Quick Notes

Peak emissions in India and China: Promises, progress and prognosis

Promises

The 2014 report by working group III of the Intergovernmental Panel on Climate Change (IPCC) noted that the energy sector was responsible for 35 percent of total anthropogenic greenhouse gas (GHG) emissions. Despite the efforts of the United Nations Framework Convention on Climate Change (UNFCCC) and the Kyoto Protocol, emissions from the energy sector grew more rapidly between 2001 and 2010 than in the previous decade. Energy sector GHG emissions growth accelerated from 1.7 percent a year in the period 1991-2000 to 3.1 percent a year from 2001-2010. The main contribution to this growth came from rapid economic growth in developing countries primarily China and India and the increase in the share of coal in the global fuel mix on account of growth in coal consumption in India and China. The report argued that in the absence of mitigation policies, energy related CO2 (Carbon Dioxide) emissions are likely to increase to 50-70 GtCO2 (giga tonnes of CO2) by 2050. The report concluded that the concentration of CO2 in the atmosphere can only be stabilised if global net emissions of CO2 emissions peak and decline towards zero in the long term. In most of the stabilisation scenarios (limiting concentration of CO2 equivalent in the atmosphere to 450-530 ppm [parts per million]), the share of low carbon energy in electricity supply increase from 30 percent to 80 percent. Following the release of the report, China made the following statement in 2014 when the then-President of the United States visited China:

‘China intends to achieve the peaking of CO2 emission around 2030 and make best efforts to peak early and intends to increase the share of non-fossil fuels in primary energy consumption to around 20 percent by 2030.’

An equivalent statement on carbon peak was not extracted from India in 2014 but pressure began to mount and more recent expert opinion has suggested that India could achieve peak carbon by 2040-45.

Progress

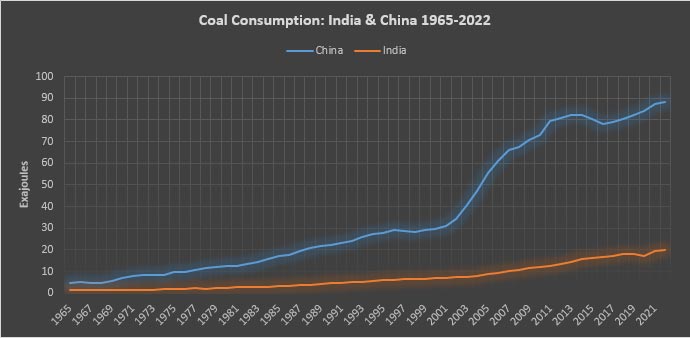

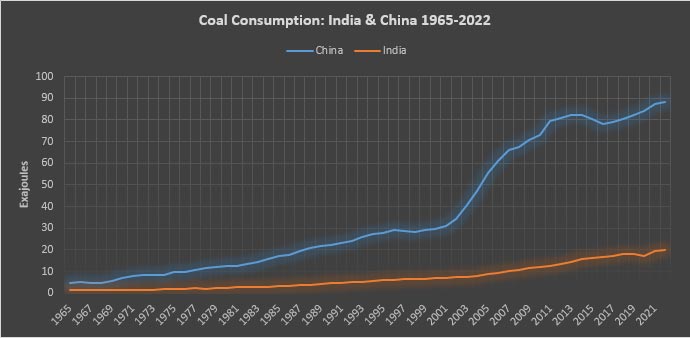

In 2022, the share of non-fossil fuels (nuclear energy, hydropower and renewable energy) in China’s primary energy mix was close to its 2030 target at 18.37 percent. Although India has not committed to a share of non-fossil fuels in its primary energy mix, India derived 11 percent of its primary energy from non-fossil fuels in 2022. Globally, non-fossil fuels accounted for about 18.2 percent of primary energy in 2022, which means over 82 percent of global primary energy came from fossil fuels. Coal’s share in the global primary energy fuel mix increased by 5 percent from 2003-2013, to touch 29 percent, making it the second most important fuel behind oil. Projections made in 2013-14 anticipated that China would remain the single largest coal consumer, accounting for 51 percent of global consumption, while India was expected to take the second place with 13 percent of global consumption overtaking the United States in 2024. This projection has materialised earlier than forecast. More moderate projections expected China’s coal demand growth to decelerate rapidly from 1.3 billion tonnes (BT) representing an annual growth of 6.1 percent in 2005-15 to just 19.5 MT (million tonnes) representing a growth of just 0.1 percent a year in 2025-35 with coal peak in 2030. India and China were expected to contribute 87 percent of global coal growth by 2035. Structural changes and policy measures, such as China’s move from a manufacturing & industry-driven economy to a service and domestic demand-driven economy along with efficiency improvements and stringent environmental policy, were expected to drive a rapid fall in coal demand in China. More ambitious projections expected China to stop importing coal by 2015 and China’s coal demand to start declining by 2016.

Source: Statistical Review of World Energy 2023

Projections made in 2015 celebrating the ‘coal crash’ in the United States argued that the decline in demand for coal in Organisation for Economic Cooperation & Development (OECD) countries will not be made up by China and India. Drawing on the fact that the price of seaborne thermal coal had weakened the argument was made that much of exported production to China and India would not cover costs and that future prices of coal were unlikely to show much improvement. As China’s coal consumption fell for the first time in 14 years despite economic growth of 7.4 percent, peak coal consumption in China was expected before 2020. The impending coal peak was attributed to a structural shift, driven by China following the western world in beginning to phase out coal.

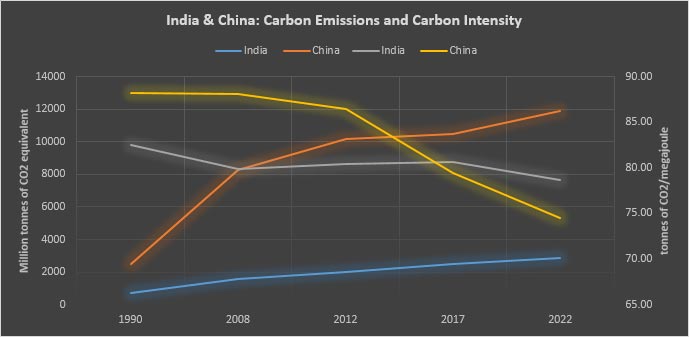

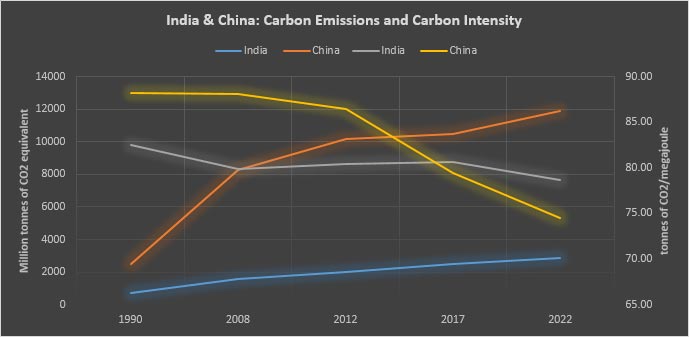

In 2022, China’s coal consumption was 88.41 EJ (exajoules), accounting for over 54.8 percent of global coal consumption. Though growth in coal consumption in China in 2012-22 had slowed down to an annual average of 0.9 percent compared to over 9 percent in 2002-12, it has not peaked as expected by ambitious projections. In 2002-12, China’s Gross Domestic Product (GDP) grew at annual average of 10.7 percent and in 2012-22 it grew at an annual average of 6.25 percent. India’s coal consumption grew at an annual average of over 6.2 percent in 2002-12, and at 3.9 percent in 2012-22 while India’s GDP grew at an annual average of 6.9 percent in 2002-12 and at 5.6 percent in 2012-22. Sustained economic growth in China and India without proportional growth in coal consumption indicates an extent of decoupling between carbon emissions and economic growth. This is illustrated by the declining trend in the coal intensity of the Chinese and Indian economies (coal required per unit of GDP) since 2002. In the last two decades, the coal intensity of the Chinese economy has fallen by over 48 percent, while the coal intensity of India’s economy fell by about 18 percent. Services, which are generally less energy-intensive, contribute a much larger share to the economy in India than in China, but India’s coal use efficiency is lower than that of China resulting in higher coal intensity.

China committed to reducing carbon intensity of its economy (CO2 emissions per unit of GDP) by 40-45 percent during 2005-2020, but China experienced a 3 percent increase in carbon intensity in 2002-09 because gains in efficiency were offset by movement towards a carbon intensive economic structure. If China accelerates the progress towards peak emissions, it could end up increasing carbon emissions as it could potentially drive industries to less efficient countries.

Prognosis

China and India can reduce their emissions and prosper materially only if economic growth is disentangled from energy-related emissions. This is theoretically possible, but the required transformation would impose considerable costs, and drastically re-orienting development towards low carbon growth is not cost-less. In June 2023, the Katowice committee of experts under the UNFCCC acknowledged that developing countries will bear disproportionate cost of decarbonisation in its technical paper on the impacts of the implementation of response measures (to climate change).

Most of the reduction in carbon emission achieved in OECD countries was without any radical policy interventions. Fuels with higher carbon-to-hydrogen ratio, such as firewood, were replaced with cheaper fuels with lower carbon-to-hydrogen ratio such as coal, oil and gas. Some countries in OECD have achieved an annual reduction of 2 percent in carbon intensity ,but this was not necessarily because of a shift towards alternative fuels or greater efficiency in using energy. Structural changes in the economy, such as a move towards a service-oriented system, played a big part. The shift was natural as most OECD countries had already completed their industrialisation processes. Decarbonisation rates sustained from 1971-2006 range across the 26 OECD nations ,from a 3.6 percent per year. The unweighted average rate for all 26 OECD nations is 1.5 percent per year, only 16.5 percent faster than long-term global decarbonisation rates (1.3 percent per year).

Many OECD nations also decarbonised by exporting their polluting industries to other countries. Japan had an explicit policy of locating heavily polluting industries in foreign countries. European countries reduced carbon emissions by 6 percent from 1990 to 2008 by exporting production to developing countries. In the same period, European import of embodied carbon from developing countries increased 36 percent. 18 percent of embodied carbon was through exports from China.

In 2022, carbon emissions were 64 percent higher than in 1990, the year the first report of the Intergovernmental Panel on Climate Change (IPCC) was released and 5.2 percent higher than in 2015 when the Paris Agreement was signed. Even when the economy slowed down dramatically under COVID-19 restrictions, carbon emissions fell by only about 6 percent in 2020 and rebounded quickly after restrictions were lifted.

Current projections of global population size and GDP per person imply that the world must reduce the rate of CO2 emissions per unit of real GDP by around 9 percent per year on average to decline by around 95 percent to reach the climate targets. The rate of decoupling during the next three decades will have to be almost five times greater.

Most of the burden of decoupling has fallen on developing countries like China and India. The methodologies of carbon emission reduction efforts sharing between countries are based on equal marginal abatement costs (to minimise global carbon mitigation costs), which is not only un-equitable and disadvantageous for emerging economies such as India and China with lower historical emission. Between 1990 and 2016, the world achieved an average so-called ‘decoupling rate’ of 1.8 percent per year. Since the 1860s, the global annual average decoupling rate is 1.3 percent per year. For China to achieve peak carbon emission by 2030, a 4.5 percent reduction is required. Achieving a 4 percent per year or greater rate of decarbonisation is unprecedented in recent history.

Decarbonisation policies could have a negative impact on the goal of increasing per person incomes in China and India. In June 2015, Zou Ji, Deputy Director General, National Centre for Climate Change, China, highlighted the importance of the joint announcement from the world's top two economies and emitters, USA and China, and pointed out the significance of China's aim to peak emissions before reaching the income level of USD 20-25,000 per person. In 2022, the per person GDP of China was about USD 12,720 (current USD), and in India it was about USD 2238. Carbon emissions of industrialised countries peaked at per person income levels of well over USD 23,000 – USD 34,000. Though the USA is an outlier with per person CO2 emissions peaking at well over 20 tonnes, countries in western Europe peaked at CO2 levels of about 10-15 tonnes at comparable incomes. To achieve per person GDP of about USD 34,000 by peak year 2030 China will have to grow by an annual average of over 13 percent while its carbon intensity is falling at about 9 percent. For India to achieve emission peak in 2040 with per person GDP of USD 34,000 it will have to have an annual average growth of over 16 percent while substantially reducing its carbon intensity. These trajectories are practically impossible to achieve.

The academic debate on decarbonisation is largely theoretical as it substitutes the need for growth with the need for near impossible decarbonisation rates in developing countries. Developing countries like India and China want to grow and will implement policies for growth. The idea that rich countries will make deep cuts to GDP to achieve decarbonisation, make space for growth of developing countries and support poorer countries with financial aid is also theoretical. Rich countries have to grow and limit financial outflows to service pensions and social security for an ageing population. It is time for the debate on decarbonisation to get real.

Source: Statistical Review of World Energy 2023

Monthly News Commentary: Coal

Growth in Domestic Coal Production Limits Imports

India

Imports

India’s thermal coal imports are expected to fall for the first time this year since the COVID-19 pandemic due to increasing domestic output and record high inventories. Out of eleven coal traders, eight expected shipments of the fuel to decrease this year, while the others foresaw flat imports or marginal growth. Surging production and supplies by world’s largest miner Coal India (CIL) have pushed stockpiles at power plants to record highs of over 43 million metric tonnes (MT), prompting it to sell more to non-power sector users such as sponge iron and aluminium smelters, which have traditionally imported the fuel.

India’s coal import registered a rise of 27.2 percent to 23.35 MT in December, over the corresponding month of the previous fiscal. The coal ministry is aiming for zero thermal coal import by FY26. The country’s coal import was 18.35 MT in the corresponding month of the previous fiscal. Of the total imports in December, non-coking coal imports stood at 15.47 MT, against 10.61 MT imported in December 2022. Coking coal import volume was 4.84 MT, against 4.71 MT imported in the same month of the previous financial year. The coal import in the April-December period of the current fiscal increased to 192.43 MT, over 191.82 MT a year-ago. During the April-December period of the current fiscal, non-coking coal import was at 124.37 MT, marginally lower than 126.89 MT imported during the same period in the previous financial year. Coking coal import was at 42.81 MT during April-December 2023-24, slightly up against 41.35 MT recorded for April-December 2022-23.

Production

CIL plans to start operations at five new mines and expand capacity of at least 16 existing ones to address growing demand for the fuel. India has increasingly relied on coal to address record power demand in recent months, with the rise in coal-fired power output outpacing renewable energy growth for the first time since at least 2019. A record output by Coal India - the world’s largest coal miner whose profits and share price have surged since early 2023 - is set to boost inventories at power plants running on domestic coal by 16.1 percent year-over-year to 40 MT by end-March, Prasad said. Coal India aims to boost output by more than 7 percent to a record 838 MT for the next fiscal year that starts 1 April, with initial stockpiles at 80 MT, over 15 percent higher from a year earlier. The miner plans to start operations at five new mines, with a combined annual capacity of 14.3 MT, in the next fiscal year. Last year’s decline in global coal prices from 2022’s historic highs prompted Indian traders and users to increase imports of thermal coal, which rose 9.4 percent to 176.3 MT in the year ended December 2023. Non-power users were avid buyers of imported coal. Meanwhile, lower seaborne coal prices have resulted in a decline in Coal India’s margins on what are usually lucrative spot auction sales, though volumes offered through auctions rose nearly 80 percent to 73 MT in the ten months ended January.

NTPC Ltd has crossed 100 MT coal production mark from its captive mines. The milestone was achieved on 25 February 2024. As per the NTPC Ltd., while the first 50 MT coal production was achieved in 1,995 days on 19 June 2022, the next 50 MT coal production was achieved in 617 days only. The coal production from its captive mines contributes to NTPC’s fuel security and ensuring efficient supply. NTPC Mining Ltd (NML) has five operational captive coal mines namely Pakri Barwadih, Chatti Bariatu and Kerandari Coal Mines in Jharkhand, Dulanga Coal Mine in Odisha and Talaipalli Coal Mine in Chhattisgarh. NML is targeting 100 MT coal production per annum by 2030.

The West Bengal government will float a global tender seeking Expression of Interest for a Mine Developer and Operator (MDO) for the Deocha Pachami coal block. The coal block in Birbhum district could see a peak investment of INR350 billion (bn) (US$4.2 bn). This block is considered the world’s second-largest and holds immense potential for the state’s economy. The block faces the challenge of a thick layer of basalt rock before reaching the coal reserves. West Bengal has been allotted the Deocha Pachami Harinsingha Dewanganj coal block, which is India’s largest and the world’s second-largest coal block, by the Centre in 2018. Basalt, a major hurdle in accessing the coal, is valuable for construction purposes. Estimates suggest extracting around 140 MT of basalt will be necessary. The Deocha Pachami block boasts an indicative coal reserve of 1,198 MT spread over 12.31 sq km. However, the area has houses of tribal people, forests, religious sites, and stone quarries.

Transport

Three first mile connectivity projects of South Eastern Coalfields Ltd (SECL) in Chhattisgarh were inaugurated. The First Mile Connectivity (FMC) projects are valued at INR6 bn (US$72 million (mn)). SECL is a subsidiary of CIL. One project is the Dipka Open Cast Project (OCP) coal handling plant that has been constructed at a cost of over INR2.11 bn. With an annual coal handling capacity of 25 MT, the project has an overground bunker with a capacity of 20,000 tonnes and a 2.1-kilometre-long conveyor belt. This will facilitate the rapid loading of 4,5008,500 tonne of coal per hour. The second project is the Chhal OCP coal handling plant, built at a cost of more than INR1.73 bn. With a capacity to handle 6 MT of coal annually, it includes an overground bunker, a conveyor belt spanning 1.7 km, and a silo with a capacity of 3,000 tonnes. Besides, the PM will inaugurate the Baroud OCP coal handling plant at that is designed to handle 10 MT of coal annually. The project has been constructed at a cost of INR2.16 bn (US$26 mn). Equipped with an overground bunker with a capacity of 20,000 tonnes and a 1.7 km conveyor belt, the project features a rapid loading system capable of loading 5,000-7,500 tonnes of coal per hour. FMC projects aim to reduce dependence on coal transportation through roads, thereby reducing traffic congestion, road accidents, and environmental impact.

Chhattisgarh announced scrapping of an order issued during the previous Congress government regarding the issuance of permits for coal transportation in the state through offline mode. The move will restore the old system of coal transportation by seeking transport permits online.

Rest of the World

World

Asia’s imports of seaborne thermal coal eased from record highs in January as top buyers China and India saw arrivals ease. However, there was strength in Japan and South Korea, which helped drive some divergence in prices between the high-energy coal preferred by the third- and fourth-biggest importers in Asia, and the lower quality fuel sought by China and India. Asia seaborne imports of thermal coal, used mainly to generate electricity, dropped to 77.65 MT in January, according to commodity analysts Kpler data. China’s January imports of seaborne thermal coal slipped to 27.92 MT from December’s all-time peak of 31.59 million, but were still 34 percent above the 20.86 million from January 2023. China’s appetite for imported coal has been fuelled by strong demand for thermal generation amid lower output from hydropower, as well as by a price advantage compared to domestic coal prices. The main grades imported by China are lower-energy coal from Indonesia and mid-rank fuel from Australia.

China

Global emissions from coal-fired power typically dip to their lowest point of the year during March and April as use of the fuel for heating drops off after the northern hemisphere winter. But this year China’s mammoth power and manufacturing systems may single-handedly reverse historical pollution trends if authorities unveil stimulus packages aimed at reviving industrial output in the spring. In turn, given the current delicate state of the economy, power producers will likely opt to use the cheapest fuel sources available when increasing baseload power generation, which in China’s case means more coal. And as China accounts for nearly 60 percent of worldwide coal use in power generation, more coal use in China means more global use of the world’s dirtiest power fuel. Coal generated a record 5,760 terawatt hours (TWh) of electricity in China in 2023, which was 6 percent up from 2022’s total, data from energy think tank Ember shows. In 2023, China’s total emissions of carbon dioxide (CO2) from coal-fired power generation hit 5.56 billion metric tonnes, an all-time high that was nearly 6 percent greater than 2022’s record. With coal use largely declining globally outside of China, China’s share of total coal emissions climbed to a record 64.4 percent in 2023 and could creep higher still in 2024 if the country's power sector supply growth remains coal-oriented.

Rest of Asia Pacific

The world’s top exporter of thermal coal is on track to smash last year’s record sales after projected shipments for the first two months of 2024 jumped nearly 25 percent from the same period in 2023. Indonesian exports of thermal and thermal bituminous coal - used in power generation - are on track to top 90 MT for January and February, up 24 percent from the same two months in 2023, ship tracking data from Kpler shows. China, India, South Korea and the Philippines were the top markets for Indonesia coal so far this year, accounting for 33 percent, 15 percent, 5.8 percent and 5.1 percent respectively of the shipments so far. Along with Japan, those markets were the top five destinations for Indonesian coal in 2023. In volume terms, the 29.4 MT shipped to China through February is nearly 9 percent less than shipped over the first two months of 2023. However, data has assessed over 21 MT of coal cargoes that have loaded or are being loaded but have yet to confirm their final destination on ship manifests. Many of those cargoes are likely bound for China, the world’s largest coal consumer, but may not be confirmed until after the Lunar New Year break is over. Indonesian coal shipments bound for Vietnam are already on track to rise by close to 600,000 tonnes from the January-February period in 2023, to a record 2.15 MT.

News Highlights: 6 – 12 March 2024

National: Oil

US-bound ship from Reliance’s Sikka port hits BPCL crude import facility

11 March: Oil tanker Hafnia Seine bound for the United States (US) from Sikka port in Western India hit Bharat Petroleum Corporation Ltd (BPCL)’s crude import facility in an accident late. The tanker was carrying gasoline-blending fuel known as alkylate for Reliance Industries' US unit from a refinery in Jamnagar in Gujarat state. BPCL has a single point mooring at Sikka to import crude for its landlocked Bina refinery in central India.

ONGC’s first oil from 98/2 block goes to MRPL

10 March: ONGC in January started oil production from its Krishna Godavari basin KG-DWN-98/2 (KG-D5) block, lying in Andhra offshore. The field is producing some 12,000-12,500 barrels of oil per day currently, using a floating production and storage offloading (FPSO). The oil is stored on the FPSO, and once it reaches a critical level, it is transferred to a ship, which carries it to a refinery. MRPL received the first cargo, loaded on a ship Swarna Sindhu on 9 March. Crude oil was loaded on the ship in the Bay of Bengal, and it travelled around the southern tip of India to reach Mangalore on the west coast.

IOC sets sight on Grand Prix, to join high table of F1 fuel producers

10 March: After delivering back-to-back innovations in fuel grades, Indian Oil Corporation (IOC) has set sight on the Grand Prix and will in next three months start producing fuel used in adrenaline-pumping Formula One or F1, motor racing. The firm’s refinery at Paradip in Odisha will in three months produce the petrol used in F1 car racing, its chairman Shrikant Madhav Vaidya said. IOC controlling roughly 40 percent of fuel market share, will be the first Indian company and only a handful globally that will produce fuel used in F1 racing. Vaidya said the company expects to get its Formula 1 fuel certified in around three months, after which it will start competing with other global majors like Shell to supply it to the F1 teams. IOC had in October last year helped India join a select league of nations when it began producing highly specialised 'reference' petrol and diesel that are used for testing automobiles.

Government extends subsidy on LPG for Ujjwala beneficiaries upto 12 refills

8 March: The Union Cabinet, chaired by Prime Minister Narendra Modi, has approved the extension of a targeted subsidy of INR300 per 14.2 kg (kilogram) cylinder for up to 12 refills per year for the beneficiaries of Pradhan Mantri Ujjwala Yojana (PMUY) for the financial year 2024-25. As of 1 March 2024, there are more than 102.7 million PMUY beneficiaries. The total expenditure will be INR120 billion for the financial year 2024-25. The subsidy is credited directly to the bank accounts of the eligible beneficiaries, the Ministry of Petroleum and Natural Gas said. To make liquefied petroleum gas (LPG), a clean cooking fuel, available to rural and deprived poor households, the government launched the Pradhan Mantri Ujjwala Yojana in May 2016, to provide deposit-free LPG connections to adult women of poor households. India imports about 60 percent of its LPG requirements. To shield PMUY beneficiaries from the impact of sharp fluctuations in international prices of LPG and to make LPG more affordable to PMUY consumers, thereby ensuring sustained usage of LPG by them, the government started a targeted subsidy of INR200 per 14.2 kg cylinder for up to 12 refills per annum (and proportionately pro-rated for 5 kg connections) to the PMUY consumers in May 2022. In October 2023, the government increased targeted subsidies to INR300 per 14.2 kg cylinder for up to 12 refills per annum (and proportionately pro-rated for 5 kg connections). As of 1 February 2024, the effective price of domestic LPG for PMUY consumers is INR603 per 14.2 kg LPG cylinder (Delhi). The average LPG consumption of PMUY consumers has increased by 29 percent from 3.01 refills in 2019-20 to 3.87 refills (till January 2024) prorated for 2023-24. All PMUY beneficiaries are eligible for this targeted subsidy.

India’s fuel consumption increases 5.7 percent in February on strong factory output

7 March: India’s fuel consumption rose 5.7 percent year-on-year in February, government data showed, helped by strong factory activity in the world's third-biggest oil importer and consumer. Total consumption, a proxy for oil demand, totalled 19.72 million metric tonnes (4.98 million barrels per day) in February, up from 18.66 million tonnes last year, data from the Petroleum Planning and Analysis Cell (PPAC) of the oil ministry showed. Demand was up about 5.1 percent on a daily basis from the 4.74 million barrels per day (20.04 million metric tons) consumed in January. Sales of diesel, mainly used by trucks and commercially run passenger vehicles, rose by 6.2 percent year-on-year to 7.44 million tonnes (MT) in February. They were up about 6.8 percent month-on-month to 1.88 million barrels per day on a per-day basis. Sales of gasoline in February rose 8.9 percent from the previous year to 3.02 MT. Cooking gas, or liquefied petroleum gas sales rose by 8.5 percent to 2.59 MT, while naphtha sales jumped by 11.7 percent to about 1.19 MT, compared with last February, the data showed.

National: Gas

PM to inaugurate Barauni-Guwahati national gas pipeline

8 March: Prime Minister (PM) Narendra Modi is scheduled to inaugurate the Barauni-Guwahati Natural Gas Pipeline (BGPL), a milestone project linking the North East region to the National Gas Grid, during his visit to Assam, GAIL (India) Ltd, said. This pipeline will provide a dependable source of clean energy, foster economic growth and enhance the overall well-being of the people of the region, GAIL’s executive director (Projects) AK Tripathi said. The 718 km pipeline which traverses through Bihar, West Bengal and Assam has been built at a cost of INR39.92 billion by GAIL, a Maharatna PSU under the Ministry of Petroleum and Natural Gas, he a said. The pipeline is designed to supply natural gas to nine geographical areas covering 31 districts across these three states through authorised city gas distribution (CGD) entities along its route, he said.

CNG prices reduced by INR2.5 per kg in Mumbai by Mahanagar Gas

6 March: Mahanagar Gas Ltd (MGL) reduced prices of Compressed Natural Gas (CNG) by INR2.5 per kg to INR73.50 per kilogram (kg). The new price has been brought into effect from midnight of 5 March, the company said. The prices have been reduced due to a dip in gas input costs, it said. Following the reduction in the rate, CNG offers attractive savings of 53 percent in Mumbai, compared to petrol, and 22 percent, compared to diesel, at current price levels in the city. MGL has supplied natural gas in the city for over 25 years. It is currently the only authorised distributor of compressed natural gas (CNG) and piped natural gas (PNG) in Mumbai and its adjoining areas. In Raigad, it reaches out to nearly 20.5 lakh households and above 4,000 small commercial and industrial establishments.

Monthly natural gas trades up 17 percent in February due to fall in global prices: IGX

6 March: A significant fall in the global natural gas prices led to the monthly gas volumes traded on the India gas exchange (IGX) rising by 17 percent to touch 6.13 million metric million British thermal units (mmBtu) in February, the company said. Traded volumes were up 3.24 times on a sequential basis. Meanwhile, the monthly Regasified Liquefied Natural Gas (RLNG) volumes rose to a record 4.74 million mmBtu in February. IGX is the only national-level gas exchange for the physical delivery of natural gas. IGX has said demand will show a growing trend in the near term driven by the expansion of city gas distribution networks and increasing uptake from the power sector. In 2024, India’s LNG imports are expected to get a boost if prices stay pressured, with year-on-year inflows likely to grow up to 7-8 percent, driven by higher demand in the power, industrial and transportation sectors while infrastructure spending also strengthens in a year due for national elections, S&P Global had said. February was the first month when Gujarat’s Hazira terminal became the most active delivery point for free market gas, IGX said. The deepwater port has seen a rise in incoming LNG cargoes in recent months. Other trading delivery points in February were Dabhol, Gadimoga, Dahej, Ankot, Suvali, Mhaskal & KG Basin.

National: Coal

Coal India production hits record 703.91 MT this fiscal until 7 March

8 March: Production of Coal India Ltd (CIL) hit a record 703.91 million tonnes (MT) in this fiscal until 7 March, surpassing the last fiscal's output of 703.20 MT, the coal ministry said. Highlighting that several key measures were implemented to enhance production, the ministry said CIL maintains an ample stock of 72.70 MT as of 7 March 2024. Adoption of the Mine Developer and Operator model, mechanization and modernization of CIL mines, both Underground & Opencast, undertaking new projects, expanding existing projects, have bolstered coal production, it said. The ministry said that the domestic coal sector registered a growth of 10.2 percent in January. The index of the coal industry reached 218.9 points during January as compared to 198.6 points in the year-ago period. The coal sector has demonstrated a growth of 10.2 (provisional) among the eight core industries in January as per the Index of Eight Core Industries (ICI) (Base Year 2011-12) released by the Ministry of Commerce & Industries.

Government panel backs higher carbon tax on coal imports to limit polluting fuel

7 March: A panel of officials from Indian ministries has called for a bigger carbon tax on higher quality imported coal while cutting rates for domestic coal, in a bid to slash shipments of the polluting fuel, the coal ministry said. Coal is among India’s top five commodity imports by value. Despite surging domestic production, mainly of low-quality coal with high ash content, it has failed to cut back on imports and ranks as the world’s second largest importer. In its report to the coal ministry, the panel said the current carbon tax rate of INR400 (US$4.83) on every metric ton of coal, regardless of the quality bought, favoured imports and hit sales of domestically mined coal.

GMDC unveils INR6.6 bn compensation package for Odisha’s Baitarani-West coal mine

7 March: Gujarat Mineral Development Corporation (GMDC) has unveiled a INR6.63 billion ‘Land and Resettlement and Rehabilitation plan’ to operationalise its first coal mine in Odisha. This involves acquisition of 354 hectares of government and private land for the proposed ‘Baitarani-West’ coal mine.

National: Power

Punjab CM cuts down service charges for enhancing power load

9 March: Punjab Chief Minister (CM) Bhagwant Mann announced a new voluntary disclosure scheme (VDS) for consumers having tubewell, commercial and residential power connections. The CM said Punjab State Power Corporation Limited (PSPCL) has been directed to launch the scheme for consumers having agriculture, residential and commercial power connections. He said consumers having agriculture connections who are willing to enhance their load of tubewell connections will have to now pay INR2,500 per horsepower as service charges against INR4,750 per horsepower fixed by Punjab State Electricity Regulatory Commission (PSERC). Likewise, the security for enhanced load has also been slashed by 50 percent to INR200 per horsepower. The CM said for residential category connections too, VDS has been launched for enhancing the load and rates have been reduced to half. The rates have also been slashed for VDS for commercial consumers. The CM exhorted the agriculture, residential and commercial consumers to take maximum benefit of the scheme and apply for enhancement of the load, if any.

Delhi cabinet approves power subsidy scheme for 2024-25: Atishi

7 March: Delhi Cabinet, in its meeting chaired by Chief Minister (CM) Arvind Kejriwal, approved power subsidy scheme for financial year 2024-25, Power Minister Atishi said. Atishi said that the AAP government has been fulfilling this promise for past nine years. Around 22 lakh households get zero power bills. The Kejriwal government is providing free electricity to consumers with a monthly consumption of 200 units. A subsidy of 50 percent is given to those who use 201-400 units per month.

Power sector to attract INR17 tn in next 5-7 years: Singh

7 March: Domestic power industry is expected to attract investments of INR17 trillion over the next 5-7 years, Union Minister R K Singh said. India added 200,000 circuit kilometres to transmission lines and the transmission system is the largest integrated transmission system in the world. It can transfer 116 GW (gigawatt) of power from one corner of the country to another. The module manufacturing capacity has gone up from 20 GW to 50 GW, and cell manufacturing capacity from 2 GW to around 12-13 GW, he said.

Mizoram government mulls corporatisation of power department

6 March: The Mizoram government is mulling an option to corporatise the state’s power department so that it functions efficiently. Power Minister F Rodingliana said the state government is planning to construct three dams to generate electricity. He had said Mizoram spends INR330-370 million in a month for the purchase of power from outside the state and requires 156 MW (megawatt) of electricity during peak hours. The state has 15 small hydroelectric projects, which together generate 38.55 MW of power, he said. The quantity of power generation fluctuates frequently depending on the weather conditions, he said.

National: Non-Fossil Fuels/ Climate Change Trends

NTPC, NGEL look to develop thermal plants, renewables project in Rajasthan

10 March: NTPC Ltd and its arm NTPC Green Energy signed two separate initial pacts to explore the possibility of developing supercritical thermal plants and renewables as well as green hydrogen in Rajasthan. The MoU between NTPC and Rajasthan Rajya Vidyut Utpadan Nigam was signed to explore opportunities for adding supercritical units to the existing Chhabra Thermal Power Plant. The MoU between NGEL (NTPC Green Energy) and RVUNL was signed for development of Renewable Energy Projects and Green Hydrogen Derivatives up to 25 GW and 1 million ton capacities respectively in the State of Rajasthan.

SJVN receives 1.3 GW solar energy projects worth INR74 bn

7 March: SJVN arm SJVN Green Energy has secured 1,352 MW (megawatt) solar power projects, entailing an investment of INR74.36 billion. The projects have been bagged by SGEL (SJVN Green Energy Ltd) through a competitive bidding process in a tender floated by MSEB Agro Power Ltd, Maharashtra. The total capacity of the tender was 7,000 MW and SGEL participated for 1,500 MW -- 500 MW in round one and 1,000 MW in round two. The company is on rapid progression to achieve its shared vision of 25,000 MW by 2030 and 50,000 MW by 2040.

Suzlon Group wins an order for 72.5 MW wind power project

7 March: Suzlon Group announced a new order win for the development of a 72.45 MW (megawatt) wind power project for Juniper Green Energy. Suzlon will install 23 wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 3.15 MW each at the clientfs site at the Dwarka district in Gujarat.

International: Oil

US raises domestic crude production growth forecast for 2024

12 March: United States (US) Energy Information Administration (EIA) predicted that domestic oil production will grow by 260,000 barrels per day (bpd) in 2024, up 90,000 barrels per day (bpd) from its previous forecast, but said estimated production cuts from OPEC+ will still slow global oil growth. US crude oil production will rise to 13.19 million barrels per day (bpd) this year, the EIA said. It had previously projected that crude production would rise this year by 170,000 bpd. US crude oil output reached a record 13.3 million bpd in December 2023, following sustained productivity increases at new wells. Production notched an annual record of 13.21 million bpd in 2023. US oil production is expected to rise by 460,000 bpd to 13.65 bpd in 2025, which would be a record high.

China’s crude oil imports rise on-year, but softer trend remains

7 March: China’s imports of crude oil rose in the first two months of the year compared with the same period in 2023, but they were also weaker than the preceding months, continuing a trend of softening purchases by the world’s biggest buyer. Customs data showed crude imports of 88.31 million metric tonnes in the January-February period, up 5.1 percent from the same period in 2023. However, on a barrels per day (bpd) basis, the increase was only 3.3 percent, given the extra day this year in February for the quadrennial leap year. China’s crude imports in 2023 peaked in August at 12.43 million bpd, which was the second-highest on record, and although there has been some volatility in the monthly data since then, the overall trend is toward lower arrivals.

Argentina state oil firm YPF to invest US$3 bn in shale in 2024

7 March: Argentina’s national oil company YPF said it would invest US$3 billion of a US$5 billion capital spending plan this year in shale, as it looks to generate more cash by exiting some major conventional fields. The company had previously said it would exit from some 55 conventional mature blocks as it looks to focus on its more profitable shale operations. By 2025, CEO (chief executive officer) Horacio Marin said he expects shale oil output to reach 160,000 barrels per day (bpd) after boosting production 24 percent in 2024 and a further 35 percent the following year. By 2027, the company could produce some 250,000 bpd.

IEA sees relatively well supplied oil market in 2024

7 March The global oil market is relatively well supplied with demand growth slowing, while supply is increasing from the Americas, the International Energy Agency (IEA)’s oil markets and industry division said. OPEC+ members led by Saudi Arabia and Russia agreed to extend voluntary oil output cuts of 2.2 million barrels per day (bpd) into the second quarter, giving extra support to the market amid concerns over global growth and rising output outside the group. While oil demand last year grew by some 2.3 million bpd, the increase in 2024 is expected to be smaller, at 1.2 million to 1.3 million bpd. The IEA expects supply to grow to a record high of about 103.8 million bpd, almost entirely driven by producers outside OPEC+, including the United States (US), Brazil and Guyana.

International: Gas

Sinopec starts natural gas production at 2 bcm per year at Sichuan gas field

12 March: China’s Sinopec has begun production at a natural gas field in southwestern China's Sichuan province with an annual production capacity of 2 billion cubic meters (bcm), according to the company. The West Sichuan Gas Field project has total reserves of 100 bcm of natural gas, the Chinese state oil and gas major said. The project is Sinopec’s third gas field in the Sichuan Basin with more than 100 bcm in reserves. Sinopec currently has proven natural gas reserves of nearly 3 trillion cubic meters (tcm) in the Sichuan Basin, with an annual output of 26 bcm.

Japan boosts reliance on allies Australia, US for long-term LNG supplies

11 March: Resource-scarce Japan is shoring up long-term supplies of liquefied natural gas (LNG) from close allies Australia and the United States (US) as key contracts from providers including Russia are set to expire by the early 2030s. Japan’s biggest power generator JERA agreed to buy a 15.1 percent stake in Woodside Energy’s Scarborough project in Australia. It was the latest in a string of deals as the fallout from Russia’s invasion of Ukraine threatens to disrupt access to gas from its northern neighbour, making it more imperative to find reliable long-term supply sources. LNG accounts for about a third of Japan’s power generation and it is the world’s second-largest importer behind China. Since 2022, Japanese LNG buyers have struck equity deals in five projects in Australia and the US including an exploration block. LNG export licence approvals have not dented Japan’s appetite for long-term supplies from those countries.

UK energy regulator opens investigation into Scotia Gas Networks

11 March: Scotia Gas Networks Limited, which operates gas infrastructure in southern England and Scotland, said British energy regulator Ofgem’s Gas and Electricity Markets Authority (GEMA) had opened an investigation into the company. Ofgem said that GEMA had launched an investigation into suspected abuse of a dominant position. Ofgem said the opening of the investigation did not imply it had made any findings about whether there had been an infringement of competition law.

AG&P LNG acquires 49 percent stake in Vietnam’s Cai Mep LNG terminal

7 March: Singapore-based Atlantic, Gulf and Pacific LNG (AG&P), a unit of US (United States) investment and development firm Nebula Energy, has acquired a 49 percent stake in Vietnam’s Cai Mep liquefied natural gas (LNG) terminal. Developed by Vietnamese petroleum trader Hai Linh Company and valued at US$500 million, the Cai Mep terminal is located in the southern Ba Ria Vung Tau province, and has a capacity of 3 million metric tonnes per annum. This would make it Vietnam’s second LNG terminal to begin operations, following the Thi Vai LNG terminal by PetroVietnam Gas located in the Ba Ria Vung Tau province. The Cai Mep terminal is currently undergoing pre-commissioning works, and should see the import of its commissioning cargo two to three months before first gas in September. Apart from supplying LNG by truck, the terminal has break bulk capabilities to allow LNG to be reloaded into smaller vessels for transport.

Europe’s mild winter leaves gas stocks at record high

7 March: Europe is on track to end the winter with a record volume of gas in storage, which has pushed futures prices back to pre-crisis levels once inflation is taken into account. The supply picture has been transformed from two years ago, when traders and policymakers were worried about possible gas shortages following Russia’s invasion of Ukraine. Storage facilities across the European Union and the United Kingdom were 62 percent full on 5 March compared with an average of 41 percent full on the same date between 2011 and 2020.

International: Coal

Russian coal exports to Asia struggle amid lower prices

12 March: Russia’s exports of seaborne coal to Asia have been weakening in recent months, with lower shipments of both thermal grades and metallurgical coal used to make steel. Exports of all grades of coal were assessed by commodity analysts Kpler at 8.48 million metric tonnes in February, slightly higher than January’s 8.37 million. However, that small increase came after six straight months of declines, and the February exports were also some 21.6 percent below the 10.81 million tonnes for February 2023. Coal miners in Russia switched from selling mainly to Europe to markets in Asia in the wake of Moscow’s February 2022 invasion of Ukraine, which saw Western countries adopt sanctions against Russian energy exports. Russia’s seaborne coal exports to Asia peaked at 14.69 MT in April last year, almost double the levels in months preceding the attack on Ukraine. Much of the increase came as Russia boosted shipments to India, the world’s second-largest coal importer behind China.

Indonesia vastly underreports methane emissions from coal

12 March: Methane emissions from Indonesia’s coal mines are significantly underreported, potentially undermining its international pledges on climate change, according to a report. The findings by Ember, a London think-tank, suggest that emissions from coal mine methane (CMM) in Indonesia are nearly seven times underreported because Southeast Asia’s largest country uses outmoded measurement methods and excludes emissions from underground mines. Indonesia has 15 companies involved in underground coal mining, the study said, although in 2021 it reported to the United Nations Framework Convention on Climate that it had none.

Italy to phase out coal from 2025, excluding Sardinia island

6 March: Italy is committed to stopping electricity generation from coal by the end of 2025 nationwide except in the island of Sardinia, the energy ministry said. Oil and coal plants are more polluting than gas-fired stations, though some governments believe they can help reduce carbon emissions while renewables energy capacity is ramped up. On Sardinia, however, the use of coal to produce electricity will end only between 2026 and 2028, the ministry said.

International: Power

US power use to reach record highs in 2024 and 2025: EIA

12 March: United States (US) power consumption will rise to record highs in 2024 and 2025, the US Energy Information Administration (EIA) said. EIA projected power demand will rise to 4,099 billion kilowatt hour (kWh) in 2024 and 4,128 billion kWh in 2025. That compares with 4,000 billion kWh in 2023 and a record 4,003 billion kWh in 2018. As homes and businesses use more electricity instead of fossil fuels for heat and transportation, EIA forecast 2024 power sales would rise to 1,511 billion kWh for residential consumers, 1,396 billion kWh for commercial customers and 1,042 billion kWh for industrial customers. That compares with all-time highs of 1,509 billion kWh for residential consumers in 2022, 1,391 billion kWh in 2022 for commercial customers and 1,064 billion kWh in 2000 for industrial customers.

Tesla’s German gigafactory reconnected to grid after week-long outage

11 March: Tesla’s German gigafactory near Berlin has been reconnected to the electricity grid following a week-long outage caused by arson, the power firm in charge of fixing the disruption said. The outage, which began on 5 March at the site in Gruenheide, was a result of an arson attack on a nearby power pylon for which activists from the far-left Vulkangruppe claimed responsibility. E.dis, a division of German energy network firm E.ON said speedy weekend assembly work had enabled it to carry out a multi-hour high voltage test and get a green light from engineers. Tesla said that it would gradually start up systems in the factory, which employs around 12,500 staff, after the resumption of power.

International: Non-Fossil Fuels/ Climate Change Trends

Alberta’s ban on renewables could hurt US$8.2 bn in investments

11 March: Alberta’s ban on some renewable projects could hurt C$11.1 billion (US$8.24 billion) in investments and stall up to 6.3 gigawatt (GW) of solar and wind power capacity, the Pembina Institute, an Alberta-based clean energy think tank, said in the study. The new rules potentially affect 42 projects and several thousand jobs, the study said. Canada’s main oil-producing province implemented a ban on renewable power projects proposed for prime agricultural land and also ordered the creation of buffer zones so that wind turbines do not spoil scenic views. Out of 111 solar and 34 wind projects proposed in Alberta, 36 solar projects and six wind projects, which are either proposed or awaiting approval, could be affected, the study said.

Equinor’s Mendubim solar plant in Brazil starts production

8 March: Norway's Equinor said its 531 megawatt (MW) Mendubim solar plant in Brazil had started power production, increasing the company's renewable energy production in the South American country by 30 percent. Mendubim will annually produce 1.2 terawatt hours (TWh) of electricity, and about 60 percent of that will be sold on a power purchase agreement with Norsk Hydro’s Alunorte, one of the world’s largest alumina refineries. The remaining production will be sold in the power market in Brazil, Equinor said.

US solar installations to benefit from Inflation Reduction Act in 2024

6 March: United States (US) solar industry is expected to continue its momentum in 2024 after accounting for over 50 percent of new electricity capacity additions to the grid last year, according to a report by Wood Mackenzie and the Solar Energy Industries Association. Companies and residents have aimed to capitalize on US President Joe Biden’s Inflation Reduction Act, which provides generous tax credits for EVs and clean energy technologies such as wind and solar farms. The report said that an additional five gigawatts (GW) over last year’s capacity could be installed in 2024. The solar sector added 32.4 GW in 2023, 51 percent higher from 2022, primarily due to increasing supply chain stability as a backlog of projects were completed.

Italy’s green transition efforts held back by lack of big solar projects

6 March: Italy’s energy transition is building on a myriad of solar panels mounted on roofs, but the country has installed far fewer large plants than its neighbours, signalling hurdles on Rome's path to decarbonisation. Italy has added big solar farms worth 6 gigawatt (GW) since 2016, significantly less than Germany and Spain, where more than 20 GW of new capacity has been installed by building plants with a size of at least 1 megawatt (MW0, sector association SolarPower Europe data show. To do so, experts estimate the country needs around 12 GW of new green capacity every year by 2030. With solar the country’s largest source of renewable energy, that is hard to achieve without boosting the number of big photovoltaic plants. Italy has deployed around 22 GW in small plants, including a multitude of rooftop panels, since 2016 - more than France, Spain and the Netherlands - thanks in part to incentives for home improvements that are now being phased out.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2023 is the twentieth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV

.png)

.png)