CONTENTS

WEEK IN REVIEW

Ø COAL: India’s Coal Import Strategy Needs a Re-Think

ANALYSIS/ISSUES

Ø Geopolitics Matters: the Ukraine Crisis Triggers the Discussion of Europe’s Dependence on Russian Natural Gas

DATA INSIGHT

Ø Scenario of Biomass Power in India: Tariffs

NEWS HEADLINES AT A GLANCE

· Development of KG-D6 R-series fields to depend on new gas price: Niko Resources

· RIL, BP to invest ` 8 bn in Tamil Nadu

· ONGC to invest ` 57 bn in Mumbai High North development

· Teesta III hydropower project to go on stream in early 2015

· REC, PFC to give ` 78 bn loan to AP power projects

· NPC's 10 reactors of 1.9 GW under IAEA safeguards

· Telangana to buy 1 GW from Chhattisgarh

· 'Power Grid to invest ` 58 bn on upgradation work in Gujarat'

· Tata Power Delhi controls ` 11.2 mn theft using technology

· Coal India yet to sign fuel supply pacts for 4.9 GW

· Goldman says Shale gas boom driving fear from market

· Africa Oil discovers O&G in Block 9 onshore Kenya

· Japan oil refiners may cut capacity to meet new efficiency rules

· Max commissions new Kazakh pipeline

· Lukoil to build $30 bn cash pot after debt freeze

· Koch to start EU power trading as it plans LNG expansion

· Toshiba and GDF Suez sign deal for nuclear power project in Cumbria

· TBEA signs two 100 MW PV power plant deals in China

· LPG prices hiked by ` 16.50 per non-subsidised cylinder; ATF by 0.6 pc

· PNGRB again extends date for CGD bidding

· Petrol price hiked by ` 1.69 per litre, diesel by ` 0.50

· Small chance of Iraq strife disrupting oil supplies: Petroleum Ministry

· Govt to start consultations afresh on raising gas prices

· Oil Minister for setting up statutory safety body for O&G industry

· Unfair to expect gas price decision by new govt so soon: ONGC

· Govt not mulling raising LPG, kerosene prices

· Karnataka mulls cut in power subsidy to farmers

· UP govt to launch 60 days campaign against power theft

· PM Modi to visit J&K for power boost

· Power ministry sets up advisory panel for integrated development of sector

· Goyal keen on states replicating Gujarat power model

· New York towns can ban fracking, state’s top court rules

· Scotland holds billions of barrels of shale oil, report says

· Egypt's Oil Minister says $10 bn gas project with BP restarted

· France sells stake in GDF to raise $2 bn for Alstom

· Jordan approves $2.4 bn power plant

· India gets lowest June rain in 5 yrs as El Nino Looms

· India to strengthen climate change negotiation team

· Budget 2014: Power Ministry may seek scrapping of proposed anti-dumping duty on imported solar gear

· Solar power likely to get top billing in Rail Budget

· Opting for coal-based energy 'wasteful approach' by government: IPCC

· Demand for India renewable credits rises to 3 month high

· Suzlon regains top position in India wind-turbine market

· Sumitomo, partners to provide loans for Japan biomass projects

· Renewables to get most of $7.7 tn power investments

· Vestas wins 450 MW of US wind-turbine orders

· Wind power service market to almost double by 2020: Make

· China catches industrial polluters with drone missions

· EU seen curbing coal use by quadrupling carbon price

· US, India launch a new clean energy initiative

India’s Coal Import Strategy Needs a Re-Think

Ashish Gupta, Observer Research Foundation

he elections are over and it is the time for the new government to fix coal sector issues at the earliest. Though there have been speculations that the new government will open the coal sector for private participation, the new coal, power and renewable minister has made it very clear that they are currently not exploring the idea of privatising the coal assets. On the Coal India Ltd front (CIL) too, the government made it clear that CIL subsidiaries will continue to work under the umbrella of CIL. This is a good sign as the minister is keeping his faith on the public sector company but this does not mean that the reforms of the coal sector can take the back seat.

Since the prevailing situation is that import of coal is inevitable, any solution to minimise coal shortage will not only depend upon the internal environment but also on the geopolitical arena from where India is importing coal. This means that India can minimise risks only by rationalising indigenous coal production by resolving internal administrative and structural issues. Otherwise India will not be able to achieve energy security and it will in addition end up paying more for energy which could be devastating for the economy!

Given the complex geopolitical structure coal imports is unlikely to be stable. Why? Elections are round the corner in Australia and the new government could make changes in export may affect India’s coal import strategy. One such policy is the repealing of the carbon tax on the coal mining. If implemented, it will be very unfortunate for India. Going by the past trends it is unlikely to be implemented because the Australian coal lobbyists are stronger than the American coal lobbyists who have succumbed to assault by climate lobbyists. But India has to keep its fingers crossed. If the new government makes amendments in the labour laws on the ground of infusing more safety it will make coal mining a very costly affair and this will be reflected in coal prices. This is a warning bell for India. It must prepare the groundwork for bilateral negotiations beforehand rather than leaving the matter to the company level.

In Indonesia too, elections are going to take place and therefore India must watch carefully how things develop in Indonesia as we are importing 50% of our steam coal from them. As we have witnessed in the past Indonesia frequently changes its mining laws and it is no longer seen as a trusted partner in the context of coal trading. Though it is bad for India, it makes sense for Indonesia as they are keen to give impetus industrialisation process and full electrification. So there is a possibility (speculation) that there will be an increment in the export tax as well as in the domestic coal obligation when the new government takes over. Any new amendments in the coal mining policy will make India vulnerable to change.

Apart from elections in coal exporting countries, recent accidents such as that at Fukushima have pushed countries to drop their plans of electrification through nuclear reactors. Japan too is quite reluctant to push its civil nuclear program and is shifting to coal based thermal plants. Though Japan has said that new thermal plants will be constructed on clean coal technologies, it will mean an increase in coal demand. It does not matter whether these power plants are clean coal based or not because Japan will import coal from the global market at any price. Given India’s financial and current account deficit situation this luxury is not available to India. This means India will have to pay more. This is an additional burden!

South Africa is currently diversifying its energy basket by erecting more gas and renewable plants. But the question is whether they can afford this transition? In the wake of slow growth of the economy and costly gas and renewable sources it is unlikely they will be able to absorb the transition cost. Therefore ultimately they will try to bridge the gap through coal based plants. That implies less coal for export.

The whole point in highlighting the above facts is to show that India must re-think its coal import plan. Otherwise it will push the already stressed economy into distress mode. What is the way forward? In the short term it is not possible to correct things but if India wants to hedge against devastating situations in the long run then it must increase the domestic coal production. As far as coking coal is concerned we do not have any choice and so strategy of imports should be limited to coking coal only. As they say, prevention is better than cure!

Views are those of the author

Author can be contacted at [email protected]

Geopolitics Matters: the Ukraine Crisis Triggers the Discussion of Europe’s Dependence on Russian Natural Gas

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

ven though LNG has gained a larger share of gas traded among regions, long distance natural gas transportation by pipeline still plays an important role in international gas trade. Recent examples like the planned Power of Siberia pipeline from Russia to China shows that cross border pipeline transportation is an attractive investment to trade natural gas within certain geographical scope. Even India, which is surrounded by gas rich countries within decent pipeline reach, is facing some decades of discussion and planning on specific projects like TAPI or IPI.

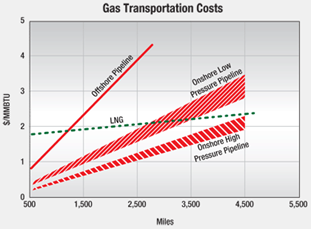

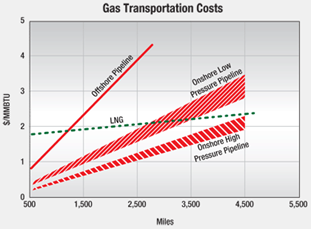

Theoretically cross-border gas supply by means of long distance pipeline transportation is one of the most opportune ways of gas imports, since transportation is technically almost non-disruptive and continuous gas flows can provide highest load factor of supply. However, one of the most striking key factors in favour of pipeline transportation is and will remain costs. Figure 1 shows that for intraregional distances (1500-4500 miles), pipelines can typically be considered more economical than LNG with variations due to land or subsea laying as well as transportation volumes and pressure, respectively. LNG is more competitive for intercontinental routes. In practice, LNG projects do not often compete directly against pipeline transportation for the same supply project. Nevertheless, cross-border gas transportation suffers of prevailing vulnerability due to geopolitical risks, which actually can lead to a trade-off, apart from economic considerations, as India’s import spectrum from the Middle East by means of LNG or pipeline transportation by land or subsea demonstrates.

Figure 1:

Geopolitical risks might matter quite seriously. This matter of fact can currently be observed in the ongoing Ukraine crisis, which can also be seen in the light of a natural gas crisis in the longstanding and successful gas trade relationship between several European countries and Russia. Since the extent of economic relations between Europe and Russia is considerable and very far-reaching, this raises substantial hopes that economic sanctions against Russia or its sheer threat indeed can be helpful to avoid an act of war. Russia's economic growth continues to be driven by energy exports: oil and gas revenues accounted for 52 % of federal budget revenues and over 70 % of total exports in 2012. In contrast, about one quarter of total natural gas supplies to Europe are currently sourced from Russia.

About half of the European gas imports from Russia, or 16 % of overall European gas consumption, cut across Ukraine using the two major cross-border pipeline systems Brotherhood and Soyuz. Previously, Russian dependency on transits through Ukraine was even higher, with about four-fifth of all its gas exports to Europe transiting Ukraine. However, the Russians have tackled this vulnerability by forking out huge sums of money into alternatives bypassing Ukraine. The new connections can partly be considered as strategic overcapacities: The Nord Stream subsea pipeline was completed end of 2012 with a total combined capacity of 55 bcm/a. The South Stream pipeline will ship natural gas from Russia under the Black Sea to Bulgaria, crossing through Turkey's waters, hence avoiding Ukraine's territory altogether. First gas supplies are scheduled for late 2015 and overall cost including feeder pipelines and financing expenses is expected to exceed a striking € 56 bn.

Against the backdrop of the tight economic interdependencies gas cut-offs and cut-backs on the one hand and a gas boycott on the other hand has to be seen within one’s means. The strategic option of boycotting natural gas imports from Russia, or at least its gradual and/or temporary reduction, has been broadly discussed in European and German political as well as economic circles. The European Commission is drawing up options for “reducing energy dependence on Russia” as part of a possible package of sanctions. In contrast Russia has cut off gas to Ukraine in a dispute over unpaid bills in mid June that could disrupt supplies to the rest of Europe and set back hopes for reconciliation between the former Soviet neighbours.

A profound analysis has shown that Russia and Europe remain quite closely tied in economic terms, even if they fall apart politically. Any reaction to the Crimean aggression, be it gas cut-offs from the Russian side or economic responses such as gas boycotts or trade sanctions from the European side, will be painful for both: European investors might lose part of their substantial (recent or future) FDI options in Russia, not to mention Europe is still strongly dependent on Russian gas and oil, while Russia is liable to lose urgently needed technology and knowledge transfer as well as money inflow to keep its already weakening economy alive. It cannot be stressed enough that oil and gas export revenues are particularly essential for the Russian budget. Nonetheless, the threat of gas sanctions against Russia seems not to be as implausible as often stated, and in the longer term even makes sense with respect to an enhanced security of supply (reduced gas needs at all, more diversification).

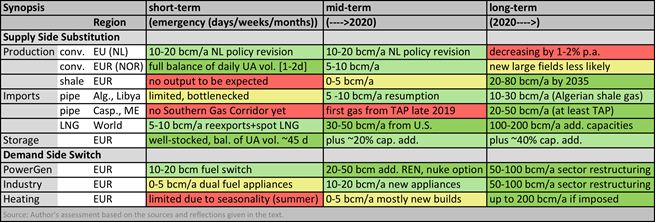

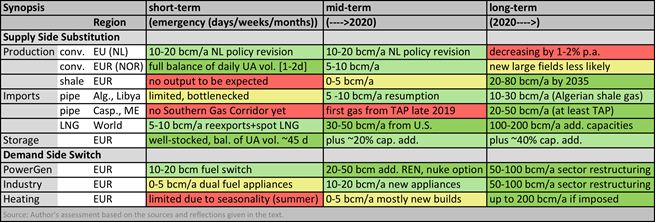

As demonstrated in Table 1, in the short term, it seems as if Europe will be able to survive a temporary short-term cut-off or cut-back of gas supplies via Ukraine, as Norway can substitute these volumes for a few days, storage is sufficient and demand is in its seasonal lows. Furthermore, some more LNG might be attracted for landing in Europe. The Institute of Energy Economics at the University of Cologne has calculated that a short-term gas embargo of about three month would have a different impact on distinct regions: the NWE countries might only face a price increase of about 5‑10 % due to relatively comfortable storage levels and low seasonal gas demand, whereas East European countries like Poland or Hungary might witness a price surge of more than 20 %.

Enlarging the time period till the end of the decade (mid-term), Europe can gradually withstand a shortfall of gas coming in through Ukraine even better since structural changes can be initiated and new supply sources can be arranged for. However, it will be in conflict with the self-imposed climate policy targets and might prove costly. As shown in a rough calculation, it will cost more than $200 million per bcm to replace Russian gas with LNG at current market prices.

In the long run, it appears quite feasible to gradually switch away from Russian gas dependency if there is the fundamental political will and sufficient willingness to pay. Structural changes on the demand side can be imposed or steered, and on the supply side some new options will arise; trust in shale gas might be strengthened, LNG from North America could consequently be contracted, and first gas supplies from Caspian will be shipped via TAP.

Table 1: Synopsis –Potential of Supply Side Substitution and Demand Side Switch

Source: Compiled by author.

Given that Russia’s President Putin plays with sharp-edged tools, risking more fundamental and structural changes being implemented in the European gas industry, the Ukraine crisis might negatively influence this long-lasting and successful partnership. Even if Russia turns towards Asian countries like China (an actual longstanding threat uttered against European buyers), its reputation as a reliable supplier might be eroded, and its position of leverage against potential contract partners might be jeopardised.

Furthermore, some strategic partnerships with Russia’s energy giants Gazprom and Rosneft might be threatened from either side if the situation worsens: Gazprom’s marketing arms in Germany (Wingas) and UK (GMT) or E.ON’s, BASF’s (Wingas), Statoil’s upstream investments. Most recently, the German upstream RWE DEA has been sold to Russian investors. Given that the German government does not feel qualms about approving new natural gas projects with Russian investors, this finally leads to the question of how serious and credible German (and European) policymaking is.

Views are those of the author

Author can be contacted at [email protected]

Scenario of Biomass Power in India: Tariffs

Akhilesh Sati, Observer Research Foundation

`/KWh

|

State*

|

Biomass Power

|

Biomass Cogeneration

|

Biomass Gasification

|

|

Andhra Pradesh

|

5.55

|

5.4

|

5.91

|

|

Haryana

|

6.05

|

6.12

|

6.45

|

|

Maharashtra

|

6.15

|

5.8

|

6.55

|

|

Punjab

|

6.25

|

5.67

|

6.65

|

|

Rajasthan

|

5.52

|

|

5.88

|

|

Tamil Nadu

|

5.49

|

4.93

|

5.85

|

|

Uttar Pradesh

|

5.61

|

5.71

|

5.97

|

|

Others

|

5.8

|

5.56

|

6.17

|

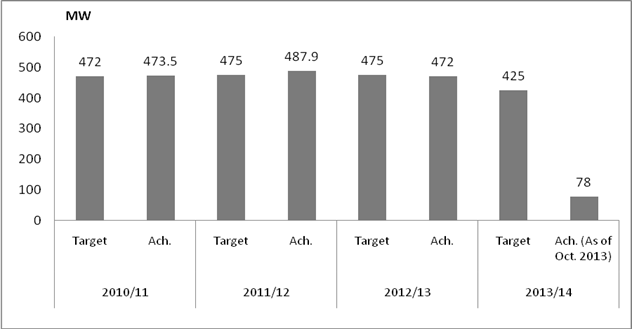

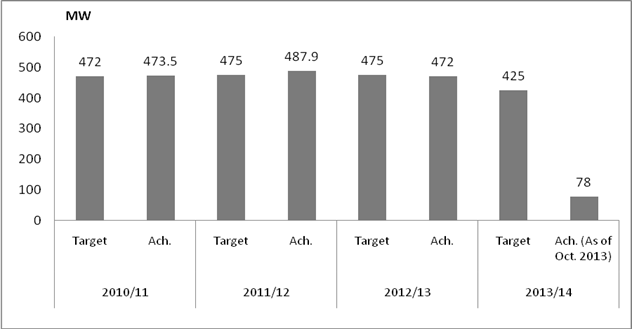

Biomass Power: Targets & Achievement in Electricity Generation Capacity Additions

* CERC determined tariffs & tariff order dated 28 Feb 2013.

Source: BioPower India, Ministry of New and Renewable Energy

NEWS BRIEF

OIL & GAS

Development of KG-D6 R-series fields to depend on new gas price: Niko Resources

July 1, 2014. The development of R-series fields in Reliance Industries-operated KG-D6 blocks, which can significantly increase gas output in future, depends on the price of natural gas that the government allows the operator to charge, Niko Resources, which holds 10% in the block, said. However, the planned investment would not be deferred if the government announces the new price by October 1, Niko said. The government had approved doubling the price of natural gas to about $8.4 per unit from April 1, 2014 but this was blocked by the Election Commission. After the Narendra Modi government came to power, the Cabinet deferred the decision by three months and said that the existing price of $4.2 per unit would continue until the end of September. Reliance has already initiated arbitration saying billions of dollars of investment are at stake. Niko also commented on RIL's plans to optimise output in the existing D1 and D3 fields in the KG-D6 block. (economictimes.indiatimes.com)

RIL, BP to invest ` 8 bn in Tamil Nadu

June 30, 2014. Reliance Industries Ltd (RIL), along with its partner British Petroleum (BP), plans to invest about ` 800 crore to carry out exploratory drilling in an offshore block in the Bay of Bengal, off the Tamil Nadu coast. RIL is the operator of the offshore block CY-DWN-2001/2, also known as CY-III-D5, with 70 per cent equity, while BP holds the remaining stake. Thus, of the total ` 800-crore investment, BP's contribution would be ` 240 crore. The block is off the east coast of India between Puducherry and Karaikal off Tamil Nadu. The deep-water block covers an area of around 10,655 sq km with its nearest boundary about 22 km from the shore. In 2011, BP joined hands with RIL for joint exploration for its 21 oil and gas blocks for a 30 per cent stake. RIL and BP have since relinquished 15 blocks owing to weak prospects. RIL had struck a $7.2-billion deal with BP for the deal. In August 2013, RIL and BP announced gas discovery in the offshore block. The discovery was named D-56. RIL received environmental clearance to carry out 11 exploratory wells off the Tamil Nadu coast. As on date, eight wells were drilled and hydrocarbon was discovered in two wells, said RIL. Investment in each of these wells would be around ` 100 crore and the exploratory drilling campaign is expected to commence from the last quarter of FY15 and it will be a temporary phase extending three-four months for a well at a location. RIL's existing supply base at Kakinada, which was established for the ongoing exploratory and development projects, will be used for the proposed drilling programme. Seismic data and the drilling campaign in the area also revealed the presence of hydrocarbons. However, to ascertain the quantum and economic viability of extraction of hydrocarbons, the company is required to drill 11 more exploratory/ appraisal wells within the block area. If the company succeeds in the discovery of hydrocarbons and if it is commercially viable to extract, then the project will help reduce the supply demand gap of hydrocarbons in the country, said RIL. In FY13, the production of crude was 0.75 million barrels a day, which is 21 per cent of the consumption of 4.35 million barrels a day. Indigenous crude oil production has remained stagnant over the past five years and it is unlikely to improve in the near future unless new discoveries are made, said RIL. (www.business-standard.com)

ONGC to invest ` 57 bn in Mumbai High North development

June 27, 2014. Oil and Natural Gas Corp (ONGC) said it will invest over ` 5,700 crore in redevelopment of its giant Mumbai High (North) oil and gas field off the west coast. The project will yield an incremental 6.997 million tonnes of crude oil and 5.253 billion cubic metres of gas by 2030, the company said. The project is designed to carry forward the success of the previous two editions of redevelopment projects of the fields that were discovered four decades ago. This will give a new lease of life to the giant field.

The project cost includes ` 2,586.42 crore in creation of surface facilities, ` 1,992.11 crore in new oil and gas wells and ` 1,127.94 crore in sidetracking of existing wells. The facility parts under the project are scheduled to be installed by April 2016, while drilling of wells and the overall project completion is scheduled for May 2017. (economictimes.indiatimes.com)

Leakage in ONGC pipeline detected

June 30, 2014. Close on the heels of a GAIL pipeline blast at Nagaram in Andhra Pradesh that claimed 19 lives, a leakage in another pipeline belonging to Oil and Natural Gas Corp (ONGC) was detected at Tatipaka. ONGC, however, appealed to the people not to panic as it had replaced the leaked pipeline. (economictimes.indiatimes.com)

Gas pipeline accident kills 15 people in southern India

June 27, 2014. At least 15 people were killed in a fire that followed a blast at a GAIL natural gas pipeline in south India. The federal government has ordered an inquiry in to the cause of the fire, Oil Minister Dharmendra Pradhan said. GAIL has closed a section of the pipeline that was carrying gas from a field operated by Oil & Natural Gas Corp. (ONGC) to Lanco Infratech Ltd.’s power station in Andhra Pradesh state, GAIL said. The incident follows a series of accidents this month. A fire broke out at a vacuum-gasoil treating unit at a refinery operated by HPCL Mittal Energy Ltd. in Punjab state on June 20. Six people died and 36 were injured after a gas leak at Steel Authority of India Ltd.’s plant in Chhattisgarh state in central India on June 12, according to the company. ONGC has shut some gas wells in the area, ONGC said. The company’s oil refinery near the site is operating normally, ONGC said. (www.bloomberg.com)

GAIL fire: AP CM, Oil Minister visit site; compensation announced

June 27, 2014. An ex-gratia of ` 25 lakh each would be given to the kin of those who died in the gas pipeline fire in Andhra Pradesh (AP), Chief Minister (CM) N Chandrababu Naidu said after visiting the mishap site. A high-level inquiry would be conducted into the incident involving GAIL gas pipeline in East Godavari district and those responsible for it would be punished, he said.

Of the ` 25 lakh compensation, GAIL would provide ` 20 lakh, while the Centre and AP government would give ` 2 lakh and ` 3 lakh respectively, Naidu said. ` 5 lakh each would be given to those who suffered permanent disability, Naidu said. Oil Minister Dharmendra Pradhan said a high-level inquiry would be conducted into the mishap which left 15 people dead and 18 injured when a huge blaze raged through Nagaram following a blast in an apparently leaking GAIL gas pipeline. (economictimes.indiatimes.com)

CPI(M) demands alternate route for laying gas pipeline

June 27, 2014. In view of GAIL gas pipeline blast in Nagaram village in East Godavari District of Andhra Pradesh, the proposed laying of pipeline from Kochi to Dharmapuri District via Coimbatore should be stopped or find an alternate route, former CPI(M) MP P R Natarajan said. The tragedy should be an eye opener to the GAIL, which, despite protests from farming community, was continuing laying of pipeline through their lands, he said. The farmers of five districts in Tamil Nadu were opposing the project for the last three years, fearing such blasts and a case was pending in Madras High Court, he said. (economictimes.indiatimes.com)

The case before SAT against Sebi not related to insider trading: RIL

June 27, 2014. Reliance Industries Ltd (RIL) said its pending plea before the SAT against Sebi is not related to any insider-trading, but challenges the regulator's arbitrary decision to shut the consent mechanism window on it. The Securities Appellate Tribunal (SAT) concluded a near four-year hearing on RIL's plea against market regulator Sebi's allegations of the company violating the FUTP (fraudulent and unfair trade practices) norms in its dealings on the shares of one of its arm Reliance Petroleum in 2007. SAT will pronounce its order. (economictimes.indiatimes.com)

‘Iraq crisis not to affect oil supply to India’

June 25, 2014. The Centre said the situation in Iraq was a matter of concern and hoped that the turmoil in the Gulf country will not affect the oil supplies to India. Minister of State for Defence Rao Inderjit Singh said talks with Pakistan for resolving bilateral issues can progress if Islamabad fulfills its commitment of not allowing its territory to be used against India by the terrorists. Singh said talks cannot be held when guns roaring. He said situation in Kashmir was not only under control but had improved over the years. Asked if India still perceived China as a threat, the Minister said New Delhi will have to remain cautious about all the countries with which it had had issues in the past. (economictimes.indiatimes.com)

PNGRB again extends date for CGD bidding

July 1, 2014. Petroleum and Natural Gas Regulatory Board (PNGRB) has once again extended the bid deadline for licences to retail CNG and piped cooking gas in 14 cities, including Bengaluru and Pune, by one month to August 11. Bid for the latest round of city gas distribution (CGD) licences were originally due on February 11 but the regulator in January extended the deadline to May 12. On April 23, it extended bid deadline to July 10 and now it has further pushed it back to August 11. Accordingly, the last date for sale of bid document will now be August 4 and bids will close by 1200hours on August 11. PNGRB had invited bids for development of CGD networks in Eranakulam in Kerala; Rangareddy/Medak, Nalgonda and Khammam in Andhra Pradesh; Bengaluru rural and urban districts in Karnataka; Raigarh, Pune and Thane in Maharashtra; Daman; Dadar & Nagar Haveli; Shahjahanpur in UP; Guna in MP; Panipat in Haryana and Amritsar in Punjab. Bidders have been asked to quote the tariff they will charge for the pipeline network to be laid in the city and the compression charge for dispensing CNG (compressed natural gas) over the 25 years. (economictimes.indiatimes.com)

LPG prices hiked by ` 16.50 per non-subsidised cylinder; ATF by 0.6 pc

July 1, 2014. Price of non-subsidised cooking gas (LPG) was hiked by ` 16.50 per cylinder and that of jet fuel by over half-a-per cent after international oil prices surged due to the ongoing Iraq crisis. The increase in rates of non-subsidised LPG and ATF accompanies the ` 1.69 a litre hike in petrol and 50 paisa a litre in diesel announced. The price of non-subsidised LPG, which customers buy after using up their quota of 12 subsidised cylinders, was raised by ` 16.50 per 14.2-kg cylinder, the first hike in six months. Each non-subsidised 14.2-kg cooking gas cylinder will now cost ` 922.50 in Delhi, up from ` 906, according to Indian Oil Corp (IOC). (economictimes.indiatimes.com)

Petrol price hiked by ` 1.69 per litre, diesel by ` 0.50

July 1, 2014. State oil marketing companies raised the price of petrol by ` 2 a litre, the biggest increase in nine months in Delhi, as international gasoline rates have surged and the rupee has depreciated following unrest in Iraq. Companies also increased the price of diesel by about 56 paise in the Capital as their revenue losses on the fuel have increased to about ` 3.90 per litre from ` 1.62 in the previous fortnight. All-India price increase is ` 1.69 per litre on petrol and 50 paise on diesel, but the impact of the hikes would differ in different cities because of local levies, IndianOil said. (economictimes.indiatimes.com)

Small chance of Iraq strife disrupting oil supplies: Petroleum Ministry

June 30, 2014. The petroleum ministry foresees very little possibility of a disruption in India's oil imports due to the on-going violence in Iraq. Iraq is India's second largest crude oil supplier after Saudi Arabia, supplying about 25 million tonnes (MT) in 2013-14, to meet over 13 per cent of India's oil needs. Saudi Arabia was the largest supplier with around 38 MT. For the current year, oil marketing companies (OMCs) planned to import 19.4 MT, of which 18.7 MT was for Indian Oil Corp (IOC) and Hindustan Petroleum Corp Ltd (HPCL). (economictimes.indiatimes.com)

Govt to start consultations afresh on raising gas prices

June 29, 2014. After putting off implementation of a contentious gas pricing formula, the new government will start consultations afresh with all stakeholders to arrive at an acceptable increase in natural gas rates. The Cabinet Committee on Economic Affairs had deferred a decision on raising gas prices based on a formula approved by the previous UPA government by three months to hold consultations with all stakeholders keeping public interest in mind. The formula approved by the previous government would have led to prices of gas, which is used mainly for power and fertiliser production, more than doubling to around $8.8 per million British thermal unit. (economictimes.indiatimes.com)

‘Modi should leverage his position for energy security’

June 28, 2014. Former oil and gas minister Mani Shankar Aiyar felt that instead of concentrating on pricing, Prime Minister Narendra Modi should leverage his diplomatic position to network for energy security in the Asian region. He said this region is the largest producer of oil and the largest consumer of oil and so the price of oil should be decided by an Asian index like the earlier Dubai index. Mani Shankar Aiyar who was holding additional and temporary charge as minister for petroleum and natural gas in the UPA-1 government said that the ministry of petroleum and natural gas should not be concerned with gas pricing but should be more concerned with energy security and technology for deep sea water drilling. He said when he was the minister his focus was on securing sources for oil and tried to push for the Iran-Pakistan-India pipeline. (www.asianage.com)

Oil Minister for setting up statutory safety body for O&G industry

June 27, 2014. With more than a dozen people killed in a deadly fire at a gas pipeline in Andhra Pradesh, Oil Minister Dharmendra Pradhan expressed shock at the lack of a statutory body for formulating safety measures for the oil and gas industry. The Oil Industry Safety Directorate (OISD), under the Petroleum Ministry, carries out safety audits of oil and gas installations, besides formulating and standardising procedures and guidelines for design, operation and maintenance. However, the body lacks statutory authority. The then Oil Minister S Jaipal Reddy had in August 2012 suggested giving statutory powers to OISD but the proposal has not materialised so far. The new government would work towards giving statutory powers to OISD, which currently is only a recommendatory body. The Ministry of Petroleum and Natural Gas had in 1986 constituted the Oil Industry Safety Directorate (OISD) to enhance safety in the industry. There are hazards on account of inherent risks associated with the oil and gas industry such as extreme physical conditions in addition to potential fire and explosion from accidental release of flammable hydrocarbons. Reddy had proposed transferring the work of Petroleum and Explosive Safety Organisation (PESO) to OISD. At present, PESO comes under the Ministry of Commerce but has high synergy with the oil and gas sector. (economictimes.indiatimes.com)

Govt mulls pricing gas in rupees

June 27, 2014. The government is weighing the option of switching to a mechanism of fixed return on investment for producers and setting domestic gas prices in rupees instead of dollars to shut out exchange rate volatility. Finance Minister Arun Jaitley raised these points when the Cabinet Committee on Economic Affairs met to put off the plan to revise domestic gas prices for another quarter, or three months till September 30. The UPA government had approved a complex formula suggested by a panel headed by C Rangarajan, then head of PM's Economic Advisory Council. This formula was benchmarked to averaged rates at major global gas trading hubs and cost of Indian and Japanese liquid gas imports. According to this formula, gas prices would have risen to $9 per unit, considered unviable. (timesofindia.indiatimes.com)

Unfair to expect gas price decision by new govt so soon: ONGC

June 26, 2014. A day after the hike in natural gas prices was put off by three months, India's largest gas producer ONGC said it was unfair to expect a decision on such a complex issue from a government that's one month old. Reliance Industries Ltd (RIL) and Oil & Natural Gas Corp (ONGC) stocks plunged as the markets reacted negatively to the decision by the Cabinet headed by Prime Minister Narendra Modi. ONGC, the biggest beneficiary of a gas price hike, expects the new government to take a decision on the matter by balancing the interests of producers and consumers. ONGC said gas prices have a direct bearing on the costs of power, fertilisers, CNG and cooking gas. (economictimes.indiatimes.com)

Govt to slap additional penalty of $578 mn on RIL

June 25, 2014. The government plans to impose an additional penalty of USD 578 million on Reliance Industries Ltd (RIL) for producing less-than-targeted natural gas from its eastern offshore KG-D6 block. The penalty in the form of disallowing costs incurred on the field will be for missing the target in 2013-14. With this, the total costs disallowed will increase to USD 2.375 billion. The government had previously issued a notice to RIL disallowing a total of USD 1.797 billion in costs for falling short of production during 2010-11 (USD 457 million), 2011-12 (USD 548 million) and 2012-13 (USD 792 million). RIL, which disputed the levy and initiated arbitration against the government, did not respond to an e-mail seeking comment. Production from the main gas fields in the KG-D6 block has dropped to about a 10th of the planned 80 million standard cubic meters per day. The fall in output meant that facilities created at huge investment went unutilised. The production sharing contract allows RIL and its partners BP Plc and Niko Resources to deduct all capital and operating expenses from the sale of gas before sharing profit with the government. (economictimes.indiatimes.com)

Govt not mulling raising LPG, kerosene prices

June 25, 2014. Putting speculations at rest, the government said it is not considering raising prices of LPG and kerosene. Speculation was rife that the government might raise prices of cooking gas (LPG) and kerosene aimed at wiping out the ` 80,000 crore subsidy on the two fuels. Subsidy on LPG currently is a staggering ` 432.71 per 14.2-kg cylinder and at ` 5 per month increase it will take 7 years to wipe out the subsidy. On kerosene, the subsidy currently is ` 32.87 per litre and at a hike of ` 1 per month, it would take more than two-and-a-half years to wipe out the subsidy. (economictimes.indiatimes.com)

POWER

BHEL commissions Rajasthan discom's ` 9.9 bn thermal unit

July 1, 2014. BHEL has successfully commissioned another 250 MW thermal unit, valued at ` 990 crore, at Chhabra plant in Rajasthan. Rajasthan Rajya Vidyut Utpadan Nigam Limited had placed an order valued at nearly ` 990 crore for setting up two units of 250 MW each as part of the expansion of Chhabra thermal plant. The equipment for the project was supplied by BHEL's Haridwar, Trichy, Ranipet and Bangalore plants, while BHEL's Power Sector - Northern Region undertook erection and commissioning of the equipment. At present, BHEL is executing on Engineering, Procurement and Construction basis a 2x660 MW coal-fired project based on eco-friendly super-critical technology at Suratgarh in Rajasthan. BHEL is executing the 2x700 MW Rajasthan Atomic Power Project of Nuclear Power Corporation in the desert state. (economictimes.indiatimes.com)

Teesta III hydropower project to go on stream in early 2015

June 30, 2014. Delayed by over two years due to natural calamities, the 1200 MW Teesta III hydropower project in Sikkim is scheduled to commence commercial production in the first quarter of 2015. With over 100% of cost overrun, the project has so far seen investment of ` 7000 crore from public institutions and over ` 1200 crore in the form of foreign direct investment (FDI) from major private equity players including Morgan Stanley, Everstone Capital, General Atlantic, Goldman Sachs Investment Management, Ashmore Group and Norwest Venture Partners. Teesta III is considered to be one of the largest FDI flows into the country's power sector. Commencement of Teesta - lll is expected to make the tiny Himalayan State not only self-sufficient in electricity, but a net power exporter. About 12 - 15% of Teesta-III power will be available free of cost to the state of Sikkim. About 70% of the rest will be transmitted to power-starved states like Delhi, Uttar Pradesh, Haryana and Rajasthan, while balance 30% will be sold on spot basis, providing significant relief in peak summer months of the northern India. Sikkim's peak hour demand is 114 MW which can go up to 144 MW in a couple of years. (www.business-standard.com)

REC, PFC to give ` 78 bn loan to AP power projects

June 27, 2014. Rural Electrification Corporation (REC) and Power Finance Corporation (PFC) together have agreed in principle to extend a loan of around ` 7,842 crore for upcoming projects in Andhra Pradesh (AP), according to an energy department. The funds will be used for the construction of two super critical thermal power units, each having a capacity of 800 MW, at Vijayawada and Krishnapatnam power stations. The total project cost of these two units is ` 10,426 crore. Chief Minister N Chandrababu Naidu asked the energy department to expedite the work on these two projects since the state needed additional supply of power. (www.business-standard.com)

NPC's 10 reactors of 1.9 GW under IAEA safeguards

June 26, 2014. India's 10 nuclear reactors with a total generation capacity of 1,940 MW have now put under International Atomic Energy Agency (IAEA) safeguards. This was after the BJP led NDA government has ratified the additional protocol, a commitment given under the Indo-US civil nuclear deal by the UPA government to grant greater access to the IAEA to monitor country's civilian atomic programme. The list of nuclear reactors which have been put under IAEA safeguards include Tarapur, Maharashtra 1 & 2 (320 MW), Rawatbhata, Rajasthan 1 to 6 (1180 MW) and Kakrapar, Gujarat 1&2 (440 MW). These reactors, which are currently operating on imported fuel with plant load factor of 94%, are part of the country's total nuclear installed capacity of 4,780 MW. The remaining reactors with generation capacity of 2,840 MW have not yet been put under the IAEA safeguards. The Nuclear Power Corporation (NPC) is currently operating these total 19 reactors with both indigenous and imported fuel. The IAEA safeguards in the country are implemented in accordance with the agreement entered between Government of India and the IAEA. (www.business-standard.com)

Transmission / Distribution / Trade

Electricity consumers in Maharashtra may face more load shedding

July 1, 2014. Electricity consumers in Maharashtra might face additional load shedding if the monsoon is delayed further in the state. The generation plants run by the Maharashtra State Power Generation Company (MahaGenco) have started taking a hit due to depleting water in reservoirs, coupled with decreasing availability of coal. Currently, the state distribution company, Maharashtra State Electricity Distribution Company (MahaVitaran) is carrying out daily load shedding ranging between 350 MW and 900 MW, which might increase further if power plants face closure. Besides, the burgeoning rates of power on exchanges make purchases dearer for MahaVitaran, which it might not be able to bear for long. MahaGenco is merely generating 500 MW to 600 MW from the Koyna hydro project, against the total generation capacity of 2,000 MW, in order to save water if the situation worsens further. MahaVitaran has to purchase power from exchanges at rates ranging between ` 3.70 & ` 4.62 a unit. The state distribution did not draw power from exchanges when the rates crossed ` 5.62 a unit. (www.business-standard.com)

Telangana to buy 1 GW from Chhattisgarh

June 30, 2014. A team of top officials from Telangana met Chhattisgarh officials to work out a plan to purchase power from the latter. Earlier, Telangana chief minister K Chandrashekhar Rao spoke to his Chhattisgarh counterpart Raman Singh over phone on the matter. The Telangana state has sought 1,000 MW of power from Chhattisgarh, principal secretary- energy department Aman Singh said. The state government was examining the proposal, he said. Singh said Telangana wanted to reach a long-term agreement with Chhattisgarh for power purchasing. The new state expected Chhattisgarh to supply power to it for the next 25 years. (www.business-standard.com)

'Power Grid to invest ` 58 bn on upgradation work in Gujarat'

June 29, 2014. Power Grid Corporation of India Ltd (PGCIL) will invest ` 5,800 crore for upgrading its network in Gujarat over the next three to four years, its Executive Director D K Singh has said. Power Grid will invest ` 5,800 crore in Gujarat to increase the number of Extra High Voltage (EHV) substations to 12 from the existing five. It will also be used for increasing the transmission capacity to 19,000 mega volt ampere (MVA) from the existing 4,000 MVA. The transmission lines shall be expanded to 7,575 kms in Gujarat from the existing 5,610 kms, he said. Singh was speaking on the sidelines of the inauguration of Chinese company TBEA's ` 1,000 crore Ultra-High-Voltage (UHV) power transformer plant at Karjan. The TBEA plant was inaugurated by Gujarat's Chief Minister Anandiben Patel. (www.business-standard.com)

Goyal promises uninterrupted power supply to AP

June 27, 2014. Coal and Power Minister Piyush Goyal has promised uninterrupted power supply to at reasonable rates to Andhra Pradesh (AP). Goyal conveyed this decision to Andhra Pradesh Chief Minister N.Chandrababu Naidu during a meeting with him. The central government has said it would speed up work on three railway lines key to transporting 100 million tonnes of coal per year from remote mines, a priority for Prime Minister Narendra Modi, who wants to supply continuous power to all. Coal India Ltd, the world's No. 1 coal miner that controls about 80% of India's output, says better connections could push its annual production up by as much as 300 million tonnes from 462 million now. (www.business-standard.com)

Tata Power Delhi controls ` 11.2 mn theft using technology

June 27, 2014. Tata Power Delhi Distribution, the electricity supply arm of Tata Power, said it controlled power theft to the tune of ` 1.12 crore in Delhi by using automated systems. The company is using technology in its area of distribution in North and North-West Delhi, Tata Power Delhi Distribution said. The company has installed AMR (Automated Meter Reading) based energy systems at Distribution Transformers (DT) level and carries energy audit of all DT on a regular basis. (economictimes.indiatimes.com)

Power ministry approves mega ` 125 bn package of transmission projects

June 26, 2014. With lack of transmission infrastructure hurting electricity availability, the power ministry approved a ` 12,500 crore package for development of nine high capacity transmission projects. The package of new lines and substations, when commissioned, will ramp up the country's transmission capacity by three-fourth and boost supply across five states. These transmission projects will benefit several states such as Haryana, Chhattisgarh, Utar Pradesh, Madhya Pradesh and Maharashtra by enabling high capacity 765 Kilovolt lines carrying up to 2,100 MW each apart from construction of new 765 KV substations, the power ministry said. (www.business-standard.com)

Coal India yet to sign fuel supply pacts for 4.9 GW

June 26, 2014. Coal India Ltd (CIL) has so far signed fuel supply pacts with power plants for a capacity of only 73,075 MW. The coal and power ministries are now under one Minister- Piyush Goyal. Out of 78,000 MW capacity as on date Coal India (CIL) signed fuel supply agreements (FSAs) for a capacity of 73,075 MW, the Coal ministry said. Pacts for the remaining 4925 MW could not be signed till date due to issues, including "extension of coal supplies beyond the period admissible under tapering linkage policy", the ministry said. (economictimes.indiatimes.com)

PXI alleges discrimination in transmission corridor allocation

June 25, 2014. Power Exchange India (PXI), the Mumbai-based electricity exchange, has alleged discrimination in allocation of the limited transmission corridor it has to share with its bigger competitor the Indian Energy Exchange (IEX). The National Stock Exchange (NSE)-promoted electricity exchange that accounts for less than five per cent of the ` 8,600-crore exchange-based short-term trading market in India has knocked on the doors of Central Electricity Regulatory Commission (CERC), seeking change in the allocation methodology. (www.business-standard.com)

Policy / Performance

Javadekar assures Arunachal govt of speedy forest clearance for Dibang Hydropower Project

July 1, 2014. Environment minister Prakash Javadekar has assured the Arunachal Pradesh government that forest clearance for the 3000 MW Dibang Hydropower Project will be expedited. According to a communique from the chief minister's office, the assurance by Javadekar was given when Arunachal Pradesh Chief Minister Nabam Tuki met him in New Delhi. The 3000 MW hydro power project has been rejected by the statutory green panel, Forest Advisory Committee, on two occasions—the most recent being at its meeting in April. The panel had rejected the project on the grounds that it required the diversion of 4577.84 hectares of biodiversity rich forest land and the felling of 3.24 lakh trees Javadekar is understood to have assured the chief minister that the entire clearance mechanism was being overhauled in order to speed up the implementation of hydropower projects in the state. (economictimes.indiatimes.com)

NTPC's coal mine development delay on govt radar

July 1, 2014. Government's crackdown on delays in development of coal mines is set to spread to state-run entities. One of the biggest beneficiaries of captive coal mine allotments, NTPC, appears to be next in line for a closer scrutiny. NTPC has come on the PMO radar due to the rising decibel of demand for coal from private power producers, who are facing acute fuel shortage. An explanation is likely to be sought from the company for failing to start production from its mines allotted as back as January 2004. (economictimes.indiatimes.com)

Karnataka mulls cut in power subsidy to farmers

June 29, 2014. Karnataka is mulling the possibility of reducing subsidised power to farmers and meter the power supplied to irrigation pump sets.

This move will not only help improve the revenues for the electricity supply companies but also prevent any misuse of power by installing illegal IP sets, said D K Shivakumar, minister for energy, government of Karnataka. (www.business-standard.com)

UP govt to launch 60 days campaign against power theft

June 27, 2014. Uttar Pradesh (UP) government will launch a 60-days campaign, aimed at tightening the screw on power pilferage and installing 25 lakh new power connections starting July 1. Chief Secretary Alok Ranjan directed divisional commissioners, DIGs, district magistrates and police chiefs through video conferencing in this regard. He said that a target of collecting ` 30,000 crore in revenue has been fixed by releasing new connections in the current fiscal year. Power pilferage would not be allowed at any cost as it leads to revenue loss and emergency roistering in districts due to supply deficit, Ranjan said. He said that another review would be conducted by the end of July month and officers with poor performance would be penalised. He said that government plans to ensure round the clock power supply in urban areas and 18 hours supply in rural areas by October 2016. He said that FIRs would also be lodged against people indulging in power thefts. (www.business-standard.com)

Want to start a power plant? Go, get 143 approvals

June 27, 2014. How easy is it to set up an integrated power plant in India? Not very, given that companies have to seek 90 clearances during construction and 53 clearances, while starting operations. Besides, compliance reports have to be filed on 1,982 counts, nearly half of which attract imprisonment for failure. A majority of these norms are good for justifying the existence of a vast pool of officials in various government departments, they have little relevance in business and economic environment and often times substantially contribute in projects getting delayed. Industry insiders say the burden finally falls on consumers by way of higher tariff due to rising IDC (interest during construction), which is loaded on to costs that decide the final tariff. Besides, the delays also put the project viability at risk. A World Bank report last month tagged India as "less than favourable" for doing business. India was ranked 131st in 2013 but slipped to 134th position among 185 countries; even lower than its BRICS (Brazil, Russia, India, China, South Africa) counterparts. (economictimes.indiatimes.com)

PM Modi to visit J&K for power boost

June 27, 2014. Prime Minister (PM) Narendra Modi is slated to visit Jammu and Kashmir (J&K) shortly — most likely in the first week of July and is expected dedicate to the nation the ` 2,100 crore and 240 MW Uri-II hydroelectric project located near the Indo-Pak border. Power minister Piyush Goyal will also accompany Modi to J&K. Constructed by the NHPC, the Uri-II hydro power project is located on river Jhelum near Uri in Baramulla District of Jammu & Kashmir. It comprises of four units of 60 MW each and is the second stage project of NHPC, the first being the 480 MW Uri-I hydroelectric project. (www.hindustantimes.com)

Power ministry sets up advisory panel for integrated development of sector

June 26, 2014. The power ministry was understood to have set up an advisory group headed by former power minister in the National Democratic Alliance (NDA) regime, Suresh Prabhu. The seven-member panel will be called “Advisory Group for Integrated Development of Power, Coal and Renewable Energy.” The group’s mandate includes looking into subjects including optimal energy mix; state action plan for 24X7 power for all; requisite transmission and distribution infrastructure; development of renewable energy from sources like oceanic, bio-mass, coal bed methane and coal gasification; optimising fuel supplies; energy efficiency; research and development; and innovation. The advisory group will be assisted by the officers of the power, coal and renewable energy ministries and would meet as often as required. (www.business-standard.com)

‘Companies can provide power 24X7 without tariff hike’

June 26, 2014. There is enough scope for utilities to ensure uninterrupted power supply without tariff shocks but consumers too need to do their bit by willing to pay for getting 24X7 service and actively help stop electricity theft, minister for power and coal Piyush Goyal said. Goyal said every entity involved in the electricity chain — generators, transmission and distribution utilities as well as coal companies — have to improve their operations instead of covering inefficiencies by raising a debate over inadequate tariffs or absence of tariff revisions. Goyal's statement comes in the backdrop of the power ministry recently telling the Prime Minister's Office that the country loses 27 units in transit out of every 100 units being generated due to inefficiency and theft, euphemistically described by the industry as 'aggregate technical and commercial losses'. Also, the minister's strong views are likely to force regulators to look more closely at arguments and numbers being forwarded by utilities in several states, including Delhi, for revising tariffs. (economictimes.indiatimes.com)

Power Ministry seeks Goyal's help for coal supply to 9.9 GW plants

June 25, 2014. With Coal Ministry rejecting the Power Ministry's request to provide fuel to 9940 MW plants of companies like Essar Power, GMR and Power, the latter has sought intervention of Coal and Power Minister Piyush Goyal into the matter. The Cabinet had decided that coal may be supplied to similarly placed projects without affecting 78,000 MW of power projects. The criteria for similarly placed, among other things, state that the plants should be commissioned before March, 2015 and Power Purchase Agreements (PPAs) should be signed. (economictimes.indiatimes.com)

Goyal keen on states replicating Gujarat power model

June 25, 2014. Keen to kick-start reforms, Power Minister Piyush Goyal wants states to replicate the Gujarat model which provides 24-hour electricity supply. The Minister, who recently visited the western state of Gujarat, was all praises for the separate feeder segregation and metering consumption model followed by the state government. He said that some other states such as Rajasthan, Andhra Pradesh, Haryana, Punjab, Karnataka, Maharashtra and Madhya Pradesh have also adopted this model. Gujarat's Jyotigram Yojana is a scheme to make available 24 hours three-phase quality power supply to rural areas. (economictimes.indiatimes.com)

OIL & GAS

Goldman says Shale gas boom driving fear from market

June 27, 2014. Rising U.S. shale gas production is driving fear out of the futures market, says Goldman Sachs Group Inc., and will constrain prices for the next two decades. Gone will be the near tripling of costs to $15.78 as in 2005 as traders remain confident the fuel will be there when needed. Natural gas will trade “largely” at $4 to $5 per million British thermal units for the next 20 years, says Goldman Sachs. Societe Generale SA sees prices at $5 through 2019. Bank of America Corp. forecasts $5.50 for 2017, while BlackRock Inc. projects $4 to $5 for the next decade. The U.S. Energy Information Administration (EIA) forecasts natural gas prices will average below $5 through 2023 and less than $6 until 2030. The fuel will average less than $5 through 2017, based on analyst estimates. (www.bloomberg.com)

O&G rigs in US rose to 1,873, Baker Hughes says

June 27, 2014. Rigs targeting oil and natural gas in the U.S. rose by 15 to 1,873, according to Baker Hughes Inc. Oil rigs rose by 13 to 1,558, data posted on the company’s website show. The gas count increased by 3 to 314, the Houston-based field services company said. Pioneer Natural Resources Ltd. and Enterprise Products Partners LP said the U.S. Commerce Department gave them approval to export ultra-light crude processed at gathering facilities in the fields of south Texas. The decision could lead to more drilling in wet gas plays, Vienna-based JBC Energy said. (www.bloomberg.com)

Africa Oil discovers O&G in Block 9 onshore Kenya

June 26, 2014. Africa Oil has announced new discovery at the Sala Prospect in Block 9 of onshore Kenya. A large 80km² anticlinal feature has been drilled along the northern basin bounding fault in the Cretaceous Anza graben and identified various sandstone intervals containing oil and gas shows. Africa Oil said there is a great need for power in Kenya and also the potential for downdip oil and additional prospects on trend. Additionally, Africa Oil is planning to drill an appraisal well on the crest of the Bogal structure to identify the large potential gas discovery, which has closure over a 200km² area. (drillingandproduction.energy-business-review.com)

Petrobras $6.8 bn surprise raises share-sale specter

June 26, 2014. Petroleo Brasileiro SA’s decision to pay billions of dollars for new deep-water oil rights increases the chances that the state-run producer will sell shares to raise cash, according to Banco BTG Pactual. Petrobras agreed to pay 15 billion reais ($6.8 billion) through 2018 to produce as much as 15 billion additional barrels from a region that holds the giant Buzios field, it said. It is considering selling assets and restructuring other projects to help shoulder the cost. (www.bloomberg.com)

Japan oil refiners may cut capacity to meet new efficiency rules

June 30, 2014. Japan’s oil refining industry may be forced to cut about 10 percent of capacity as the government is set to impose new targets to improve efficiency and spur restructuring and mergers. Refiners will be required to increase the volume of high-value fuels such as gasoline and diesel they produce in relation to the output of low-quality by-products by either renovating their facilities or reducing oil-processing volumes, according to the Ministry of Economy, Trade and Industry (METI). The new targets may force them to cut about 400,000 barrels a day from the country’s current 3.95 million a day of capacity, the ministry said. Japan’s oil demand has declined due to its shrinking population and a shift to more energy-efficient cars, prompting refiners to lower output. Further reductions would be needed as about 22 percent of the country’s capacity would be redundant by fiscal year 2018, METI said. Under the proposed rules, the average ratio of the industry’s capacity to process residues compared to simple crude distillation should be improved by the end of March 2017 to about 50 percent, from 45 percent now, according to METI. The new rules would allow the refiners to take into consideration three types of units not covered by the 2010 order: fluid catalytic crackers, residue desulfurization units and solvent de-asphalting units. Previously, only residue fluid catalytic crackers, cokers and hydro-crackers were counted. Refiners will also be allowed to cut crude distillation nameplate capacity, unlike the previous rule, which required them to close units. The companies will be required to submit their plans by end of October. (www.bloomberg.com)

Rosneft says Gazprom monopolizing China pipeline would break law

July 1, 2014. OAO Gazprom’s plan to monopolize a pipeline to be built as part of a $400 billion deal to supply Russian gas to China would be illegal, rival OAO Rosneft said. While Gazprom is Russia’s pipeline export monopoly, it must allow others access to the network to supply domestic customers in the east of the country, Rosneft said. The company plans to use only its own gas to fill the pipeline and for its contract with China. Gazprom and Rosneft are jockeying for position as Russian President Vladimir Putin pivots to China as a buyer of gas to cut reliance on the European Union. The U.S. and EU have threatened to broaden sanctions against Russian companies and officials, saying Putin is supporting separatists in Ukraine. The U.S. blacklisted Rosneft CEO Igor Sechin but not his company. Gazprom agreed a 30-year natural-gas deal with China overseen by Putin in May after a decade of negotiations. The accord includes plans for the pipeline and will allow the company to invest $55 billion to develop gas fields. (www.bloomberg.com)

US shale will drive LPG ship market growth, Latsco says

July 1, 2014. Increased U.S. exports of liquefied petroleum gas amid higher shale oil production will boost demand for ships that carry gases such as propane, butanes and ethane, Latsco Shipping Ltd., said. Shipments of LPG from the U.S. rose to a record 506,000 barrels a day in April, up 65 percent from a year earlier, Energy Information Administration (EIA) data show. Production of the gases has grown as high oil prices and improvements in horizontal drilling and hydraulic fracturing techniques have allowed producers to tap into crude and gas trapped in layers of shale rock more than a mile beneath the Earth’s surface. The EIA projects the U.S. will be a net exporter of LPG through 2040, because of continued increases in natural gas and oil production. Shale gas production in the U.S. will grow to 19.8 trillion cubic feet in 2040 from 9.7 trillion cubic feet in 2012, according to the EIA. Greece has the world’s largest merchant fleet with over 3,400 vessels accounting for almost 16 percent of global carrying capacity, according to the Greek Shipping Ministry. (www.bloomberg.com)

Max commissions new Kazakh pipeline

July 1, 2014. Kazakhstan-focused Max Petroleum announced that it has commissioned a new oil pipeline, and associated oil terminal, connecting its Zhana Makat field with the regional oil export pipeline approximately seven miles away from the field. Max said that it is now be possible to deliver oil directly from the Zhana Makat Central Processing Facility to the national Kazakh pipeline network. Oil produced at the Zhana Makat, Borkyldaty, Sagiz West and East Kyzylzhar I fields can now be transported to end users via the pipeline at a transport cost saving of approximately $4 per barrel, the firm said. (www.rigzone.com)

Libya’s biggest oil port Es Sider may open in August, Rebels say

June 29, 2014. Libya’s largest oil-export terminal, the port of Es Sider, may re-open in August after the North African nation’s new parliament takes office, said the rebel group that shut the facility almost a year ago. Ras Lanuf is the second of two ports still under control of the Barqa rebels. The rebels’ Executive Office for Barqa seeks self-rule for the region known also as Cyrenaica. It occupied oil ports in eastern Libya at the end of last July, demanding an oil-revenue sharing agreement to make up for the neglect the area experienced under Muammar Qaddafi’s 42-year rule. (www.bloomberg.com)

Half-million oil barrels bound for export erasing glut

June 28, 2014. As many as 500,000 barrels of light oil a day may be eligible for export under a new government classification, helping to soak up surging U.S. shale oil production. Significant oil exports would help relieve a glut of oil on the Gulf Coast, where inventories rose to record levels this spring as production reached the highest since 1986. That could narrow the discount for U.S. oil relative to the rest of the world, weakening an advantage that U.S. refiners have enjoyed since 2011. U.S. benchmark West Texas Intermediate crude has averaged a $7.96 a barrel discount to European Brent crude, the international marker. (www.bloomberg.com)

Lukoil to build $30 bn cash pot after debt freeze

June 26, 2014. At Russia’s largest private-sector oil company, the Ukraine crisis is forcing a change of strategy. OAO Lukoil will cut spending to reduce its dependence on international debt markets, billionaire shareholder Leonid Fedun said. It also plans to build a cash reserve of $30 billion over the next five years to guard against the risk of further disruption to capital markets and to finance future acquisitions, Fedun said. To boost cash, the company will offer at least $1 billion in shares in Hong Kong as early as next year and reduce capital spending by a quarter, he said. Lukoil’s new tack shows the impact the collapse in relations with the U.S. and EU is having on Russia’s largest companies after President Vladimir Putin’s decision to annex Crimea from Ukraine. The Moscow-based oil producer, which pumps about 20 percent of the country’s crude, postponed plans to sell $1.5 billion of Eurobonds. (www.bloomberg.com)

US House votes to speed up LNG exports

June 26, 2014. The U.S. House of Representatives voted 266–150 to pass a bill that cuts federal red tape and accelerates liquefied natural gas (LNG) exports to Europe and other allies. The Domestic Prosperity and Global Freedom Act (H.R. 6) authored by Rep. Cory Gardner (R-Colo.) now moves to the Senate. Experts suggest it has a 20% chance of being enacted. The bill seeks to expedite the construction of LNG facilities to ensure exports can begin by at least 2018. It essentially provides that once the Federal Energy Regulatory Commission completes an extensive environmental review for a project, complying with the National Environmental Policy Act, the Department of Energy (DOE) will have only 30 days to issue a final decision on the pending application. Significantly, it also amends the Natural Gas Act and requires that before authorization is granted to export LNG, applicants must publicly disclose where the exports are going. The DOE proposed to suspend its current practice of issuing conditional decisions on applications to export LNG from the lower-48 states to countries without free trade agreements with the U.S, and to instead act on applications only once an environmental assessment is completed. (www.powermag.com)

Koch to start EU power trading as it plans LNG expansion

June 25, 2014. Koch Supply & Trading, a unit of Koch Industries Inc., will start buying and selling European electricity and expand its liquefied natural gas (LNG) business to take advantage of a globalizing market for the fuel. The trading unit of the second-largest closely held U.S. company by revenue is hiring one or two power traders in Geneva and plans to be ready for trading next year. The company will expand into Turkey and the Caspian region in 2015 and open an office in Tokyo for its LNG business this year. (www.bloomberg.com)

New York towns can ban fracking, state’s top court rules

June 30, 2014. New York’s cities and towns can block hydraulic fracturing within their borders, the state’s highest court ruled, dealing a blow to an industry awaiting Governor Andrew Cuomo’s decision on whether to uphold a six-year-old statewide moratorium. The Court of Appeals in Albany upheld rulings dismissing lawsuits that challenged bans enacted in the upstate towns of Dryden and Middlefield. The ruling may lead the oil and gas industry to abandon fracking in New York as Cuomo considers whether to lift a statewide moratorium instituted in 2008 that he inherited when he took office. Fracking in states from North Dakota to Pennsylvania has helped push U.S. natural gas production to new highs in each of the past seven years, according to the U.S. Energy Information Administration (EIA), while the practice has come under increasing scrutiny from environmental advocates. Parts of New York sit above the Marcellus Shale, a rock formation that the EIA estimates may hold enough natural gas to meet U.S. consumption for almost six years. (www.bloomberg.com)

Scotland holds billions of barrels of shale oil, report says

June 30, 2014. Scotland may have billions of barrels of shale oil buried under its most densely populated areas, geologists said. Scotland’s central belt, running between Glasgow and Edinburgh, may have 6 billion barrels of oil in place, according to a report by the British Geological Survey. While only a fraction of the resource will end up being viable, the deposits could supplement the U.K.’s 3 billion barrels of proven oil reserves, held mostly in North Sea fields off Scotland. The oil and gas industry is central to the debate on Scotland’s independence ahead of a referendum in September. The Scottish government says existing fields in the North Sea will underpin the economy of an independent nation while opponents say declining production from offshore reserves leaves the region vulnerable. (www.bloomberg.com)

Unconventional energy boom drives O&G patents to record

June 30, 2014. A boom in the search for unconventional forms of energy such as shale gas or oil sands has led to a record high in new oil and gas patents filed across the world, research showed. Inventors filed a total of 12,062 oil and gas patent applications in 2013, up a third from 2012 and three times as high as approvals sought ten years ago. Mature oil basins are running low on easily recoverable hydrocarbons and countries are increasingly looking at tapping fresh domestic resources to cut import dependence. The search for unconventional sources of energy has been accompanied by innovations in technology to help improve hydraulic fracturing or to enter deeper and more treacherous offshore locations. Around 60 per cent of all new oil and gas patents filed now come from China where 7,243 applications were made last year, data showed. In the United States total oil and gas patents filed rose 18 percent year on year to 2,188 in 2013. In Britain, which is at the early stages of exploring for shale gas, oil and gas patents have halved over the past ten years, with only 150 applications made in 2013. (economictimes.indiatimes.com)

Egypt's Oil Minister says $10 bn gas project with BP restarted

June 26, 2014. Egypt's Oil Minister Sherif Ismail said that BP's $10 billion gas project, stalled for three years, had restarted and that production would begin in 2017, a sign of progress in efforts to ease the worst energy crunch in decades. Sherif Ismail also said Egypt would pay $1.5 billion of the money it owed to foreign energy companies by the end of 2014. The minister said that production at BP's North Alexandria concession would begin in 2017, with 450 million cubic feet per day initially being extracted. He said output would rise to 800 million cubic feet per day in 2018. (www.rigzone.com)

France sells stake in GDF to raise $2 bn for Alstom

June 25, 2014. France sold a 1.5 billion euro ($2 billion) stake in GDF Suez SA, the country’s largest natural-gas distributor, as it seeks cash to buy a holding in Alstom SA. The state offloaded 3.1 percent, trimming its holding to 33.6 percent, Finance Minister Michel Sapin and Economic Minister Arnaud Montebourg said. The government planned to sell the stake at 20.18 euros to 20.81 euros. The joint book runners for the sale were Citigroup Inc., Bank of America Corp., Societe Generale SA and Goldman Sachs Group Inc. France has proposed to buy as much as a fifth of Alstom from Bouygues SA as part of a $17 billion deal for General Electric Co. to buy Alstom’s gas-turbine unit. Alstom and GE plan steam-turbine, renewable-energy and power-grid ventures. (www.bloomberg.com)

Obama administration widens export potential for US oil

June 25, 2014. The U.S. Commerce Department opened the door to more U.S. oil exports as long as the crude is lightly processed, tempering the impact of a law that’s banned most overseas petroleum shipments for the past four decades. The department widened its definition of what’s traditionally been considered a refined product eligible for shipping to customers abroad. That means more of the oil being pumped from U.S. shale formations may be eligible for export after being run through small-scale processing units. (www.powermag.com)

POWER

Generation

Toshiba and GDF Suez sign deal for nuclear power project in Cumbria

July 1, 2014. Toshiba has signed an agreement with GDF SUEZ to boost development of Moorside new nuclear power project on the West Cumbria coast in northwest England. Under the terms of the agreement, Toshiba will acquire a 60% stake while GDF SUEZ own the remaining stake in the UK-based nuclear energy company, NuGeneration (NuGen) which is planning to contract three Westinghouse AP1000 reactors in West Cumbria.

The project, which is forecast to create between 14,000 and 21,000 jobs, will deliver around 7% of the UK's future electricity requirements. Scheduled to come online in 2024, the Moorside plant, when fully operational, is expected to have a combined capacity of 3.4 GW, which is sufficient to deliver power to six million homes. (nuclear.energy-business-review.com)

TBEA signs two 100 MW PV power plant deals in China

July 1, 2014. Chinese PV manufacturer and the largest PV system integrator, TBEA SunOasis has secured agreements with Tongxin County in the Ningxia Hui autonomous region of China to build two 100 MW PV power plants. The second 100 MW plant was said to have a construction time of three years with a capital cost of around US$161 million. (www.pv-tech.org)

China’s Huaneng Nuozhadu hydropower station enters service

July 1, 2014. Huaneng Group has announced the commercial operation of the Huaneng Nuozhadu Hydropower Station, which has a total installed capacity of 5,850 MW, the fourth largest hydropower station in China and the largest hydropower station in Yunnan Province. The hydropower station has a total reservoir capacity of 23.703 billion m3, equivalent to 16 times the storage capacity of the Dianchi Lake. (hydro.energy-business-review.com)

SUWECO’s 8 MW hydropower plant to be commissioned in July

July 1, 2014. Sunwest Water and Electric Company’s (SUWECO) 8 MW hydropower plant is scheduled to be commissioned in July. SUWECO said that the Villasiga 1 will be ready for commissioning on 5 July but an official inauguration ceremony will be held in August. SUWECO had signed a 20-year power supply agreement in July 2013 with Antique Electric for the output of Villasiga 1. SUWECO, in addition to the 8 MW plant, is planning to develop the 9.4 MW Villasiga 2 within the same area worth about PHP 2000m ($45.7 mn). (hydro.energy-business-review.com)

Russian company negotiates construction of power plants in Iran

June 30, 2014. The Russian company Technopromexport, which is part of the Rostec Corporation, has confirmed it is conducting negotiations on the construction of power plants in Iran. The company had negotiated the construction of 5 power plants with Iran’s Ministry of Energy. (en.itar-tass.com)

Largest Philippine coal miner plans $400 mn plant boost

June 25, 2014. Semirara Mining Corp., the Philippines’ largest coal producer, plans to spend $400 million to boost power plant capacity, forecasting that two-thirds of profit will come from generation in three years. The company may sign a syndicated loan for 70 percent of the cost of the expansion. Fresh supply is being added as the Southeast Asian nation saw power demand rise by 50 percent in the 10 years to 2012, more than three times the 16 percent increase in generation capacity over the same period, according to government data. The expansion will increase the Calaca coal-fired power plant’s capacity by 350 MW to 1,200 MW. (www.bloomberg.com)

Zimbabwe ends CMEC’s $1.3 bn power-plant contract on delays

Jun 25, 2014. Zimbabwe said it terminated China Machinery and Engineering Co.’s (CMEC) $1.3 billion contract to expand the southern African nation’s biggest power plant after the contractor failed to stick to agreed times. CMEC won the tender to build two 300 MW units at the Hwange facility in 2012. The capacity of the plant, which is run by Zimbabwe Power Co., is 920 MW. (www.bloomberg.com)

Transmission / Distribution / Trade

Russian hackers threaten power companies, researchers say

July 1, 2014. A Russian group of hackers known as “Energetic Bear” is attacking energy companies in the U.S. and Europe and may be capable of disrupting power supplies, cybersecurity researchers said. The hackers, also called “Dragonfly,” appear to have the resources, size and organization that suggest government involvement, security company Symantec Corp. said. The attackers are targeting grid operators, petroleum pipeline operators, electricity generation firms and other “strategically important” energy companies, it said. Those group’s activities highlight the increasing reach of cyberattacks as ever-larger parts of the economy become connected and controlled via the Web. They may also be symptomatic of governments using hacking to support political strategies. More than half of the infections found were in the U.S. and Spain, Symantec said, while Serbia, Greece, Romania, Poland, Turkey, Germany, Italy and France were also targeted. The hackers, who have been active since at least 2011, appeared to work a standard week, operating 9 a.m. to 6 p.m., Monday through Friday, in a time zone shared by Russia and other eastern European countries, Symantec said. (www.bloomberg.com)

EBRD invests in Romania’s distribution firm Electrica

June 30, 2014. The European Bank for Reconstruction and Development (EBRD) has invested more than RON320m (€75 mn) for an 8.6% stake in S.C. Electrica, a Romania-based electricity distribution firm. The bank's move will help finance Electrica's investment strategy to upgrade its infrastructure. The company's network will become more flexible with the help of EBRD's funds as Romania recently had an increase in its variable renewable energy capacity. (utilitiesnetwork.energy-business-review.com)

Doble to support National Grid Saudi Arabia’s electric power grid project

June 26, 2014. Doble Engineering has secured a contract to help National Grid Saudi Arabia in developing and maintaining an electric power grid. Under the deal, Doble and National Grid Saudi Arabia will work together to carry out an asset health review of about 1000 transmission transformers. (utilitiesnetwork.energy-business-review.com)

Policy / Performance

Jordan approves $2.4 bn power plant