[INDC gives new hope to coal washing]

“The inclusion of coal washing in the INDC document shows that India has given the attention that it deserves. There is an urgent need for the adoption of policies that address the institutional barriers preventing the widespread adoption of coal beneficiation in India. Coal washing needs to be given priority as it is a genuine first step towards efficiency in the coal sector…”

Energy News

[GOOD]

Increasing availability of 5 Kg LPG cylinders will lift India out of the energy poverty trap!

[BAD]

Centre is not blameless in pushing state discoms into debt!

[UGLY]

Raising power tariff will provide a cover for inefficiency and decrease India’s manufacturing competitiveness!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Will Solar Energy defy Marx and yield to Musk using Moore? (Part III)

· INDC gives new hope to coal washing

DATA INSIGHT………………

· Performance of Indian Energy Sector

[NATIONAL: OIL & GAS]

Upstream…………………………

· Cairn India to exit Sri Lankan gas block

· RIL got ` 85 bn of gas from ONGC’s KG block: D&M

· IOC to spend $5 bn on oil exploration, production

· Cairn India's Rajasthan oil and gas output surges 3 percent in Q2

Downstream……………………………

· IOC to commission commercial production at Paradip Refinery soon

· MRPL plans to set up LNG Terminal at Mangalore port

Transportation / Trade………………

· IOC to sell subsidised 5 kg LPG cylinders in rural India

· Paradip-Durgapur LPG link to be ready by next year: IOC

· Hunt on for leader to lay $10 bn TAPI gas pipeline

Policy / Performance…………………

· DBT scheme saves ` 146.7 bn on LPG subsidy in a year: Govt

· Govt should relook new gas pricing formula: FICCI

· IOC will not ink long-term LNG price deals

· Petroleum policy for North East by end of 2015

[NATIONAL: POWER]

Generation………………

· BHEL starts 2.7 GW power projects in first half of 2015-16

· Preparations on for launching Kudankulam Unit-2 nuclear plant

· Singareni Collieries coal output up 27 percent in H1

· NTPC-SAIL Power Company gets green nod to expand Durgapur plant

Transmission / Distribution / Trade……

· ABB bags ` 1.4 bn order from PGCIL

· CIL, SCCL earn ` 300 bn incremental revenues via e-auction

· OTPC in final stages of clinching PPA with Myanmar for exporting power

· No bailout for debt-ridden state discoms

· Power Grid, Sterlite, 4 others in fray for ` 80 bn projects

· Karnataka cabinet nod for JV for gas distribution network for Bengaluru

· Punj Lloyd enters transmission, distribution segment

Policy / Performance…………………

· India assures Bangladesh help in field of atomic energy

· Power sector employees call for nationwide strike on December 8

· Over ` 110 bn spent on buying power from outside: J&K

· Delhi HC upholds quashing of CIL's revised transportation rates

· TN CM seeks PM's intervention to recommence Kudankulam Unit I

· India wants states to raise power prices gradually as part of rescue plan

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Gas discovered in Pakistan's Latif license: OMV

· OPEC sees more demand for its crude in 2016 as cheap oil hits rivals

· Brazil sells 37 of 266 exploration blocks in oil round

· China triples proven reserves at top shale gas project

· Oil spills into North Sea at Statfjord field: Statoil

· Frontera increases Georgia gas resource estimate more than tenfold

· Mexican crude oil output may only return to 2012 levels in 2018

Downstream……………………

· KPI will sell Gunvor its Rotterdam refinery

· Statoil puts second subsea gas compression project into action

· Saudi Aramco considers new Yanbu refining complex

· US funds grab refinery stock momentum in beat-up energy sector

· Traders eye floating diesel storage in Atlantic

· QIC acquires CLP gas plant in Australia for $1.2 bn

· Pemex restarts plant at Minatitlan refinery

· Niger's Soraz refinery struggling due to oil price fall

Transportation / Trade…………

· China crude imports rebound as refiners seek oil bargains

· Egypt buys 55 LNG cargoes via tender

· Russia resumes gas supply to Ukraine

· Oil traders targeting Iran for $1 bn in 2016 gasoline sales

· Shell asks shippers exporting Nigerian oil to sign guarantee

· Gas Natural Fenosa buys 8.3 percent in Chilean gas distributor Metrogas

· Libya's oil export capacity rises as Zueitina port reopens

· Hungary imports oil from Iraq's Kurdistan at expense of Russian crude

Policy / Performance………………

· Kuwait Oil Minister says no calls within OPEC for policy change

· Uganda, Tanzania to study possibility of crude oil pipeline

· Poland sees first LNG gas shipment at new terminal in Nov-Dec

· Qatar's Energy Minister says oil prices have bottomed out

· Japan's new Industry Minister says more consolidation needed among refiners

· Norway's Aasta Hansteen gas field to delay start-up to 2018: Budget

[INTERNATIONAL: POWER]

Generation…………………

· Ethiopia’s hydroelectric project begins power generation

· Advanced Power plans to build 1.1 GW gas-fired power plant in Ohio

· Mexico awards power plant contract to Spanish firms

Transmission / Distribution / Trade……

· Germany approves €3-8 bn underground power lines

· Talen Energy to sell three power plants for $1.5 bn

· Energy regulator ANEEL launches new power transmission tender

Policy / Performance………………

· Dubai awards ACWA $1.8 bn power plant deal on rising demand

· Germany says firms set aside enough nuclear decommissioning funds

· South Africa coal miners make offer to union in bid to end strike

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Inox Wind bags 50 MW wind power project order

· Suzlon commissions 50.4 MW project for Ostro

· Green Indian Mission plans approved for 4 states

· ISR hopeful of tapping geothermal energy, starts survey

· PTC signs MoU with SECI for sale, purchase of solar power

· Punjab’s largest solar power plant commissioned at Bathinda

· AP to develop 4.8 GW wind power in 5 yrs

· Financing may be a challenge under offshore wind policy: Ind-Ra

· Climate change the historical responsibility of the developed world: India

· India does not need to go in for carbon cuts: Goyal

· Energy efficient LED lighting across all metro stations: DMRC

· India extends tax benefits on bunker fuel for local movement

· Gamesa bags 40 MW wind power project of ReNew Power

GLOBAL………………

· Canadian Solar building 47 MW power plant in Japan

· China raises 2015 solar installation target by 30 percent to 21.3 GW

· 'US to cooperate with India in dealing with climate change'

· SkyPower plans 500 MW of solar projects in Panama

· UK confirms plan to end onshore wind subsidy a year early

· Climate talks need all major countries: Japan Environment Minister

· DC Water develops $470 mn waste-to-energy project in US

· 1366 Technologies plans to build 3 GW solar wafer manufacturing facility in US

· Climate aid reaching $62 bn placates developing world

[WEEK IN REVIEW]

Will Solar Energy defy Marx and yield to Musk using Moore? (Part III)

Lydia Powell and Akhilesh Sati, Observer Research Foundation

Continued from part II in Volume XII, Issue 14 and part I in Volume XII, Issue 13

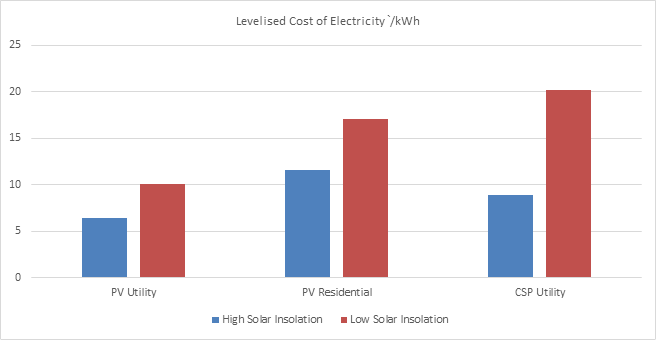

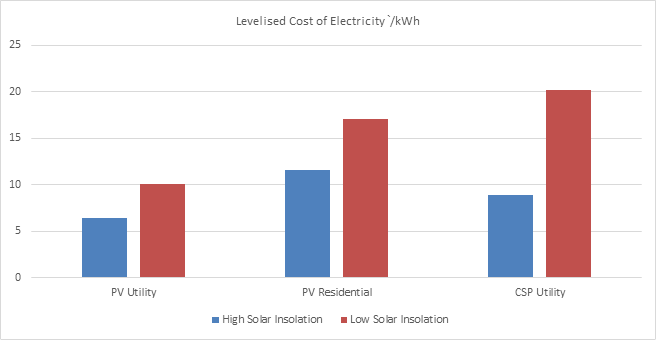

n part II of this article, some of the problems in using levelised cost of electricity (LCOE) to establish competitiveness of electricity generated by solar panels were discussed. The concluding part of the article will continue with the discussion.

One of the problems with LCOE is that it does not capture certain system costs. Grid connected solar PV units offer price bids at their marginal cost of production which is zero and receive marginal system price each hour. With zero marginal cost of production grid connected PV systems operating at the retail end (household and building rooftops) displace conventional generation with higher marginal cost at the wholesale end. The wholesale and retail markets for electricity follow different dynamics. In general the wholesale market is not subject to too many policy interventions. Even in India which has a regulated structure the government does not intervene in the wholesale market as much as it does on the retail market. The only exception is when the government mandates purchase of electricity from certain sources (such as renewables) which distort merit order dispatch. But governments actively intervene at the retail end of the market even in industrialised countries. In India the intervention is near total at the retail end.

Source: MIT report on The Future of Solar Energy

The central and state governments intervene to promote polices for energy access and electoral popularity. In industrialised nations wholesale price of electricity is lower than the retail price of electricity as it should be in a reasonably well functioning market. In India retail price for electricity is lower than the wholesale price on account of numerous policy interventions. This explains the financial distress of distribution companies which have to buy power at a higher price and sell at a lower price. Distributed solar generation such as solar PV competes at the retail level which is the most attractive for solar PV because it is the end that is most visible and subject to policy interventions but it conceals the problems that arise out of its variability and imperfect predictability that affect the wholesale end.

Variability and imperfect predictability (qualities that allowed energy sources similar to solar energy such as wind and water to be displaced by coal based steam generation during the industrial revolution according to Marx) of solar PV systems requires counterbalancing from thermal plants that have to be cycled (switched on and off) frequently as PV output varies. This increases the wear and tear of conventional thermal generation and reduces their efficiency. The cost of using back up capacity that has to suffer loss in efficiency and wear and tear on account of frequent cycling is not reflected in the LCOE. At high levels of PV penetration, the average cost of conventional plants (subject to frequent cycling) increases significantly. This in turn increases system costs that have to be borne by the rate payer or the tax payer. Many roof top PV users (in industrialised nations) gleefully declare that solar power has not only slashed their power bills but has also contributed to a net income in certain periods because they are unaware of these hidden subsidies.

The argument that distributed systems save on transmission costs is made to favour decentralised solar power. This is not entirely true. Studies have found that the savings from transmission losses are far lower than the system investment required for solar. In India as transmission and distribution losses are high decentralised energy systems may be favoured. However at a broader system level this is not necessarily an efficient outcome.

Table: Estimated Levelised Cost of Electricity for New Generation Resources in 2019

2012$ per MWh

|

Type

|

Minimum

|

Average

|

Maximum

|

|

Conventional Coal

|

87

|

96

|

114

|

|

Gas Combined Cycle

|

61

|

66

|

76

|

|

Onshore Wind

|

71

|

80

|

90

|

|

Solar PV

|

101

|

130

|

201

|

|

Solar CSP

|

177

|

243

|

388

|

Source: MIT report on The Future of Solar Energy

The MIT report that provides the basis for many of the arguments in this paper concludes that in all cases analysed by it (within USA) the per kWh costs of residential generation were just over 170 percent of the estimated cost of utility scale generation. In this light, if residential PV systems are growing faster than utility scale systems, it means that they receive a much higher per kWh subsidy than utility scale systems. A rupee subsidy for residential solar PV generation is likely to produce less solar electricity than the same subsidy given to larger utility scale investments. The government of Delhi which has come up with a roof top PV policy must take note of this. Subsidies will reduce the private costs of solar but larger social and economic benefits are likely to be insignificant at best and non-existent at worst.

Yet another concern is the hidden cross subsidies in hybrid systems that combine solar PV with conventional generation. Distribution companies that supply conventional grid based power recover distribution network costs through per kWh charges on electricity consumed. Owners of distributed grid connected PV generators use these distribution networks but shift network costs including added costs of accommodating significant PV generation to other network users. These ‘cost-shift’ subsidises users of distributed PV but it is rarely acknowledged. This subsidy raises the issue of fairness.

Current economics of PV will allow only affluent households (and PSUs that receive an explicit subsidy under current Indian policy framework) to invest in grid connected solar PV generation even if it is only to signal commitment to green values. On the other hand poor households and small businesses are likely to cling to cheap grid based power because (a) grid based electricity is cheaper and more reliable (b) they involve no transaction costs such as effort to install, repair and maintain equipment from the part of the owner (c) they do not have roof tops and (d) they cannot afford the upfront costs of PV systems. But when the less affluent are part of a hybrid grid system that privileges the use of grid connected PV they will essentially end up subsidising rich PV users on distribution network costs. This raises a serious question of fairness in public policy especially in India where the poor outnumber the rich by a huge margin.

If the affluent users of PV systems choose to exit the grid entirely it would eliminate the subsidy but it will also reduce the number of high value customers for the grid. The rich who exit the grid will have to invest in storage and backup systems such as Musk’s Powerwall but economics does not favour this option. In the USA which has a whole sale and retail market for electricity, a grid connected PV user will be better off selling PV electricity to the grid during the day and buying it back at one third the price in the night rather than using Powerwall’s stored supply at night (or any other time when the sun is not shining) at four times off-peak rates or twice peak rates for grid electricity. Regulations that mandate the dispatch of solar (a move being considered in India to promote solar PV generation) can lead to increased system operating costs (as it would intervene in merit order dispatch) and also give rise to problems in maintaining system reliability.

Another curious phenomenon that will affect the economics of grid connected PV is scale. In competitive wholesale markets for electricity the market value of the output falls as PV penetration increases. Simple economics tells us that increasing zero marginal cost solar PV generation during periods of high solar insolation will drive prices down thus reducing profitability of solar generators. This price reduction at peak hours has already been demonstrated in Germany. The more PV capacity is online the less value an increment of PV generation will produce. This means that PV costs for new PV installations have to keep falling to keep it competitive.

This phenomenon need not worry Indian policy makers now as India does not have a competitive market for electricity. Nor does India have time of the day pricing that will value electricity more during peak hours than off-peak hours. This suits solar PV prices conveyed in terms of LCOE because LCOE attributes the same value to electricity generated at different times. Ironically the absence of a competitive market for electricity in India has increased the perceived value of PV electricity and hence the profitability of PV generators. What the popular media is hailing as the success of solar in defeating coal is in fact the success (profitability) of solar energy companies. Indian policy is yet to distinguish between the two – the success of solar energy and the success of solar energy companies.

The MIT report quoted earlier observes that incremental solar capacity without storage may have little or no impact on total required non-solar capacity, especially in systems where peak load occurs at a time for low or no solar insolation. At an all India level system peak demand occurs during late afternoon or early evening when there is no solar insolation. Exceptions to this pattern are Delhi with peak air conditioner load in the middle of the day (in summer) and late afternoon and Maharashtra where industrial demand peaks during the day. Even if these loads are met with solar electricity they would have to invest in back up as a mere cloud passing for a few minutes could reduce solar generation by an order of magnitude. If the expensive 100 GW solar energy capacity that India has planned is unlikely to displace thermal power generation capacity required for the future, then on has to ask if this is a wise decision.

Overall policy makers must keep in mind that solar energy remains a value choice and not an economic choice as it is made out to be. According to the MIT report, at current gas prices in the USA using solar energy to generate electricity is more expensive than using combined cycle gas generation even at a carbon price of $38/tonne of carbon. In India coal is far cheaper as acknowledged by the government. The report also says that it may be more cost effective not to use all available zero variable cost production rather than force a coal plant to stop operating only to start it after a few hours.

Moreover policies that are designed to subsidise solar power generation may lead to inefficient and costly operational decisions in the short term and more inefficient generation mix in the longer term. Policies such as Renewable Portfolio Standards (RPS) that are state specific will locate solar PV generators at sub-optimal locations. This means that India should focus on a national policy framework. Policies that restrict international trade in PV modules and related system components in order to aid domestic industry in the name of ‘making in India’ may also raise the cost of using solar to reduce carbon emissions. Furthermore there is no evidence to show that manufacturing renewable leads to higher job creation than other industries.

Returning to the question posed in the title, solar energy is a long way from defying Marx and yielding to Musk even with some assistance from Moore. Even the Indian solar policies that have been put on steroids are unlikely to help in defying Marx!

Concluded

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

INDC gives new hope to coal washing

Ashish Gupta, Observer Research Foundation

s India’s coal based power plants age, improving their efficiency is increasingly recognized as an important aspect of energy policy. Higher efficiency in power generation is an important element of energy security and also in reducing environmental impacts, and in lowering the cost of electricity. As agreed in earlier climate negotiations, India has submitted its Intended Nationally Determined Contribution (INDC) document. The document is well drafted and measures on mitigation and adaptation that India is undertaking currently and plans to undertake in the future are described in detail.

In the INDC document, coal receives the attention that it deserves. . Some of the crucial measures with regard to mitigating carbon emissions from the coal use are given below:

- Coal beneficiation (washing) has been made mandatory (Stage I - Pre-Combustion Process).

- All new, large coal based generating plants has been mandated to use the highly efficient super-critical technology (stage II - Combustion Process).

- Renovation & Modernisation of existing old power stations in a phased manner (Stage II - Combustion Process).

- 144 old thermal based power stations have been assigned mandatory targets for improving energy efficiency (Stage I & II).

It is good that the INDC document has emphasised on efficiency. But before going into the details of efficiency we need to clarify that high ash coal does not automatically lead to higher carbon emissions. Ash is particulate matter unlike CO2 and coal washing reduce ash content. Pollution from the coal use needs to be understood in the context of how it is processed. Different kinds of pollutants arise during different stages of processing and there are technologies available to address them.

Stage I

Pre-Combustion Process

Issue: Generation of fly ash/ sulphur

Solution: Coal washing can reduce ash

|

|

Stage II

Post-combustion Process

Solution: Carbon Capture and storage

|

|

Stage III

Combustion Process – The coal burning

Issue: Carbon/ other emissions

Solution: Critical /Super /ultra critical technologies

|

|

As far as Stage II is concerned, Indian power plants are switching to super-critical technology thereby saving on coal consumption and consequently reducing carbon emissions (For example: Critical technology uses 1kg of coal to produce 1 unit of electricity; Super-critical uses 700gm of coal for producing the same; Ultra-critical technology will reduce coal consumption even further). Given the technology and costs involved, switching to ultra-critical technology will take some time. Stage III where carbon emissions are controlled by capturing it and storing it underground is not commercially viable currently.

Ash removal (Stage I), though a proven and simple technology is neglected in India. The notification regarding coal washing is in place from 2001 but unfortunately notification has no legal teeth and so it is ignored by the coal sector Most of the power plants are reluctant to use washed coal. There could be reasons behind this but it is well known that there are economic and environmental benefits in washing coal.

The use of washed coal will reduce the quantity of coal required to generate the same amount electricity by increasing the calorific value of the given amount of coal. The increment in calorific value for a given mass when coal is washed in shown in the table below

|

Reduction in Ash %

|

Increment in Gross calorific value (calculated kcal/ kg)

|

Reduction in Per Annum Requirement of Coal (MT)

|

|

Raw coal at 41

|

3,970

|

3.77

|

|

Washed coal

|

|

|

|

36

|

4,440

|

3.33

|

|

34

|

4,628

|

3.19

|

|

32

|

4,816

|

3.07

|

|

30

|

5,004

|

2.95

|

Source: India: Implementation of Clean Technology through Coal Beneficiation, 1998

Reducing the ash level from 41 percent to 30 percent, reduces coal consumption at the power plant by 22 percent (ie from 3.77 MT to 2.95 MT) as the heat content in a given mass increases and the quantity of disposable ash falls.

Reduction in disposable ash

|

Ash %

|

Reduction in Per Annum Requirement of Coal (MT)

|

Disposable Ash (MT)

|

|

41

|

3.77

|

1.55

|

|

36

|

3.33

|

1.20

|

|

34

|

3.19

|

1.09

|

|

32

|

3.07

|

0.98

|

|

30

|

2.95

|

0.89

|

Source: ibid

The table above clearly shows that the quantity of disposable ash will be reduced to 0.89 MT from 1.55 MT in case of washed coal with 30 percent ash. This will automatically bring reduction in land requirement for disposing ash.

Land requirement for disposing ash at different ash levels

|

Ash %

|

Disposable Ash (MT)

|

Land Requirement (Ha)

|

|

41

|

1.55

|

400

|

|

36

|

1.20

|

310

|

|

34

|

1.09

|

281

|

|

32

|

0.98

|

254

|

|

30

|

0.89

|

229

|

Source: ibid

The use of washed coal with ash content of 30 percent will reduce the land requirement to 229 hectare (Ha) from 400 Ha. Consequently, the water requirement to transport ash to the disposable pond will also go down from 17 million m3/annum to 9.79 million m3/annum.

Water requirement at different ash level

|

Ash %

|

Disposable Ash (MT)

|

Water Requirement (Million m3/annum)

|

|

41

|

1.55

|

17.05

|

|

36

|

1.20

|

13.20

|

|

34

|

1.09

|

11.99

|

|

32

|

0.98

|

10.78

|

|

30

|

0.89

|

9.79

|

Source: ibid

But the benefits do not end here. The carbon emissions too will go down by 2 to 3 percent when washed coal is used.. This can be further improved by improving efficiency at power plants (1 percent efficiency improvement will bring down further 2 to 3 percent in carbon emissions).

Annual Carbon emissions of power plant at different ash levels

|

Ash %

|

CO2 emissions in 1000 tonnes/ year

|

Reduction in CO2 emissions %

|

|

41

|

1.55

|

|

|

36

|

1.20

|

2.03

|

|

34

|

1.09

|

2.28

|

|

32

|

0.98

|

2.51

|

|

30

|

0.89

|

2.72

|

Source: ibid

Though combustion efficiency must be increased (Stage II) through the adoption of technology coal washing must be pursued as it is inexpensive compared to super and ultra critical technologies. The inclusion of coal washing in the INDC document shows that India has given the attention that it deserves. There is an urgent need for the adoption of policies that address the institutional barriers preventing the widespread adoption of coal beneficiation in India. Coal washing needs to be given priority as it is a genuine first step towards efficiency in the coal sector.

Views are those of the author

Author can be contacted at [email protected]

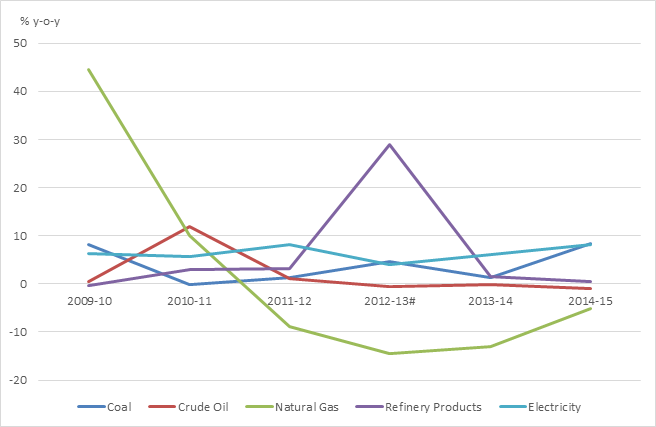

Performance of Indian Energy Sector

Akhilesh Sati, Observer Research Foundation

|

Sector

|

Growth Rate (%)

Year on Year

|

|

2013-14

|

2014-15

|

|

Coal

|

1.3

|

8.4

|

|

Crude Oil

|

-0.2

|

-0.9

|

|

Natural Gas

|

-13

|

-5.2

|

|

Refinery Products

|

1.5

|

0.4

|

|

Electricity

|

6

|

8.1

|

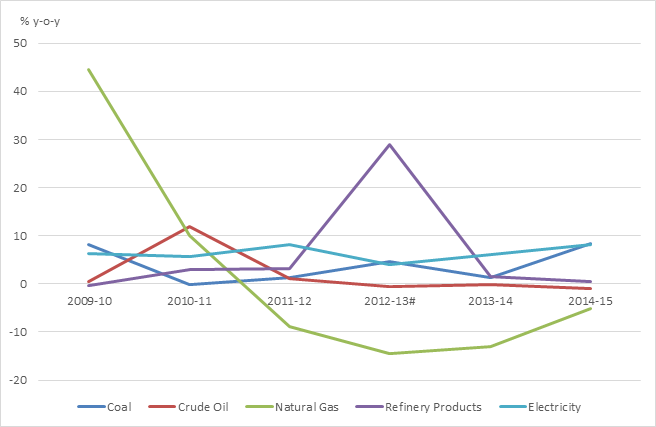

Growth Rate Trends for Energy Sector

#Refinery Products’ yearly growth rate of 2012-13 is not comparable with other years on account of inclusion of RIL (SEZ) production data since April, 2012.

Source: Press Information Bureau.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Cairn India to exit Sri Lankan gas block

October 13, 2015. Cairn India will by month end exit its Sri Lankan gas block after two discoveries it had made were found to be commercially unviable. Cairn, whose main asset are the oilfields in Barmer district of Rajasthan, will relinquish the 2,912 sq km block SL—2007—01—001 in the Mannar basin after expiry of exploration period at end of October. The company has so far drilled four wells on the block and discovered gas reserves in two of them. But the discoveries were assessed to be commercially unviable. Cairn Lanka, a wholly—owned subsidiary of CIG Mauritius Pvt Ltd under Cairn India, held 100 percent interest in the block. It’s Phase—1 exploration resulted in two gas discoveries — CLPL—Dorado— 91H/1z and CLPL—Barracuda—1G/1. After this it drilled two more exploration wells as part of Phase—II. (www.thehindubusinessline.com)

RIL got ` 85 bn of gas from ONGC’s KG block: D&M

October 13, 2015. Private explorer Reliance Industries Limited (RIL) extracted at least 9 billion cubic metres (bcm) of gas from government-owned explorer ONGC’s block in the Krishna-Godavari (KG) Basin block off the Andhra Pradesh coast, according to a draft report by the US-based international consultant DeGolyer and MacNaughton (D&M). This means that at an average gas price of $4.20 per million British thermal units and an exchange rate of ` 60 against the dollar, RIL drilled gas worth ` 8,000-8,500 crore that belonged to ONGC, analysts said. A final report may take a few more weeks. The petroleum ministry would decide on the action to be taken only after it receives D&M’s final report as reviewed by Directorate General of Hydrocarbons (DGH). According to D&M’s findings, of around 59.5 bcm of gas that was extracted by RIL since inception (2009) from its block KG-DWN-98/3, commonly known as KG-D6, around 9 bcm or 15% is suspected to have flowed in from the adjacent block, KG-DWN-98/2, which belong to ONGC. The consultant D&M found that gas flowed out from a few wells drilled by RIL including A5, A9 and B8, which were closer to ONGC block. In addition, gas reservoir from another area — G4, which belongs to ONGC and adjacent to its KG-DWN-98/2 block — is also connected to RIL’s KG-D6. ONGC’s claim of RIL’s extraction of gas from its block was reiterated when it engaged Schlumberger to drill wells in the block early this year. The results showed that gas pressure in the newly drilled wells had reduced by more than half compared with prior findings. It indicated that gas was drained out of the block. (www.financialexpress.com)

IOC to spend $5 bn on oil exploration, production

October 12, 2015. Indian Oil Corporation (IOC) planning to spend about $5 billion (` 32,500 crore) to expand its exploration and production business, with half the amount slated to go into acquisition of new assets that are increasingly becoming available in the wake of a global crude oil crash. About 50 percent decline in crude oil prices in a year and the expectation that the prices may not go up in a hurry has shaken the faith at many oil firms, which have been redrawing plans, shelving projects and touching only those projects that are viable at current prices. But energy-starved economies like India have been encouraging their firms to go out and buy equity, mainly in producing fields with an aim to aid the country's energy security. ONGC Videsh Limited (OVL) recently acquired 15 percent stake in a prolific Russian field. And now IOC hopes to acquire some oil equity overseas. The company, which is in talks with potential strategic partners internationally, will prefer a producing or a near-producing asset since this eliminates much risk. IOC is a late entrant and still a peripheral player in the exploration and production business. It mostly has a lower minority stake in the 10 blocks at home and seven overseas. Just three of its projects are producing. Its biggest overseas purchase happened last year when it bought a 10 percent stake in the Pacific Northwest LNG, an integrated upstream and liquefied natural gas project in Canada in which it committed an investment of about $4 billion. $1.6 billion has already been invested in the Canadian project and another $2.4 billion will go in two-three years. The balance $2.6 billion or so, part of the $5 billion planned for the next five-seven years, will be spent on acquiring new assets in India and overseas. IOC also plans to invest ` 50,000 crore in expanding capacity at its existing refineries in the next five-seven years. Another ` 30,000 crore will be spent on setting up new petrochemicals plants by 2022. (economictimes.indiatimes.com)

Cairn India's Rajasthan oil and gas output surges 3 percent in Q2

October 9, 2015. Cairn India reported a 3 percent rise in crude oil and natural gas production from its Rajasthan fields to 1,68,126 barrels per day in the second quarter (Q2) ended September 30. Average production from the Rajasthan block in July-September stood at 1,68,126 barrels of oil and oil equivalent gas per day (boepd) compared with 1,63,262 boepd in the same period a year ago, Cairn said. Its eastern offshore Ravva field saw a 27 percent jump in output to 26,064 boepd in the second quarter. During April-September, the Rajasthan output was down 2 percent at 1,70,164 boepd while Ravva soared 23 percent to 27,303 boepd. In Q2 of FY16, average gross operated production was up 6 percent at 2,05,361 boepd. Production in Rajasthan was primarily driven by in-line reservoir performance in Mangala and production from additional in-fill wells in the Aishwariya field, it said. Gas production from the Raageshwari field in the second quarter increased to an average rate of 30 million standard cubic feet per day (mmscfd), from 19 mmscfd in the previous quarter, recording a peak production of 34 mmscfd. (www.business-standard.com)

IOC to commission commercial production at Paradip Refinery soon

October 13, 2015. Indian Oil Corporation (IOC) to commission commercial production at Paradip Refinery soon. Paradip refinery is the 11th refinery being set up by IOC in Jagatsinghpur town in the state of Odisha. The installed capacity of refinery will be 15 million metric tonnes per annum (mmtpa). IOC announced in March, 2006 that it is going to set up a refinery and petrochemical complex in the state of Odisha. Initially the production capacity was stated to be 9 mmtpa which was augmented to 15 mmtpa later on. It was announced that the plant will produce polymers like paraxylene, polypropylene and styrene in addition to the commissioning of a pipeline from refinery to Ranchi. IOC had acquired a land area of 3,000 acres for the petrochemical complex. (www.orissadiary.com)

MRPL plans to set up LNG Terminal at Mangalore port

October 8, 2015. Mangalore Refinery and Petrochemicals Limited (MRPL) will conduct feasibility studies for setting up a liquefied natural gas (LNG) terminal at Mangalore port. MRPL, a unit of Oil and Natural Gas Corp (ONGC), will explore a possibility of setting up a fixed or land based LNG import terminal as well as a floating receipt facility on high seas. The company signed an MoU with New Mangalore Port Trust (NMPT) to study the feasibility of setting up an LNG re-gassification terminal at Mangalore, the company said. In March 2013, MRPL's partent firm, ONGC along with its partners Mitsui of Japan and BPCL had signed an agreement with NMPT to conduct feasibility of setting up USD 500-750 million LNG import terminal at Mangalore. The ONGC terminal was to have an initial capacity of 2-3 million tonnes, which can be expanded to five million tonnes later. In 2005, ONGC planned to build a LNG terminal, which was then shelved in 2006 due to change in leadership. But the company in 2013 started looking actively at the plan of LNG import, with the clear idea that domestic gas availability at 160 million standard cubic metres per day (mmscmd) in 2018 will be way short of demand of 290 mmscmd. MRPL itself will be a big consumer of gas. Also, its petrochemical plants will also use gas. (timesofindia.indiatimes.com)

Transportation / Trade…………

IOC to sell subsidised 5 kg LPG cylinders in rural India

October 12, 2015. Indian Oil Corporation (IOC) plans to sell subsidised 5-kg LPG cylinders in rural India in an effort to increase usage of clean fuel for cooking. The state-owned oil marketing company is in the process of setting up infrastructure and working out the logistics. It plans to sup pipelines at major centres that will connect either LNG terminals or bottling plants and refineries to cut on the cost of transportation and increase the speed of delivery. IOC sells 14-kg cylinders in urban areas at subsidised rates. It has come up with subsidised 5-kg cylinders for families below poverty line that are not sold to any other category at present. These cylinders are made available at market price through petrol pumps and kirana shops for families with temporary residency in cities. The company is planning to sell subsidised 5-kg cylinders in large numbers to people living in rural areas. These rural consumers will be eligible for 112 kg of subsidised cooking gas in a year which will be delivered in 5 kg containers. (timesofindia.indiatimes.com)

Paradip-Durgapur LPG link to be ready by next year: IOC

October 10, 2015. The proposed Paradip-Durgapur LPG pipeline will be ready by the next year to boost supplies, Indian Oil Corporation (IOC) said. IOC said that after the pipeline construction is over, it is expected that there would be no backlog in supplies. IOC said the overall demand of LPG connections would rise from 18 million tonnes (mt) to 25 mt by 2022-23, potentially growing at 11-12 percent each year. Fifty percent of India's LPG requirement is being imported. IOC said that to cater to rising demand, IOC has drawn up plans on infrastructure development and improving logistics for movement of gas. Towards this, IOC will construct one pipeline from Paradip to Muzzafarpur touching Haldia, Durgapur and Patna involving a total cost of ` 2,700 crore. (profit.ndtv.com)

Hunt on for leader to lay $10 bn TAPI gas pipeline

October 9, 2015. The four-nation consortium has revived the search for a leader to help lay the $10 billion TAPI gas pipeline, laying bare the lack of confidence among the countries to go ahead on their own and threatening to delay the project further. Turkmenistan, Afghanistan, Pakistan and India had agreed to co-own the project with TurkmenGaz, the state-owned firm of Turkmenistan, expected to make the majority investment in laying the 1800-km pipeline that would begin the construction work in December. Now again the timeline looks shaky. None of the four countries have experience building or managing transnational pipelines, especially in a volatile region like Afghanistan and Pakistan where Taliban and other extremists could pose big threat to the security of the pipeline, expected to carry natural gas from the hydrocarbons-rich Turkmenistan to India. Partly fuelled by the fear that Iran, one of the countries with richest gas reserves, may kill Turkmenistan's chances of becoming the key gas supplier to India and Pakistan following the lifting of sanctions, the central Asian nation convinced partners and hurriedly stitched an agreement soon after Iran's pact with world powers for a sanction free regime. The urgency to find buyers has heightened among oil and gas producers following a collapse in the commodity prices and a war for market share. The pact was quickly reached also partly because Prime Minister Narendra Modi was pushing for it. India has revived discussion on subsea pipelines proposed to carry gas from Iran or Oman. (economictimes.indiatimes.com)

DBT scheme saves ` 146.7 bn on LPG subsidy in a year: Govt

October 13, 2015. A total of ` 14,672 crore is saved in LPG subsidy in a year as a result of direct benefit transfer (DBT), the government said. The oil ministry said as on April 1, 2015, there were 18.19 crore registered LPG consumers and 14.85 crore active consumers implying a gap of 3.34 crore consumers which are duplicate/fake/inactive accounts. The duplicate/fake connections were blocked under the direct benefit transfer scheme, called PAHAL. The oil ministry said the subsidy outgo is a result of multiplicity of factors like prevailing crude price and exchange rate as well as tax structure in various States. (www.financialexpress.com)

Govt should relook new gas pricing formula: FICCI

October 9, 2015. With natural gas prices being cut by 18 percent using the new pricing formula, the Federation of Indian Chambers of Commerce and Industry (FICCI) advocated a mechanism that adequately remunerates country’s exploration and production activity and helps ramp up domestic supplies. In a letter to Oil Secretary, FICCI said the current gas formula of pricing gas based on rate prevalent in surplus economies like US and Canada should be relooked. The formula "is unfairly biased towards the pricing in gas surplus economies such as the US, Canada and Russia and is not consistent with realities of the Indian Market," it said. This view has also been corroborated by rating agencies Standard & Poor and Moodys, which have recommended that the pricing formula incorporate prices in similar geographies such as Indonesia and Thailand which average around $8-10 per million British thermal unit (mmBtu), it said. Gas price in India fell by 18 percent to $3.82 per mmBtu for six months beginning October 1. FICCI emphasised that India’s vast untapped reserves in deepwater, ultra-deepwater as well as North East and frontier basins can only be brought online by creating a favorable pricing regime which incentivises both domestic and foreign oil and gas majors to commit significant amounts of risk capital and advanced engineering solutions in these areas. Furthermore, FICCI said that the higher premium for deepwater, ultra-deepwater along with high pressure and high temperature fields, as previously announced by the government needs to be implemented expeditiously. Ficci said "continuing with the current gas pricing regime will severely affect India’s larger goal of reducing oil import dependency and building the domestic hydrocarbon capacity as envisaged in Prime Ministers Make in India initiative." (indiatoday.intoday.in)

IOC will not ink long-term LNG price deals

October 8, 2015. Indian Oil Corporation (IOC) will not enter into long-term price contracts with liquefied natural gas (LNG) suppliers, drawing lessons from the fiasco where Petronet LNG has been forced to purchase expensive LNG to honour an old contract but struggles to sell it further to consumers. The company would have a long-term agreement only for the quantity of gas and not for the price. IOC just wants to avoid the difficulty Petronet LNG, which it co owns with other state oil firms, is caught in. IOC is betting big on the gas business, hoping it would help the firm defend its market share in the fuel business as rising environmental concerns and a public rage against air pollution are accelerating a shift towards cleaner fuel. Natural gas is considered one of the cleanest among fossil fuels such as coal and crude oil but higher prices have kept its industrial usage suppressed well below the potential in India. IOC has a 30 percent share in the LNG segment. India imported about 18.5 billion cubic meters (bcm) of the 51 bcm of natural gas it consumed in 2014-15. Much of its cooking and transport needs are met by cheaper domestic gas but industries also have to depend on expensive imports. Since the crude oil prices started falling sharply last year, Petronet, a firm engaged in importing LNG and selling to domestic gas consumers, has been struggling to find buyers for the gas purchased under the term contract with Qatar’s RasGas. Petronet had agreed to take 7.5 million ton of LNG a year from RasGas at a rate linked to the trailing five year crude oil prices. As crude oil prices halved in a year, it quickly depressed the spot LNG prices. At about $6.8 per unit, the spot LNG is almost 50 percent cheaper than the price Petronet is charging from consumers. It is this situation IOC wants to escape by not entering into long-term price contracts. Meanwhile, the shifting market dynamics has given IOC the hope that the future belongs to gas. (www.diligentia.net.in)

Petroleum policy for North East by end of 2015

October 8, 2015. The Petroleum Ministry is likely to finalise the North East Exploration Policy by end of this calendar year. To promote exploration in the north eastern states, the ministry will be providing incentives to these upstream companies to increase domestic production from new discoveries while not relying only on ageing fields. The Directorate General of Hydrocarbons (DGH) was earlier been directed to conduct a study, which aims to have a policy that would encourage exploration and production of oil and gas in the region. The DGH has examined the issues that were limiting exploration and production of oil and gas in the region and has suggested workable solutions with action plan. The government plans to extend sops for explorers to attract investment in the space. Regulatory hurdles have proven to be a major obstacle to businesses vying to operate in India for decades. Since 2010, the country has seen a steady fall in domestic energy output due to failure in attracting new private investment into exploration and maintaining production levels of existing blocks. (www.newindianexpress.com)

[NATIONAL: POWER]

BHEL starts 2.7 GW power projects in first half of 2015-16

October 12, 2015. Bharat Heavy Electricals (BHEL) said it has commissioned 2,730 MW of utility power projects in the first six months of 2015-16. The company said power generation has also commenced from the BHEL-supplied 660 MW unit at Lalitpur thermal power station (TPS) in Uttar Pradesh. Significantly, the 11 utility sets commissioned by BHEL have been with projects across the country. Projects in the North include two units each of 200 MW at Koldam hydro electric project (HEP) in Himachal Pradesh and four units each of 82.5 MW at Shrinagar HEP in Uttarakhand, it said. Also, two thermal sets of 500 MW each -- one at Anpara in Uttar Pradesh and another at Vindhyachal in Madhya Pradesh -- have been commissioned during the year. The 660 MW Lalitpur unit was synchronised 3 months ahead of schedule. Notably, this is the first supercritical set to be commissioned in Uttar Pradesh. BHEL has started the 250 MW Bongaigaon Unit-1 in Assam. It commissioned the 500 MW Tuticorin-2 in Tamil Nadu and the 250 MW Unit-4 at Sikka TPS in Gujarat. The hydro sets commissioned by BHEL in the first two quarters total 730 MW, which is nearly the same as the total hydro capacity added in the country during 2014-15. In addition, 125 MW of overseas projects and 330 MW of captive power plants were also set into motion by BHEL during this period. (profit.ndtv.com)

Preparations on for launching Kudankulam Unit-2 nuclear plant

October 11, 2015. Preparations are underway for operationalisation of the Unit-2 of Kudankulam Nuclear Power Plant in Tamil Nadu and stage is set for construction of two more reactors of 1000 MW capacity each, according to Russian company Rosatom which is building the atomic power plant. It said the primary and secondary circuits of the second power unit (Unit-1) have successfully passed hydraulic tests, including circulation flushing, using parameters with the powering of the main circulation pumps. The Units 2, 3 and 4 are part of “strategic vision” between India and Russia under which 12 nuclear power plants will be built and made operational over the next 20 years. About the Unit-1, which is already operational, the company said it is the “most powerful” reactor in India and “meets the state-of-the-art safety requirements”. To a question about the status of another nuclear plant proposed to be set up by Russia, for which Haripur in West Bengal was identified by India, but has been delayed because of objections by the locals, it said. (www.thehindu.com)

Singareni Collieries coal output up 27 percent in H1

October 7, 2015. The Singareni Collieries Company Limited first half of 2015-16 ended September 30 was witness to record coal production and despatches with the output up by 27 percent at 27.20 million tonnes.n The mining company has recorded a production of 27.20 million tonnes (mt) of coal during the first half of 2015-16 against target of 25.09 mt, registering 108 percent output. This was higher by 27.46 percent over previous year first half production of 21.34 mt during the same period. The company despatched 28.34 mt coal, recording 14.55 percent growth over previous year supply of 24.74 mt. The company claimed this was the highest ever despatch as it managed to meet the requirement of power utilities, captive power plants, cement companies and other industries. The management of the company has initiated steps to increase the coal output to meet the requirements of coal for power units in Telangana. During the first half, it excavated overburden of 139.99 million cubic meters against target 131.76 million cubic meters, representing 6 percent increase over last year excavation of 113.71 million cubic meters. The mining company is at advanced stage of implementing the 1200 MW thermal power project in Adilabad and expects to commission both the units before the end of this fiscal. (www.thehindubusinessline.com)

NTPC-SAIL Power Company gets green nod to expand Durgapur plant

October 7, 2015. NTPC-SAIL Power Company has got environment clearance for expansion of its Durgapur captive power plant in West Bengal with an investment of ` 362 crore. The company is a joint venture (JV) between state-owned firms, the country major power producer NTPC and steel major SAIL. The environment clearance (EC), which will be valid for seven years, has been given subject to certain conditions. As per the proposal, the expansion project -- located within the Durgapur Steel plant -- will cost about ` 361.94 crore, which includes about ` 18.1 crore for environmental protection measures. The coal requirement will be 0.3 million tonnes per annum and will be sourced from SAIL's Ramnagore Captive Coal mine. And the project does not require any further land acquisition. NTPC formed a JV with SAIL on 50:50 basis in March 2001. The JV took over captive power plant-II located at Durgapur Steel Plant (2X60 MW) and Rourkela Steel Plant (2X60 MW) from SAIL. (www.firstpost.com)

Transmission / Distribution / Trade…

ABB bags ` 1.4 bn order from PGCIL

October 13, 2015. ABB has won orders worth ` 141 crore from Power Grid Corporation of India Limited (PGCIL) to supply 765 kilovolt (kV) ultrahigh voltage power transformers for substations in Uttarakhand and Uttar Pradesh. Three of these ultra-high voltage transformers will be installed at the Meerut substation in the north west of Uttar Pradesh, while 14 transformers will be installed in new substations being constructed in Uttarakhand. The new substations will receive power from the Tehri Hydropower Complex in the northwest for distribution across Uttarakhand and Uttar Pradesh. The enhanced transmission capacity will help address growing demand in the region. ABB will design, manufacture, test, transport, erect and commission the 765 kV single-phase autotransformers at the substation sites. The 14 transformers for the greenfield substations in Uttarakhand are rated at 266.7 megavolt ampere, while the three transformers for the Meerut substation in Uttar Pradesh are 500 megavolt ampere. (www.business-standard.com)

CIL, SCCL earn ` 300 bn incremental revenues via e-auction

October 12, 2015. Coal India Limited (CIL) and Singareni Collieries Company Limited (SCCL) have earned incremental revenues of about ` 30,000 crore through e-auction, Mjunction Services said. The very first e-auction it conducted fetched 54 percent above the notified price for Bharat Coking Coal, a Coal India arm. The unique methodology it put in place is still being followed, it said. Till date, over 500 million tonnes of coal have been sold using this methodology. (indiatoday.intoday.in)

OTPC in final stages of clinching PPA with Myanmar for exporting power

October 9, 2015. ONGC Tripura Power Company Ltd (OTPC) is in the final stages of clinching a power purchase agreement (PPA) with the government of Myanmar, according to the company. The company said once the PPA is signed, the company could begin exporting power from November 1, 2015. The power export agreement with Myanmar would be for a minimum period of 15 years, the company said. The Central Electricity Regulatory Authority has also been involved in the exercise. According to the company, power generation is no longer a problem in India. The problems in the sector relate to power pricing and distribution and transmission, the company said. (economictimes.indiatimes.com)

No bailout for debt-ridden state discoms

October 8, 2015. The Centre has ruled out yet another bailout for debt-ridden state electricity boards (SEBs) and has instead decided to “nurture” the state government’s initiatives to reform their distribution entities with funding support, technology and infrastructure upgrade. The SEBs together owe over ` 4 lakh crore to banks and are running out of cash to repay loans. Power, coal and renewable energy minister Piyush Goyal said the Centre would not bail out any discom but would support state governments through investments in infrastructure upgrade, ensure adequate supplies of coal and support rural electrification, which would ultimately help in increasing the demand for power and cut the losses of discoms. The minister said that a rescue plan was in the works in consultation with the states and as part of this the government would like SEBs to gradually increase electricity tariffs so that they are more reflective of costs. The proposed rescue plan would go to the cabinet for clearance this month. He said that though tariff setting was the prerogative of local regulators, the Centre wanted to help utilities fix the financial mess. The decision not to offer central support by way of another round of debt restructuring has been taken in view of the poor track record of previous attempts to clean up the books of discoms. After earlier unsuccessful rounds of debt restructuring of SEBs in the past, the Centre announced a ` 1.93 lakh crore financial restructuring package in September 2012. But even though the debt restructuring programme by banks ends this month, SEBs are still saddled with accumulated losses amounting to over ` 2.80 lakh crore and a total debt of over ` 4 lakh crore. Some of the SEBs are on the verge of defaulting on payment to banks. Eight states -- Rajasthan, Uttar Pradesh, Bihar, Tamil Nadu, Andhra Pradesh, Haryana, Jharkhand and Telangana -- account for more that 80 percent of the losses. For the Centre, the immediate concern is to prevent the collapse of the country’s distribution sector. It is with this in mind that it is working overtime to address the issues and come to a long-term solution. Last month Goyal met chief secretaries of states and representatives of the discoms to come up with a solution. After that meeting, Goyal had said that the Centre would handhold states and in two to three years time the distress of discoms would be a thing of the past. Prime Minister Narendra Modi has also held meetings on distribution reforms. A distribution reforms committee (DRC) headed by power secretary has been set up to address the problems. (dc.asianage.com)

Power Grid, Sterlite, 4 others in fray for ` 80 bn projects

October 8, 2015. As many as six companies including Power Grid Corporation of India Limited (PGCIL), Sterlite and Adani have qualified on technical grounds for submitting financial bids for power transmission project Vemagiri II, worth around ` 6,300 crore. Besides, PGCIL, Sterlite Grid, Adani, Kalpataru and Essel Infra Projects have qualified on technical ground to submit financial bids for Alipurduar power transmission project estimated at around ` 1,800 crore. REC Transmission Projects Company Limited (RECTPL) is conducting the auction these two transmission project. PGCIL, Sterlite Grid, Adani, Inabensa Bharat, Kalpataru Power Transmission and Consortium of Megha Engineering & Gayatri Projects have qualified for the Vemagiri II project. The Vemagiri II project will strengthen transmission system beyond Vemagiri and will be called Vemagiri II Transmission Ltd. It will traverse through Andhra Pradesh and Karnataka. Similarly, the Alipurduar project will strengthen transmission system in India for transfer of power from new hydroelectric projects in Bhutan. It will traverse through Bihar and West Bengal. (profit.ndtv.com)

Karnataka cabinet nod for JV for gas distribution network for Bengaluru

October 7, 2015. Karnataka cabinet approved the formation of a Joint Venture (JV) company to set up City Gas Distribution (CGD) network for Bengaluru households and fuel for CNG-run vehicles. The new JV - Karnataka Natural Gas Limited (KGNL) - would also develop CGD networks in major cities and towns along which the Dabhol-Bengaluru gas pipeline alignment passes, Law and Parliamentary Minister T B Jayachandra said. Talking about the investments, Jayachandra said KGNL would implement the project with a share capital of ` 100 crore. (economictimes.indiatimes.com)

Punj Lloyd enters transmission, distribution segment

October 7, 2015. Punj Lloyd has forayed into the power transmission and distribution (T&D) sector as it bagged two projects in the segment from Power Grid Corporation of India Limited. The company said it has won projects worth ` 488 crore in the power sector, including "its first two wins in the transmission and distribution (T&D) segment". Awarded by the Power Grid Corporation, both the T&D orders are for the rural electrification of districts in Odisha - Jajpur, Khorda and Ganjam - under the Rajiv Gandhi Gramin Vidyutikaran Yojna (RGGVY), the company said. The company said that it has won its first power project from BHEL for the civil, structural and architectural work of the non-plant works and raw water reservoir, roads and drains at the 800 MW Kothagudem thermal power project in Telangana. (profit.ndtv.com)

Policy / Performance………….

India assures Bangladesh help in field of atomic energy

October 13, 2015. India has assured Bangladesh that it will provide all the help in various sectors of science and technology, including in the field of atomic energy. India's assurance came at bilateral talks for cooperation in fields of science, technology, oceanography, earth sciences and atomic energy among others held. It is learnt that Prime Minister Narendra Modi had given instructions to extend every kind of help as asked by Bangladesh. (www.aninews.in)

Power sector employees call for nationwide strike on December 8

October 12, 2015. National Coordination Committee of Electricity Employees and Engineers (NCCOEEE) will go on a day long strike on December 8 to protest against Electricity (Amendment) Bill 2014. NCOEEE has decided to strike on December 8 throughout the country. About 12 lakh power employees and engineers are likely to participate in nationwide strike. The Electricity (Amendment) Bill, 2014 was introduced in Lok Sabha in December last year. It seeks to segregate the distribution network from the electricity supply business. NCCOEEE has planned for massive demonstration on November 6 at Kochi where power minister’s conference of all states has been arranged by the Power Ministry. According to NCCOEEE, the bill which seeks to split electricity distribution sector into carriage and content to enable profit mongers to enter into supply business of urban and revenue potential area without any investment for development or expansion of the power industry. (www.financialexpress.com)

Over ` 110 bn spent on buying power from outside: J&K

October 11, 2015. The Jammu and Kashmir (J&K) government has spent over ` 11,000 crore on purchase of electricity from outside in the last three years, Deputy Chief Minister Nirmal Singh said. The state, rich in hydroelectricity, imports electricity to meet its energy shortfall which gets worse mostly in winters. The state government said it has to pump huge amount of money in meeting its power requirement and the revenue collected from electricity dues falls way short of the expenditure. There are around 16,47,222 registered consumers in the state out of which 8,38,258 are metered consumers. Currently, NHPC generates 4,961 MW of hydroelectricity in six states out of which Jammu and Kashmir alone contributes 2,009 MW. The state generates 761 MW electricity from its own 21 power projects run by Power Development Corporation (PDC), while as it needs 2,500 MW to meet energy requirements. PDC has said its main concern is transmission and distribution losses affecting power distribution service, with highest loss percentage of 74.65 percent in Ganderbal district in the Kashmir Valley and lowest of 23.31 in Poonch district. (timesofindia.indiatimes.com)

Delhi HC upholds quashing of CIL's revised transportation rates

October 11, 2015. Delhi High Court (HC) has upheld its order quashing Coal India Ltd's decision on revision of rates of coal transportation by companies run by ex-servicemen without consulting the Director General of Resettlement (DGR). The court passed the order on CIL's appeal against the order of the single judge, who had quashed the August 8, 2012, decision regarding revision of rates of loading and transportation of coal by ex-serviceman transport companies. The memorandum of understanding drawn up between Coal India Limited (CIL) and DGR regarding transportation of coal by ex-servicemen companies had a clause that the modalities, of fixing rates and escalation to be paid yearly, would be formulated by the CIL in consultation with the latter. The ex-servicemen transport companies have been making representations since 2009 for enhancement of transportation rates on a yearly basis, the petitioner company had said. The company had submitted before the single judge that while CIL's profits had increased from ` 5,744 crore to ` 21,272 crore between 2008 and 2012, firms like it had been denied their dues. (www.business-standard.com)

TN CM seeks PM's intervention to recommence Kudankulam Unit I

October 7, 2015. Tamil Nadu (TN) Chief Minister (CM) J Jayalalithaa has requested Prime Minister Narendra Modi to give instruction to the officials in the Nuclear Power Corporation of India Limited to immediately take action to recommence power generation in Unit-I of the Kudankulam Nuclear Power Plant, which has been shut down for past 90 days. She also requested measures to expedite the commercial operation of Kudankulam Unit-II, which is undergoing final stages of commissioning. In a letter sent to the Prime Minister, she said that the Kudankulam Nuclear Power Plant which had started commercial operations on on December 31, 2014, has been shut down for maintenance for the past 90 days and there is a delay in recommencing the operations in the Unit I. Tamil Nadu has been allotted about 563 MW of power from the total of 1000 MW produced by Unit-I of Kudankulam Nuclear Power Plant. Further, the State government has been informed that the Kudankulam Unit-II is undergoing final stages of commissioning activities and awaiting approval from the Atomic Energy Regulatory Board (AERB) for full commercial production. The Chief Minister requested the Prime Minister to instruct the concerned officials to expedite the commercial operation of Kudankulam Unit-II, so that another 563 MW of power can be added to the Tamil Nadu Grid at the earliest. (www.business-standard.com)

India wants states to raise power prices gradually as part of rescue plan

October 7, 2015. Power minister Piyush Goyal said the government would like states to raise electricity prices gradually as part of a rescue plan Prime Minister Narendra Modi has urged to fix the finances of the country's money-losing utilities. State-run electricity distributors, which collectively owe $66 billion, are running out of cash and struggling to repay loans, squeezing banks' ability to spur credit growth and undermining Modi's campaign to lure energy-hungry manufacturers to expand production. Goyal said he would continue to hold meetings with states over the next few days to agree a plan. Modi is to take the politically contentious move of telling states to raise electricity prices, which are often held artificially low to appeal to key groups of voters such as farmers and the poor, and agree to performance improvements. In return, states would be able to access the financial bailout package. Modi, who successfully overhauled the power industry in his home state of Gujarat in the mid-2000s, has told the power ministry and states they must act urgently to fix the utility sector. The rescue plan would go to the cabinet for clearance this month. (in.reuters.com)

[INTERNATIONAL: OIL & GAS]

Gas discovered in Pakistan's Latif license: OMV

October 12, 2015. OMV announced that gas has been discovered in the Latif South-1 exploration well, located in Pakistan’s Latif exploration license. During testing, the Latif South-1 well flowed at a rate of 2,500 barrels of oil equivalent per day (15 million cubic feet of gas per day). OMV (Pakistan) Exploration Gesellschaft m.b.H. holds a 33.4 percent share in the exploration license. Joint venture partners Pakistan Petroleum Limited and Eni Pakistan (M) Limited both hold a 33.3 percent interest. (www.rigzone.com)

OPEC sees more demand for its crude in 2016 as cheap oil hits rivals

October 12, 2015. The Organization of the Petroleum Exporting Countries (OPEC) forecast that demand for its oil in 2016 would be much higher than previously thought as its strategy of letting prices fall hits U.S. shale oil and other rival supplies, reducing a global surplus. In a monthly report, the OPEC forecast the world would need 30.82 million barrels per day (bpd) from the group next year, up 510,000 bpd from the previous prediction. OPEC's forecast, if realized, would be a further indication its strategy is working. The group last year refused to prop up prices and instead raised output, seeking to recover market share taken by higher-cost rival production. Oil LCOc1 is trading just below $53, half its price of June 2014. Supply outside OPEC is expected to decline by 130,000 bpd in 2016, the report said, as output falls in the United States, the former Soviet Union, Africa, the Middle East and much of Europe. Last month, OPEC predicted growth of 160,000 bpd. The higher call on OPEC comes despite weaker global demand growth overall. OPEC trimmed its estimate of 2016 world oil demand growth by 40,000 bpd to 1.25 million bpd, citing slower growth in China. Other forecasters also expect less oil from non-OPEC. The International Energy Agency, which advises industrialized countries, sees an even bigger drop in their supply in 2016. Output in the United States - the biggest source of non-OPEC supply growth in recent years - is being hit by reduced drilling activity and tighter credit conditions have reduced companies' access to funds, OPEC said. The report said OPEC members continue to boost supplies. According to secondary sources cited by the report, OPEC pumped 31.57 million bpd in September - up 110,000 bpd from August and almost 2 million bpd more than its prediction of the demand for its crude this year. (www.reuters.com)

Brazil sells 37 of 266 exploration blocks in oil round

October 12, 2015. The 13th oil round organised by the National Petroleum Agency of Brazil has failed to attract investors, with only 37 of the 266 onshore and offshore oil exploration blocks it offered, generating R$121mn (US$32 mn) in signing bonus; investments are estimated at R$216m (US$57.5 mn). No international majors operating in Brazil, such as Shell, Statoil or Total, nor national oil and gas company Petrobras submitted any bids and the 17 companies that won the licenses are mid-sized explorers and Brazilian oil startups. However, ENGIE partnered with Parnaiba Gas Natural, which won six blocks. (www.enerdata.net)

China triples proven reserves at top shale gas project

October 8, 2015. China has nearly tripled the size of proven reserves at its Fuling project, by far the country's largest shale gas find, according to investor Sinopec Corp and an industry report. The Jiaoshiba block of the project, in the municipality of Chongqing in southwest China, has 273.8 billion cubic metres (bcm) of newly proven reserves, the report said. That would take total proven preserve certified by the Ministry of Land and Resources (MLR) at Fuling to 380.6 bcm, giving it the potential to have an annual production capacity of 10 bcm by the end of 2017, it said. China hopes to replicate the shale gas boom that has turned the United States into a net exporter, but more complex geology and small scale of development by only a handful state energy firms have resulted in only a few commercial discoveries. The latest reserve appraisal was conducted on the Jiaoye-4 and Jiaoye-5 wells, southwest of the previously evaluated Jiaoye-1 and Jiaoye-3 wells. By the end of August, a total of 142 wells at the Jiaoshiba block had tested high-yield industrial gas flows, the report said. Sinopec said that the company was sticking by its investment pledge on shale gas despite it being more costly and technically more challenging than its conventional fields such as Puguang. (in.reuters.com)

Oil spills into North Sea at Statfjord field: Statoil

October 8, 2015. Oil spilled into the North Sea during the loading of a tanker at Norway's Statfjord field, operator Statoil said. About 40 cubic meters of oil, or 252 barrels, leaked at 0230 ET when oil was loaded on the Hilda Knudsen tanker from the Statfjord A platform via a loading buoy, Statoil said. Production at the platform was not halted, but tanker loading has been suspended. Statoil said another buoy could be used to export oil stored on the platform. The leak was located in a flange in the loading hose between the buoy and the tanker. The Norwegian oil safety regulator was unable to provide further details. The Statfjord A platform can store up to 1.3 million barrels of oil. Statfjord is one of Norway's oldest producing fields in the North Sea. It produced 24,300 barrels per day in July, the latest available data from the Norwegian Petroleum Directorate showed. Statoil's partners at the field are ExxonMobil and Centrica. (www.reuters.com)

Frontera increases Georgia gas resource estimate more than tenfold

October 8, 2015. Frontera Resources Corporation has increased the gas resource estimate of its operations in eastern Georgia more than tenfold, compared to previous estimates. In April this year, Frontera revealed that independent consulting firm Netherland, Sewell & Associates confirmed combined prospective natural gas resources of 12.9 trillion cubic feet of gas in place, with as much as 9.4 trillion cubic feet of recoverable prospective natural gas resources, at the Mtsare Khevi Gas Complex and Taribani Field Complex, which were both combined to form the South Kakheti Gas Complex. In addition to gas resources previously identified for subsets of this combined area, Frontera’s ongoing work recently concluded new estimation of as much as 135 trillion cubic feet of gas in place from reservoir targets found between 984 feet and 16,404 feet in depth. (www.rigzone.com)

Mexican crude oil output may only return to 2012 levels in 2018

October 7, 2015. Mexico may succeed in bringing oil production only back to where it was three years ago by the time the current administration ends in 2018 despite a major reform to open up the industry. In December 2012, the month President Enrique Pena Nieto took office, Mexican crude output was 2.56 million barrels per day (bpd), well down from peak production of nearly 3.4 million bpd in 2004. By this August, it had fallen to 2.25 million bpd. Deputy Energy Minister Lourdes Melgar said that with output declining at aging fields and international crude prices down sharply since last year, it would take time for new projects to make up the shortfall. (www.reuters.com)

KPI will sell Gunvor its Rotterdam refinery

October 12, 2015. Kuwait Petroleum International (KPI) and Gunvor have reached the final stage of negotiations on the sale of the 88,000 bbl/d (4.4 Mt/year) KP Europoort refinery in Rotterdam, in the Netherlands, subject to regulatory approval and the necessary employee consultation process. In October 2014, KPI had cancelled its plans to invest US$1.4 bn to install a 38,000 bbl/d hydrocracker, a new vacuum unit and storage tanks at this refinery. The group was considering converting the 88,000 bbl/d refinery into a storage terminal, shutting it down or selling it. Gunvor already operates two refineries in Europe, a 105,000 bbl/d refinery in Antwerp (Belgium) and a 100,000 bbl/d refinery in Ingolstadt (Germany), both acquired in 2012. (www.enerdata.net)

Statoil puts second subsea gas compression project into action

October 12, 2015. Statoil ASA reported that it has started operating its second gas compression system at the Gullfaks area in the Norwegian North Sea. This latest project follows on from Statoil putting the world's first subsea gas compression plant online at the Åsgard field in the Norwegian Sea in mid-September. Gullfaks subsea gas compression will increase recovery from the Gullfaks South Brent reservoir by approximately 22 million barrels of oil equivalent. Compression is a way to get fields to produce more oil or gas for longer as the natural pressure in a reservoir drops. Until now compression plants have been installed on platforms or onshore, but this new facility is under almost 1,000 feet of water. (www.rigzone.com)

Saudi Aramco considers new Yanbu refining complex

October 11, 2015. State oil giant Saudi Aramco is considering building a $20 billion refining and petrochemical complex at Yanbu on the Red Sea coast. The new refinery would have a capacity of 400,000 barrels per day (bpd) and stand next to an existing refinery at Yanbu, wholly owned by Aramco, which has a capacity of 240,000 bpd and would also feed the planned petrochemical complex. British-based Amec Foster Wheeler was expected to win the contract to execute front-end engineering and design work for the project. The project, planning for which is still in the initial stages, would be completed in 2023 if it goes ahead. Aramco has been integrating its refineries with petrochemical production as it develops its downstream business and expands its trading of refined products. It is already building with Dow Chemical Co a mixed-feed ethane/naphtha cracker for its petrochemical complex in Jubail at a cost of approximately $20 billion. The kingdom's move to become one of the world's largest oil refiners, as well as the top oil exporter, is adding an extra dimension to its role as the main driver of OPEC policy. Aramco said its downstream investments would exceed $100 billion over the next decade and its refining capacity would reach between 8 and 10 million bpd in coming years. It currently has stakes in over 5 million bpd of refining capacity at home and abroad. (www.reuters.com)

US funds grab refinery stock momentum in beat-up energy sector

October 9, 2015. In a rare case of positive momentum in the beat-up energy sector, United States (US) mutual funds have piled into shares of Tesoro Corp and Valero Energy Corp, two independent refinery companies taking advantage of cheap crude prices. Tesoro and Valero are shining stars in an otherwise gloomy picture of the S&P 500 Energy Sector Index, whose one-year return is minus 21 percent. Falling oil prices tend to benefit refiners because they purchase crude as a feedstock for their refineries, which churn out valuable fuels such as gasoline and diesel. But portfolio managers say another reason they are interested in the sector is that the management teams at top U.S. refiners have become disciplined about their capital spending plans and are returning more cash to shareholders. (www.reuters.com)

Traders eye floating diesel storage in Atlantic

October 9, 2015. Oil traders are preparing to store diesel in giant tankers off the coasts of northern Europe and New York as land storage tanks are nearly full, traders said. Tank capacity levels are above 70 percent in some cases, levels considered near maximum, according to traders. While the recent glut in global crude oil supplies appears to ease, boosting oil prices, diesel supplies around the world are set to rise sharply in the coming months, according to analysts. Benchmark diesel barge values in northwest Europe dropped over the past week as huge volumes of the driving fuel reach the region from around the world. Traders said that Vitol, the world's top oil trader, has booked two 90,000 tonne tankers off the coast of Britain to store diesel volumes for an extended period of time. Royal Dutch Shell has also booked a 90,000 tonne tanker to store product outside the New York Harbour, according to traders and shipping brokers. Global diesel supplies are expected to sharply grow in the fourth quarter of 2015, rising by around 500,000 barrels per day (bpd) from a year earlier, according to Vienna-based consultancy JBC Energy. Huge refineries in the U.S. Gulf Coast, Russia, Asia and the Middle East have been shipping in recent months, increasing volumes of diesel to Europe, whose domestic production does not meet demand. In September, more than 5 million tonnes of diesel were imported into Europe, creating an oversupply of more than 500,000 tonnes, traders said. Europe, including Turkey, consumes roughly around 16.5 million tonnes of diesel per month. (www.reuters.com)

QIC acquires CLP gas plant in Australia for $1.2 bn

October 8, 2015. QIC Ltd. agreed to buy the Iona gas storage plant in Australia for A$1.78 billion ($1.28 billion) in cash from Hong Kong’s CLP Holdings Limited as the infrastructure investor looks at expansion opportunities. QIC is purchasing an asset that plays an essential role in energy supply on the country’s east coast, the Brisbane-based company said. CLP is selling the plant as part of a strategy to “restore value” in its investments in Australia, the company said. The Iona plant, located in Victoria state, has storage capacity to supply as much as 500 terajoules of gas per day, according to EnergyAustralia. The facility is used by energy companies to store gas during periods of low usage, which can then be distributed by pipeline to supply markets around Melbourne and Adelaide when demand is high. (www.bloomberg.com)

Pemex restarts plant at Minatitlan refinery