelectric projects have been used to bring electricity to remote areas.

Following Prime Minister Narendra Modi's visit to Nepal in 2015, India has further extended LOCs worth $ 1 billion to its neighbour. Modi has proposed the initiation of a new model for development called the Highways, I-ways and Transways (HIT) model. The HIT model will be a grant for infrastructure development and energy projects and can be used for either, as seen fit by the Nepal government.

LOCs are one of India's flagship official development assistance (ODA) programmes that provide a unique demand-driven form of assistance to countries to fulfil their development agenda. The LOC programme started in 2003 and has been instrumental in expanding India's economic diplomacy programme as well as strengthening its strategic ties with recipient countries.

The Export and Import (EXIM) Bank of India and the Development Partnership Administration offer LOCs. A recipient country identifies projects necessary in its overall development strategy and requests the Indian government for monetary and resource assistance for completion of those projects. After reviewing the viability and impact of a potential project, the Indian government may extend an LOC with certain conditions. These conditions can vary, but for infrastructure projects, these usually involve contracting Indian companies for implementing or constructing the project. The conditions also require Indian companies to be selected for procurement of equipment and for impact and evaluation. It must be noted that the only ODA aspect of the LOC is in the form of the grant element each LOC has built into it, wherein a percentage of the LOC (ranging from 34.4-56.4 per cent) of the total value of the project does not need to be repaid. The concessional credit offered in the LOC programme is usually benchmarked at accepted LIBOR rates, with standard interest rates depending on the economic level of the country, a moratorium period and a credit period.

The LOC programme has been largely successful, especially in Africa and South Asia. As of 2015, 48 countries in Africa had active LOCfunded projects; in South Asia, except for Pakistan, LOC-funded projects are ongoing.

Given this spread of LOC programmes, it is imperative to assess their impact in the South Asian neighbourhood. India regards Nepal, for example, as a key neighbour and as such would like to make heavy investments in its development. This paper aims to provide an assessment of the LOC programme in Nepal, its successes and challenges, and provides some policy recommendations to enhance the impact of the initiatives of the Indian government. The paper also provides a brief overview of the electricity situation in Nepal, and the Rahughat hydropower project, and analyses the impact of the project. Specific policy recommendations are made, to help stakeholders achieve the maximum potential gain from India's LOC programme.

NEPAL ELECTRICITY SITUATION: AN OVERVIEW

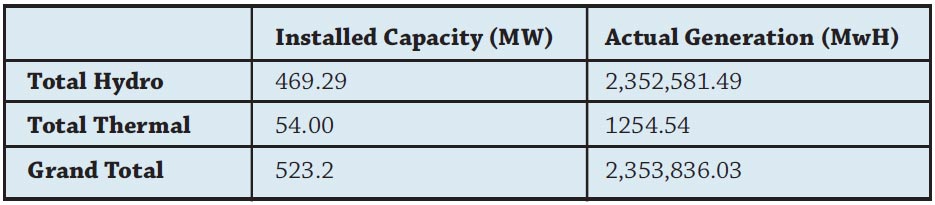

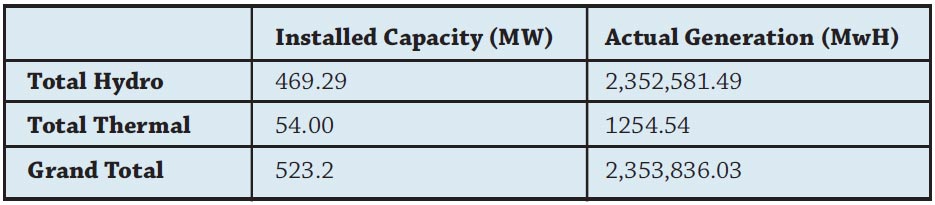

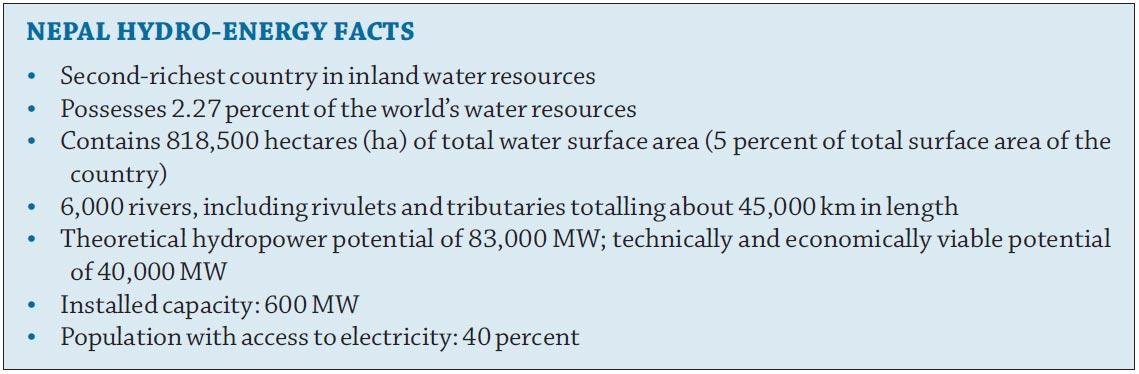

Nepal's electricity supply ranges between 750 MW and 1,140 MW, and grows annually by 7.56 percent. The country does not export any electricity, but it imports about 200 MW from India. Of the power supplied, 482.2 MW was from hydro sources (public and private) and 221.1 MW was imported from India. A small percentage of actual power supplied came from thermal sources. According to the Nepal Electricity Authority (NEA), Nepal currently needs 28 million electricity connections.

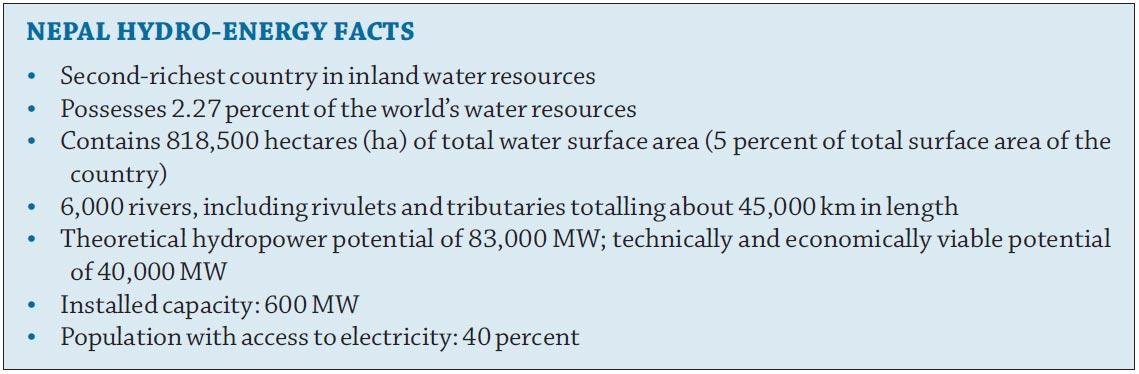

Nepal's hydropower potential in terms of generating electrical energy of approximately 727,000 Gigawatt hour (GwH) is one of the largest in the world. If tapped efficiently, this vast resource will not only make Nepal a self-sufficient energy economy, but it can also make the country one of the few large-scale energy exporters in the region.

Source: Nepal Hydropower Facts, Hydroelectricity Investment and Development Company Limited (HIDCL)

NEPAL-RAHUGHAT HYDROELECTRIC POWER PLANT

India, through its EXIM Bank, extended an LOC to Nepal in 2006 for the construction of the 32-MW Rahughat Hydroelectric power plant. The project was scheduled to be completed in 2016. The power plant is located on the river Rahughat in Galeshwor, near the district headquarter Beni, in Myagdi district in Western Nepal's Dhaulagiri zone. The project is 290 kilometres (km) from Kathmandu and 90.4 km from Pokhara.

The project envisions the generation of 187.66 GwH of power and is estimated to cost $ 67 million, which is being covered by the LOC. Of the total amount, $31 million is for civil work and construction, which includes building of headworks, de-sander, a 6.1 km-tunnel, inclined shaft, powerhouses and tailraces. The remaining $36 million is for electro-mechanical, hydromechanical, transmission and consultancy services. There are also plans to connect a 132 kVtransmission line to the Modi-Substation.

Camp facility work includes construction of 14 buildings, a 12.5 km-access road, contractor's camp, army camp, crusher plant, and various excavations. The Nepal government has acquired 30 ha of land for the project, and it is estimated that 1,400 trees will need to be cut down for space requirements. NEA, the authority convening the project, awarded the construction contract to IVRCL, an Indian infrastructure company based in Hyderabad. WAPCOS Ltd has been hired for supervising the construction of many of the civil projects that need to be completed. The contract the NEA offered is called the Engineering, Procurement and Construction (EPC) contract. This means that the winning bid provides technical expertise, procures construction equipment and performs all construction tasks towards completion of the project. IVRCL was contracted to perform the following activities:

- Main civil works

- Hydro-mechanical works

- Transmission line and substation works

The contract, however, did not have any mandatory requirements for sourcing labour and local sub-contracting was permitted. Most companies will, in most cases, provide Indian technical officers to perform high technical requirements such as engineering and design, but will sub-contract a local firm for actual construction. In the case of IVRCL, a large portion of the labour was brought from India, including construction workers. Further, the bidding for electro-mechanical works opened in March 2012, which was won by Bharat Heavy Electricals Limited (BHEL). BHEL was expected to provide the necessary hydro-mechanical equipment and machines for the operation of the plant. According to various government officials and experts in the region, the electro-mechanical equipment, especially the industrial machinery, is not available in Nepal. As part of the LOC agreement, electricity generation equipment was to be procured from Indian companies.

IMPACT ASSESSMENT: RAHUGHAT

In semi-structured interviews, stakeholders generally have agreed that the Rahughat hydroelectric power plant was too small to significantly impact the overall electricity needs of the country. The stakeholders included NEA, Ministry of Finance, Ministry of Environment, the Indian High Commission and the local population. According to the NEA, the 32-MW Rahughat project would only provide electricity to the immediate local area, rather than feeding into the main power supply for Nepal.

The Rahughat project is a result of unused funds from one of the first Indian LOCs to be extended to Nepal. The $ 100 million-LOC was used primarily for infrastructure development and some hydroelectricity power upgradation and maintenance projects. Following such maintenance work, the unspent amount of $ 67 million was then sanctioned by both the NEA and EXIM Bank of India for the development of the Rahughat plant.

STAKEHOLDER PERCEPTION AND SOCIOECONOMIC IMPACT

Interviews and interactions with the Ministry of Energy (MoE), Ministry of Finance and NEA have revealed that their general perception of the project has been negative. Both the NEA and MoE are dissatisfied with the overall progress of the project, the stipulations of the LOC and the companies hired for construction. Their negative perception is primarily due to the massive delays caused by the bidding process and financial ill health of IVRCL.

As part of the bidding process, technical consultants were to be hired for the preparation of the feasibility study for the project. The failure in negotiations between the Nepalese authorities, the Indian authorities and consultant firms stalled the hiring of technical consultants for nearly 18 months. Moreover, while it was agreed the Indian companies would only be allowed to bid for the construction of the project, as stipulated in the LOC agreement, no limitations were set on underbidding for project capture. Indian companies trying to enter the Nepalese market underbid for the project by nearly 40 percent of the total cost.

Despite flaws in the bidding process, IVRCL was hired for the development of the project. Further delays were caused when IVRCL refused to work due to issues of back-pay, which got resolved after the Indian government intervened in the matter. The project was further hampered by the financial woes of IVRCL, which reported near bankruptcy, and which further delayed construction.

The NEA and MoE believe that limiting the clauses of the LOC hampered the process and progress of the project. They are of the view that clauses allowing only Indian firms for construction, limiting the share of Nepalese contractors to less than 50 percent, and importing both labour and equipment from India can only impede a project's development. Movement and cost of such labour, logistical support and coordination require time, which cuts away from the overall project timelines. While the premise of the LOC to tie the credit to an Indian contracting company can remain, it may be prudent to allow equipment to be sourced from the local country. Each project component having a separate bidding round slows down the process. NEA and MoE also agree that Indian LOCs should not be given for small projects such as the Rahughat power plant, as these hardly contribute to the overarching energy needs of the country. The NEA and MoE though offered some positive observations of the project. These include:

- High-grade transmission lines being installed in the area, which would help with electricity distribution from other sources as well.

- Environmental standards and safeguards were well maintained, environmental protection education had been imparted to the local population.

- The remote location of the project ensured no human displacement for the project.

- Indian High Commission's cooperation had been positive, increasing Government-to- Government interaction at various levels.

Microeconomic Impact

The microeconomic perception—of the local population, local services, local industry and many others that are directly impacted by the development of this project—has been generally positive. While most of the labour employed in construction of the plant were brought from India or the Tarai (low-lying plains) areas of Nepal, casual labour activities such as transportation of material, equipment and resources were supported by the local economy. Furthermore, the 300 workers employed at the site helped stimulate the local economy, which previously survived on subsistence farming and agricultural production. The presence of the construction labour force gave impetus for growth of local trading, retail and hospitality industries. Local hospitality received a significant boost as it catered to the housing requirements of some of the senior Indian managerial employees from IVRCL.

Interviews with the local community also suggested that the project significantly improved local infrastructure conditions such as roads, sanitation and water pipelines, and industry. For example, the region's telecommunication facilities received an upgrade. Future prospects of schools, healthcare facilities, permanent housing structures and other such requirements to accommodate the incoming permanent workforce to be employed at the power plant will also help stimulate the local economy. The planned permanent presence of an army unit will help even after the current labour force leaves the area. The community agrees that presence of the army will provide security in the area.

Another potential impact as described by the local community was the prospect of uninterrupted electricity, which is intermittent at present. Due to its remote location, the area receives sporadic electricity supply and the possibility of a dedicated power plant to the local area and proximate urban areas is regarded well among most of the community members.

Some interviews revealed that certain aspects of the community have been disrupted, especially due to transportation of heavy equipment in and out of the area. The delays in construction have also affected the local economy with unpredictable seasons of labour migration into the area for the project.

CURRENT STATUS

The financial woes of IVRCL had led to the cancellation of its contract. The recent collapse of the Kolkata Flyover has illustrated the financial worries and contractual failures of IVRCL. The company has had to under take debt reconstruction as internal company debt had spiralled out of control. Indeed, the company has consistently posted losses for the past three years.

The Board of the NEA and the MoE annulled IVRCL's contract in June 2015. This came after repeated warnings to the company, but the financial strains of the company restricted it from continuing its work on the plant. After the contract was cancelled, IVRCL initially moved a Nepalese Appellate court and the Hyderabad High Court to put a stay to prevent payment of the advance guarantee. The advance guarantee is a financial bond issued by banks on advance payments made by the contract provider to recover funds in case the contractor is unable to carry out the proposed construction activities. As of August 2015, both the courts had rejected the injunction and funds have been transferred back to the NEA.

It has also been announced that for this project, joint-venture companies—Indian companies with smaller equity partners in Nepal—will be allowed to join the bid. While recent political turmoil in the country has stalled the bidding process, the NEA Board has been given the green light for bidding to begin. According to news reports, the NEA has also initiated plans to enhance the capacity of the project from 32 MW to 40 MW.

CONCLUSION

While the jury is still out on whether the Rahughat project will prove to be successful after the debacle of the contracting company and the next round of bidding, the project has both positive and negative implications. It is yet too early to have a comprehensive impact assessment of the project, as any tangible consequence can be seen only after the successful completion and operation of the plant for at least a year. Having said that, its design, objective and its current progress can offer partial view of the impact it will have in the immediate area.

The Rahughat hydropower project is too small for it to make an impact on the total energy potential of the country. It is also too small to provide any energy to India, and will be primarily used only for the local region. Even with the increase from 32 MW to 40 MW, its capacity is far below what is required to meet the needs of the large urban agglomerations.

As far as the local area is concerned, completion of the project is likely to greatly benefit the electrification needs of the local population. Rahughat and surrounding areas, as per interviews, are known to suffer intermittent power outages, sometimes lasting for days. This project will aim to rectify that and, in turn, bring positive outcomes to the local economy. Though the local area does not boast any large-scale industry, basic economic activities are often hampered by the frequent power shortages.

The benefits of the project are not limited to providing uninterrupted power supply locally. Such projects also serve to increase economic activities. For instance, prior to the launch of the project, the local town did not have much of a service industry. But this has now developed due to the presence of Indian and Nepalese construction workers. Moreover, as part of the agreement, peripheral infrastructure such as schools, hospitals and other daily required services are to be built, which will benefit the local population. The project is thus poised to boost the local economy and make it less reliant on larger urban markets such as Pokhara or Kathmandu. Additionally, the creation of a permanent army base for security of the hydropower project will increase economy activity, as this new population will rely on the local community for their needs. The local community will also benefit from the development of infrastructure such as roads, transmission lines and water distribution networks.

Concomitantly, at the macro level, assessments of such projects have provided the NEA and ministries and government agencies concerned with examples of best practices and lessons learned. For example, the NEA is now more cognisant of the underbidding by Indian companies. Following the embarrassing experience of hiring IVRCL, which had initially offered a significantly cheaper option undercutting the cost of the project, the NEA is expected to put limits on how much a company can underbid to be a favourable contender. Additionally, the MoE and the NEA have also realised that LOC funds should not be invested in small projects such as Rahughat as they have little impact on the larger energy objectives of the country.

POLICY RECOMMENDATIONS

- Government agencies, the Ministry of Finance and the EXIM Bank of India must look at projects concerning LOC through a more goaloriented approach. If the overall objective of the LOC itself is not met by the project (i.e., energy export, or contribution to overall GDP), such as the case in Rahughat, it should be taken on only if there are no other areas where these resources can be utilised. There can be multiple, economically and strategically viable projects where $ 67 million can be used.

- While there remains merit in the noninter fering role of the Indian High Commission once an LOC has been extended, non-interference can also be counterproductive. In the case of the conflict between IVRCL and NEA, intervention by the Indian High Commission could have proved useful in providing third-party arbitration, especially to resolve delay issues between the two parties. A monitoring and evaluation role for the High Commission could be useful in ensuring transparency and accountability in the disbursement and use of funds as well as maintaining the health of a project.

- The NEA and Nepalese ministries must clamp down strictly on the bidding process, wherein underbidding must be limited to not more the 10-15 percent of the total cost of the project. The IVRCL example is perhaps a much needed wakeup call for these agencies.

- In case of underbidding, government agencies concerned must ascertain a realistic view of the cost of the project through external how much a company can underbid. If a company underbids beyond a realistic limit, it should be disqualified from competing for the tender.

- It is vital that the EXIM Bank and Nepalese authorities benchmark their bidding and tender processes to accepted international standards. It would also be prudent for both stakeholders to understand and learn certain best practices for tenders and bids adopted by other countries in infrastructure projects to protect future projects from issues such as underbidding and retroactive payments. If instituted at the EXIM Bank level, such policies could be made mandatory for any bids and tenders that the recipient authorities make for any future projects. Moreover, instituting such practices by Nepalese authorities will help them be realistic in the bidding process and thus protect it from bids that may not actually be implementable as in the case of IVRCL.

- While the EPC contract allows Indian companies to import labour, clauses that make local labour participation higher than migrant labour should be instituted to maintain costs and hassles of importing any such labour. While highly technical jobs can still be given to Indian experts, some technical requirement can and should be filled by local experts. This will help reduce costs in transportation and accommodation of such officers and reduce delays.

- NEA should ensure that companies that have been contracted for the project build local infrastructure before starting the project. One of the impediments in Rahughat was the lack of proper infrastructure, which limited access to the site for supplies and other materials. NEA and the concerned ministries must ensure services like healthcare, supplies, and schools, and infrastr ucture such as functioning roads, sewage and waterworks, and pipelines, to help the local economy meet the increased demand generated by incoming labourers and operators, as well as the army that will eventually be stationed in the project area for security.

- Government agencies should require financial appraisal of companies contracted for the consulting firms, and pinpoint the limits to project to determine the financial viability and capability of such companies. Regular financial audits of such companies should be carried out.

- Strict rules and guidelines should be designed for contracting companies so that issues such as back-pay, stoppage of work, and labour strikes, do not impede the project's progress. IVRCL, for example, had stopped construction work due to back-pay issues.

- Regular checks of the project progress must be carried out to ensure adherence to the proposed timelines against the contract. This will help curb undue environmental degradation and community displacement unless for a legitimate operational reason. The EXIM Bank and Indian authorities must institute clauses in the agreement that derisks such infrastructure projects from political changes. By instituting such clauses, EXIM Bank and Indian gover nment authorities can protect large-scale, multimillion dollar credit programmes from arbitrar y cancellation or dissolution, protecting not only the credit line offered but also the interest of Indian and local stakeholders.

- Given India's geostrategic interests in Nepal, it is understandable why it is keen to providing development partnership and cooperation to Nepal. For large-scale infrastructure projects, however, it may be useful to consider participation of multilateral and foreign government development institutions in the process. At present, a number of large-scale projects are being implemented in Nepal that are joint collaborations between a specific country's development programme and institutions such as the Asian Development Bank (ADP), Japan International Cooperation Agency (JICA) and other such agencies. Such collaboration not only provides larger resources for development of large-scale infrastructure project but also assures transparency, accountability and efficiency. For future Indian LOC projects to not repeat the mistakes of the Rahughat experience, involvement of third-par ty funding institutions such as ADB or JICA can also be an immensely helpful addition.

ENDNOTES

1. Adhikari, M. Politics and Perceptions of Indian Aid to Nepal. Strategic Analysis. May 2014

2. Chand, M. India-Nepal Ties: Mapping New Horizons. Ministry of External Affairs. Government of India. June 2014

3. Fact Sheet: India-Nepal Partnership. Ministry of External Affairs, Government of India. June 2013.

4. Sinha, R and Ghimire, Y. Prime Minister Narendra Modi Promises Closer Ties, link India, Nepal to Common Future. Press Trust of India. Aug 2014. Appeared in: http://indianexpress.com/article/world/neighbours/modi-announces-nrs- 10000-crore-concessional-line-of-credit-proposes-hit-formula-to-nepal/

5. LIBOR= London InterBank Offered Rate. A benchmark rate that leading international banks use for short term loans.

6. Presentation on “Indian Lines of Credit: An Instrument to Enhance India Africa Partnership”. Export Import Bank. 2011

7. Nepal Electricity Authority. “Message from Managing Director”. Annual Rpeort. 2015. NEA. Government of Nepal.

8. Nepal Electricity Authority. Annual Rpeort. 2015. NEA. Government of Nepal.

9. Nepal Electricity Authority. Annual Report 2014. NEA. Government of Nepal. http://www.nea.org.np/images/ supportive_docs/Annual%20Report-2014.pdf

10. Nepal Hydropower Over view. Hydroelectricity Investment and Development Company Limited. http://www.hidcl.org.np/nepal-hydropower.php

11. ibid. P7

12. ibid.P7

13. ibid. P13

14. ibid. P13

15. Invitation for prequalification. Nepal Electricity Authority: Rahughat Hydroelectric Project. Standard Bidding Document. NEA. 9th July, 2012

16. ibid. P14

17. Pangeni, R. “Indian Contractor Resumes work on Rahughat Hydro”. My Republica. December 31, 2012. http://www.myrepublica.com/ portal/index.php?action=news_details&news_id=67121

18. Based on confidential interviews with government ministries and agencies which are directly involved in the development, design, implementation and evaluation of the Rahughat Project. The interviewees include Joint Secretaries from the Various Ministries, the head of the Nepal Electricity Authority and governmental consultants involved in the project in both India and Nepal

19. Based on confidential interviews of the local population, construction company officials in the Rahughat area, transporting company drivers and other local services.

20. VR, Kumar. “Flyover Collapse adds to IVRCL financial woes”. Business line. The Hindu. April 2016

21. “Contrac t for R ahu g hat Hydro ele c tr ic i t y Pro j e c t S c rap p e d ”. T he R ising Ne pal. June 2015. http://therisingnepal.org.np/news/4275

22. “Rahughat Hydro: ICICI Releases over Rs 785 million to Nepal Investment, Laxmi Bank”. Nepal Energy Forum. Aug 2015. http://www.nepalenergyforum.com/rahughat-hydro-icici-releases-over-rs-785m-to-nepal-investment-laxmibank/

23. N o t i c e fo r I nv i t a t i o n o f S e a l e d Q u o t a t i o n . N e p a l E l e c t r i c i t y A u t h o r i t y. D e c e m b e r 2 0 1 5 . www.nea.org.np/pages/download.php?f=Tender-Notice-of-RGHEP.pdf

24. Khadka, G. “Rahughat Set for Capacity Upgrade”. Scoop it. Dec 23, 2015. http://www.scoop.it/t/hydropower-in-thenews/ p/4057276289/2015/12/23/rahughat-set-for-capacity-upgrade

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

PREV

PREV

.png)