-

CENTRES

Progammes & Centres

Location

[When Elections Start Pushing Electrons]

“The force pushing electrons towards rural areas in general and agricultural pump-sets in particular was the desperate need to increase production of food grains so as to take on starvation and famine that were ravaging the country. This was the largest ever share of the power sector budget spent on rural electrification and this had the greatest impact on rural electrification in terms of number of villages electrified and the number rural households electrified…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Solar or Grid Power?

· When Elections Start Pushing Electrons

ANALYSIS / ISSUES…………

· The German Energiewende turns around Market Structures and Prices (part I)

DATA INSIGHT………………

· Energy for Cooking & Lighting in Rural India

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC targets gas production by mid-2018 from east coast block

· ONGC to spend ` 162 bn to drill 45 wells in KG-basin

· RIL signs pact with Mexican firm PEMEX for O&G hunt

· ONGC to acquire stake in two Siberian oilfields

Downstream……………………………

· BPCL to invest over ` 45.8 bn in petrochemicals push

Transportation / Trade………………

· Oil Minister dials Korea to rescue GAIL LNG ship tender

· Major transporters against zonal tariff for Gas

· SCI awaits fruition of GAIL's LNG project tender

· RIL charters smaller vessel to ship diesel to Singapore

· India receives its biggest shipment of LNG

Policy / Performance…………………

· UP to set up panel for single window node to GAIL pipeline

· Oil marketing companies sell 5 kg LPG cylinder at ` 150

· ` 100 bn lost due to under-payment of oil royalty: Assam CM

· Oil Ministry to cut subsidy burden of ONGC, adjust its cess payment

· Oil Ministry may dip into RIL incremental gas price hike revenue account

· GAIL India inks agreement to buy 2.5 mn tonnes of LNG from US-based firm

· ONGC sell-off stuck on subsidy share to help fetch better price in stock market

· State probing Centre’s decision on gas pricing is absurd: RIL to HC

· Govt mulls ways to recover $195.3 mn from RIL

· No exemption to ONGC from fuel subsidy payout: Oil Minister

· Crude oil prices at 5 year low

[NATIONAL: POWER]

Generation………………

· BHEL commissions hydro power plant in Rwanda

· Dabhol power plant will be revived: NTPC

· BHEL commissions sixth unit of 412 MW Rampur hydro plant

· Cost of units 3, 4 surpasses `390 bn: KNPP

· NTPC plans expansion of power plants in Telangana

Transmission / Distribution / Trade……

· Haryana discom DHBVN proposes 15 per cent hike in power tariff

· NTPC to bid for coal blocks

· Govt to clear $2 bn transmission projects in South

· Engineers demand blueprint of 24 hr power supply in UP

· ABB bags ` 3.3 bn worth orders from state power utilities

Policy / Performance…………………

· SC asks Centre to find 'acceptable solution' on Uttarakhand power projects

· Centre, AP ink MoU to provide 24x7 power in the state by Oct 2016

· Govt yet to award four ultra mega power plants to developers

· Govt may revise deal between generation and distribution firms to cut electricity tariffs

· No plans to give coal linkages to new private power plants: Power Minister

· Coal India seeks return of two cancelled Odisha blocks

· ` 1100 bn investment in UP power sector by 2016-17

· Will check power transmission loss in Maharashtra: Energy Minister

· Entire country to have 24x7 power supply by 2019: Power Minister

· Consumers to soon get choice to select power discom: Power Minister

· Coal Ministry to put 18 additional blocks for sale in first phase: Coal Secretary

· Many options for private players to invest in power sector: Govt

· CIL has planned output of 1 bn tonnes by 2020: Goyal

· Tripura set to top list of surplus power states

· Coal India agrees to NTPC's sample testing

· RBI move on debt recast will boost stranded power projects

· Govt plans to restart stalled power projects & create distribution infrastructure

· Govt to allocate coal mine to UP for power plant: Power Minister

· Stricter penalties in Electricity (Amendment) Act: Power Minister

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Fracking discounts seen cutting profits by $3 bn

· OVL wins oil block in New Zealand

· Eni starts up production at West Hub Development offshore Angola

· Centrica makes minor gas discovery near Aasta Hansteen

· PetroChina teams up with Sinochem to tap Chinese shale gas

· Petrobras finds gas at Orca-1 well in Colombia's offshore Tayrona Block

Downstream……………………

· US refining surge fills tankers taking fuels to Latin America

· Mexico's Pemex to boost fuel output by nearly 70 per cent at Tula refinery

Transportation / Trade…………

· LNG boom over as China looks to sell out of long-term deals

· Poland's PGNiG signs amendment to LNG deal with Qatargas

· Putin plan B to ship gas through Turkey seen as unrealistic

· Badra oilfield exporting 15k barrels per day

· South Africa's SacOil considers $6 bn gas pipeline

· Bangladesh to buy 60k tonnes of gasoil from Turkey in 2015

· Petrolight, Aratos tie up for pipeline security solutions

· Indonesia targets Pertamina oil trading in industry clean-up

· Casino-like hedges seen hurting airlines as crude plunges

· Oil drop gives US drillers argument to end export ban

· Sub-$50 oil surfaces in North Dakota amid regional discounts

· Libya's El Sharara oilfield ready to restart once pipeline reopens

· DNO confirms payment from Kurdistan for oil exports

Policy / Performance………………

· Canada will not impose oil, gas rules alone given prices

· Japan LNG spot price falls to $14.40 per mmBtu in November

· BP weighs future of aging Norwegian fields amid oil crash

· Hedge funds bet that OPEC-led oil rout is near end

· Brent oil seen at $77 next year by BofA on OPEC output decision

· Kuwait plans $7 bn heavy-oil project amid cheaper crude

· Algeria’s Sonatrach says low oil won’t deter investments

· Iran budget faces short-term oil-price strain, Rouhani says

· Global shale ambitions wane as OPEC price war deepens

· Global LNG-prices flat as demand remains weak

· Oil price plunge lends unexpected hand to southern Europe

[INTERNATIONAL: POWER]

Generation…………………

· Entergy acquires Arkansas power plant

· UAE to get first reactor for nuclear power plant by 2017

· Wartsila to supply Oman with 120 MW power plant

· EGAT ramps up push for Krabi coal-fired power plant

· Britain signs deal for nuclear plant project

Transmission / Distribution / Trade……

· Power demand is $65 bn annual task for China State Grid

Policy / Performance………………

· Finland clears way for new nuclear power plant project

· Russia, Hungary sign agreement on Paks nuclear project

· Kazakhstan to establish first nuclear power plant in 12 yrs

· Ukrainian PM reports accident at nuclear power plant

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· BHEL to set up solar photo-voltaic unit in Maharashtra

· Rajkot one of 40 global cities to cut carbon emissions

· Independence from fossil fuels, green energy need of the hour: Kalam

· Coal India signs pact for 1 GW solar power projects

· Renewable energy companies gear up for big-ticket fundraising with IPOs

· India to bring comprehensive climate legislation: Environment Minister

· Indian solar power market sees global fund flow

· MNRE plans raising RPO requirement to 10.5 per cent

· Include more adaptation efforts in Paris climate deal: India

· IIT Kanpur installs four solar power plants in campus to reduce electricity consumption

GLOBAL………………

· Japan promotes home fuel cell on path to hydrogen society

· China’s coal burning is main culprit for pollution

· Canada says cannot meet 2020 emissions target without more action

· Why Elon Musk's batteries scare the hell out of the electric company

· Brazil plans economy-wide pollution curb for climate deal

· We now know how to save the planet for $17.6 trillion

· Keystone antagonist steps down as head of climate group 350.org

[WEEK IN REVIEW]

COMMENTS………………

Solar or Grid Power?

Ashish Gupta, Observer Research Foundation

|

I |

t has been observed that the States which are less electrified are mostly the backward States. This does not indicate that the State governments are not willing to extend help in electrifying rural areas. Rather it shows that financial constraints are a major limiting factor for these States. These States are also not shying away from green solutions to electrify rural areas but to implement the same the subsidy burden on the State Electricity Boards comes out be huge. Given the prevailing financially stressed scenario of the distribution side, neither the green approach is feasible for State power utilities nor is it viable for the rural consumers who do not have the power to pay. Though grid based electrification is costly, it is the way forward for rural development and green solutions for the time being must be enforced on the rich consumers.

· As per NSSO, 2009 -10, monthly per capita rural expenditure in Bihar, Jharkhand, Orissa and Uttar Pradesh is below ` 950 (Indicated figure but assumed as ` 950 for the calculation)

· Rural per capita electricity consumption comes out to be 8.9 kwh/ month and the price paid by per capita for the electricity consumption is ` 25. 11 (one household on an average has 5 person with single income earner - therefore cost of electricity for 5 people = ` 126)

· Rural electricity tariff for Bihar = ` 1. 2/kwh, Jharkhand = ` 1.1/ kwh, Orissa = ` 1.4/kwh and Uttar Pradesh = ` 1/kwh

Cost of electrification for rural areas of Bihar, Jharkhand, Orissa and Uttar Pradesh through grid or with solar mini grid?

Cost Analysis

|

Area |

Computation of electricity bill |

Actual Cost through grid and changes in his monthly expenditure |

Actual Cost through solar mini grid and changes in his monthly expenditure |

|

Bihar Rural per capita monthly income = ` 1733 Monthly Per capita rural expenditure (excluding electricity) = ` 950 – ` 126 = ` 824 |

8.9 x 5 x ` 1. 2/ kwh = ` 53. 4 He is already paying = ` 126 (Rs. 72.6 extra) |

Actual cost of power supply = ` 7.21/kwh Original bill = 8.9 x 5 x ` 7.21 = ` 321 Increment in his monthly expenditure for electricity alone = ` 321 - ` 126 = ` 195 |

Actual cost of power supply = ` 25 kwh (with a subsidy of ` 105/ Wp) Original bill = 8.9 x 5 x ` 25 kwh = ` 1113 Extra amount the person has to pay above the original bill = ` 1113 – ` 321 = ` 792 Monthly savings reduced due to electricity bill = ` 1733 – (824+792 +195) = - ` 78 |

|

Jharkhand Rural per capita monthly income = ` 1725 Monthly Per capita rural expenditure (excluding electricity) = ` 950 – ` 126 = ` 824 |

8.9 x 5 x ` 1. 1/kwh = ` 49 He is already paying = ` 126 (` 77 extra) |

Actual cost of power supply = ` 6.62/kwh Original bill = 8.9 x 5 ` 6.62 = ` 295 Increment in his monthly expenditure for electricity alone = ` 295 - ` 126 = ` 169 |

Extra amount the person has to pay above the original bill = ` 1113 – ` 295 = ` 818 Monthly savings reduced due to electricity bill = ` 1725 – (` 824+ ` 818 + ` 169) = - ` 86 |

|

Orissa Rural per capita monthly income = ` 3281 Monthly Per capita rural expenditure (excluding electricity) = ` 950 – ` 126 = ` 824 |

8.9 x 5 x ` 1. 4/kwh = ` 62 He is already paying = ` 126 (` 63 extra) |

Actual cost of power supply = `4.78/kwh (since data is not available, national average of cost of power supply is taken) Original bill = 8.9 x 5 x ` 4.78 = ` 213 Increment in his monthly expenditure = ` 213 – ` 126 = ` 87 |

Extra amount the person has to pay above the original bill = ` 1113 – ` 213 = ` 900 Monthly savings reduced due to electricity bill = ` 3281 – (` 824 + ` 900 + ` 87) = ` 1470 |

|

Uttar Pradesh Rural per capita monthly income = ` 2161 Monthly Per capita rural expenditure (excluding electricity) = ` 950 – ` 126 = ` 824 |

8.9 x 5 x Rs. 1/kwh = ` 45 He is already paying = ` 126 (` 81 extra) |

Actual cost of power supply = ` 5.06/kwh Original bill = 8.9 x 5 x Rs. 5.06 = ` 225 Increment in his monthly expenditure = ` 225 – ` 126 = ` 99 |

Extra amount the person has to pay above the original bill = ` 1113 – ` 225 = ` 888 Monthly savings reduced due to electricity bill = ` 2161 – (` 824 + ` 888 + ` 99) = ` 350 |

References:

Urban Rural Income differential in major States: contribution of structural factors (IIM Ahmadabad Study)

Solar Mini grids for rural electrification: ORF Study

Annual Report on the working of State Power Utilities and Electricity Department 2011-12

We will pose the question again: What would the poor choose purely on the basis of value?

Views are those of the author

Author can be contacted at [email protected]

COMMENTS………………

When Elections Start Pushing Electrons

Lydia Powell, Observer Research Foundation

|

T |

he propaganda material of the BJP available on its web site says that it is time to have all of India lit up like Gujarat.[1] The poster on the site highlights how the Jyoti Gram project has achieved 100% electrification of Gujarat’s villages with 24 hour power supply in bright saffron coloured circles. Those just getting acquainted with India’s development history may think that this is yet another wonderful new idea from the new wonder Government. Lighting up India is by no means a new idea that the new Government has come up with; nor is the electrification of Gujarat an achievement by the State Government. Electrifying India is a sixty year old effort of various Central Governments that the current Government has appropriated as its own like it has many other old ideas. In fact, but for the persistent effort towards rural electrification by various Central Governments in the past, claims of 100% electrification of rural households by any State Government, leave alone the Government of Gujarat, would not be possible.

The six decade old effort towards electrification started with the First Plan (early 1950s). The First Plan document pointed out that only 1 in 200 villages were electrified and only 3% of the population in 6 large towns consumed over 56% of electricity supplied by utilities and suggested ways of electrifying rural India. The 2nd Plan continued with the emphasis on rural electrification and put the cost of electrifying a village in India (in the 1950s) at ` 60,000-70,000 amounting to a capital outlay of about ` 30 billion for full rural electrification. Going by the Plan documents, a sum of about ` 950 million was ear-marked for electrification during the 1st and 2nd Five Year Plan periods. A crude estimate suggests that this was about 10% of total earmarked spending on electricity for these periods.

The motivation for moving electrons towards the villages in this period was to arrest migration from rural to urban areas as stated explicitly in the Plan documents. By the 1960s, village electrification increased by 200% as observed in the 3rd Plan document. In the Third Plan period, about 14% of the total amount ear marked for the electricity sector was allocated for rural electrification. In the decade ending in the late 1960s, village electrification increased by 175% and energisation of irrigation pump-sets increased by 100%. In the 4th Plan period, over 34% of the budget allocated for the power sector was spent on rural electrification primarily targeting electrification of irrigation pump sets. The force pushing electrons towards rural areas in general and agricultural pump-sets in particular was the desperate need to increase production of food grains so as to take on starvation and famine that were ravaging the country. This was the largest ever share of the power sector budget spent on rural electrification and this had the greatest impact on rural electrification in terms of number of villages electrified and the number rural households electrified.

The budgetary allocation for rural electrification since the 1980s has been less than a tenth of the total allocation for the power sector and consequently the growth of electrification has been much slower. During the last three Five Year Plans, spending on rural electrification was less than 5% of the total Central Government outlay for the power sector. What was different in these periods was that schemes for rural electrification were launched under names of political leaders. This was the dawn of the era of elections pushing electrons.

Among the many ‘schemes with names’, the Minimum Needs Programme launched during the 5th Plan was probably the first. The scheme sought overall human development through spending on healthcare, education and electrification in rural areas. The target was to electrify at least 60% of the villages by 1990. According to the 7th Plan document, by 1990 out of a target of electrifying 46,464 villages by the Minimum Needs Programme, 34,489 villages were electrified. This was followed by the Kutir Jyoti Programme launched in 1988 which provided 100% grant from the Central Government to install single point light source/connection to Below Poverty Line Households (BPL). In the mid 1980s (7th plan period), the approach to rural electrification changed from one based primarily on grid based expansion to one that also included ‘electrification’ using locally available renewable resources. The presumption was that electrification using local resources would be cheaper and so the budgetary allocation for rural electrification as a share of spending on the power sector declined substantially.[2] During the 10th plan period (2002) the Accelerated Rural Electrification Programme was launched with a focus on decentralised solutions. The 10th Plan document carried a detailed investigation of rural electrification programmes implemented up to that point in time.

The 10th Plan document pointed out that while 86% of villages in India were claimed to have been electrified, less than 30% of the households had electricity connections and that the there was no role for electricity in generating economic activity in the ‘electrified’ villages. The Plan document emphasized the need for revising the definition of electrification, which stated that ‘a village was deemed electrified if electricity was used in the inhabited locality within the revenue boundary of the village for any purpose whatsoever’. It also recommended coordination of multiple rural electrification and energy access programmes such as the Pradhan Mantri Gram Yojana (PMGY), Minimum Needs Programme for Rural Electrification, MP Local Area Development Scheme (MPLADS), Jawahar Gram Siddhi Yojana (JGSY), Kutir Jyoti, Programmes of the Rural Electrification Corporation (REC) and decentralized Renewable Energy Programmes of the Ministry of New & Renewable Energy under the Integrated Rural Energy programme.

In 2003 the Electricity Act was enacted and in 2005 the National Electricity Policy that aimed for complete electrification by 2009 along with the powerful slogan of ‘Power for all by 2012’ was launched. In 2005 multiple programmes for rural electrification were consolidated into the Rajiv Gandhi Grameen Vidyudikaran Yojana (RGGVY) programme with the aim of universal access to electricity to all in five years. The basic provisions of the scheme included a 90% grant from the Central Government and 10% loan to the State Governments from the Rural Electricity Corporation (REC) for provision of universal access to electricity as per the revised definition of electrification. The new Government that took charge in 2014 has merely christened the same scheme as ‘Deendayal Upadhyaya Gram Jyoti Yojana’ and thrown in the assurance of 24 hour electricity to rural households and 8 hour power supply for agricultural pump-sets.

As indicated in the table below, electrification does not require electricity actually flowing through the wires 24 hours of the day. As per the official definition, the Government only has to ensure that a bulb or two lights up for some time in any of the specified locations to declare victory over electricity access. For the current Government, the goal-post of complete electrification is very close as only 10% of villages are yet to be electrified as per the National Electricity Plan. Furthermore as electrification of a village is defined rather loosely, making claims of fully electrification will not be very difficult. All that the new Government has to do is to provide the last straw and take credit for tipping the cart of electrification towards completion. In all probability this will be achieved just in time for next elections either at the State level or the Central level and we can anticipate loud claims of how India was magically lit up in psychedelic multi-media shows put up by the Government.

Evolving Definition of Village Electrification

|

Prior to October 1997 |

A Village should be classified as electrified if electricity is being used within its revenue area for any purpose whatsoever |

|

After October 1997 |

A village will be deemed to be electrified if the electricity is used in the inhabited locality, within the revenue boundary of the village for any purpose whatsoever |

|

After 2004-05 |

A village would be declared as electrified, if (a) basic infrastructure such as Distribution Transformer and Distribution lines are provided in the inhabited locality as well as the Dalit Basti hamlet where it exists (b) Electricity is provided to public places like Schools, Panchayat Office, Health Centres, Dispensaries, Community Centres etc (c) The number of households electrified should be at least 10% of the total number of households in the village. |

In an effort to downplay achievements in rural electrification in the past, two BJP MPs from the State of Jharkhand posed questions over the acute shortage of power in rural areas and the incomplete and deficient work carried out under the RGGY scheme in installing electricity infrastructure to the lower house of the Parliament recently. Answering the question on the 27th of November 2014, the Minister for Power inadvertently admitted that the responsibility for assuring continues supply of electricity was with the State Government as Electricity was a concurrent subject under the Indian Constitution. If we accept this answer, then we must also ask how the Central Government is going to implement its ‘Deendayal Upadhyaya Gram Jyoti Yojana’ as it guarantees 24 hour electricity supply to rural households and 8 hour supply to agricultural pump sets, especially now that it has absolved itself of the responsibility towards supplying electricity.

One of this week’s news items about Andhra Pradesh (AP) says that the Government of AP and the Central Government have signed an MoU for 24 hour electricity supply. The news item says that the Central Government will assist the State Government in assuring supply of electricity to rural areas in AP. We can speculate that this could include some form of financial assistance to the State. Though AP (undivided) is not among the worst performing States in terms of the performance of its distribution companies, financial assistance from the Centre could push more electrons into rural wires. In that case, States that are not politically aligned with the Central Government would be at a disadvantage. This trend of electoral alliances and calculations moving electrons in and out of rural wires is not necessarily new. It started about ten years ago, around the same time the Electricity Act was enacted. Though the Act had nothing to do with it, we could say that this was the time around which elections started moving electrons because this was the time around which the financial status of the sector got worse. Sector wide accumulated losses stood at more ` 1 trillion or $25 billion in 2011 more than twice that in 2003 and the losses since 2003 grew by 133%.[3] Rather than launching schemes with names for electoral gains, the Government must come to terms with the reality that the sector will thrive only when real costs are recovered from rate payers and not tax payers.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

The German Energiewende turns around Market Structures and Prices (part I)

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

|

T |

he ongoing Energiewende in Germany (“energy turnaround”) is not only turning around the structure of the energy market and prices – particularly in the power generation sector ‑ but also requires considerable transformation of the utilities’ business models. This series of articles about the world’s experimental laboratory in the matter of greening the energy industry intends to catch up with recent structural and legislative developments that tackle the German electricity markets. It will also focus on evolving new business models, which might also serve as a blue print for any other energy market in motion towards more decarbonised and smarter energy systems.

By establishing the German Renewable Energy Act in 2000, Germany has triggered the Energiewende, an ambitious restructuring program of the German energy industry with the aim to decarbonise the energy system in the long-run: the share of renewables (REN) was set to achieve 80% in electricity generation by 2050. On top of this the German government has decided to phase out nuclear power plants finally by no later than 2022 as a consequence of Japan’s Fukushima Daiichi nuclear disaster in 2011.

As the policies have been in place for such a long time, some considerable structural changes have taken place in the German power generation sector. Nevertheless various issues within this ambitious program that are no yet satisfactorily settled are leaving the Energiewende in an ongoing state of experimental mode, a showcase worthy of being narrowly observed around the globe. The restructuring process is far from self running; it requires attentive monitoring and is constantly challenging the policy makers to set proper incentives according to the legislative framework. On the other hand the numerous and diverse market players in the German industry are continuously forced to react and adapt their business models to the ongoing change of the structural and economical market conditions in order to safeguard their investments and appreciate the shareholder value.

Against this backdrop the most important structural developments and outcomes that are going to influence the German energy sector as a whole and the transformation process in particular shall be highlighted in the following.

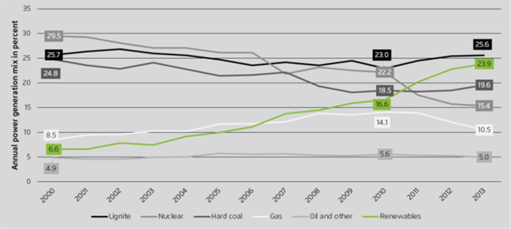

The share of REN in German electricity production has risen in an impressive manner from about 7% to 24% in 2013 (and probably to more than 28% in 2014) by squeezing fossil fuels and nuclear energy out of the power market: as shown in Figure 1 the share of nuclear generation went considerably down from 30% in 2000 to 15% in 2013, hard coal fell from 26% to below 20%, even natural gas lost ground in recent years and declined to a share of about 10%, whereas the share of lignite has been counter-intuitively stable to date. Besides the share oil-fired power generation has been stable but more or less negligibly throughout that period.

Figure 1: Development of Power Generation Shares in Germany (2000-2013)

Source: Agora Energiewende (2014) based on data from AG Energiebilanzen.

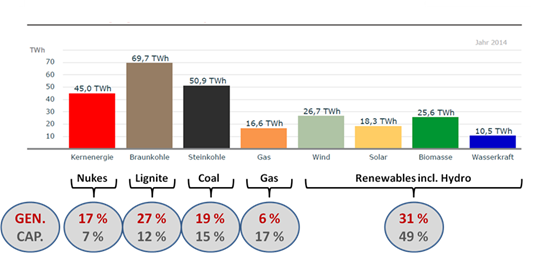

Current data for the 1st half of 2014 (as shown in Figure 2) disclose an even higher share of REN, which together with hydro and biomass adds up to 31% of total generation (and 49% of capacities) driven by high generation share from wind and solar. Although the contribution of natural gas went drastically down to a mere 6% in generation in the first six months of 2014 the capacity share remains significantly higher at 17%.

Figure 2: Net Power Generation Share of Fuels in Germany (Market Shares 1st Half Y14)

Source: ISE (2014), compiled by author. Generation shares in red numbers, capacity in grey.

The structural changes so far are not yet in accordance with the intended outcome of the Energiewende: first and foremost much more renewables (due to strong subsidies), no more nuclear power stations (not authorized anymore) and beyond that, declining shares of lignite (brown coal) and hard coal power stations as well as oil (all environmentally unfavourable). Natural gas power stations stayed over as the wild card, although assigned to play a key role in Germany’s electricity generation transition due to its fast and flexible availability as an operational back-up to provide system stability for the fluctuating or intermittent generation patterns of solar and wind power.

As opposed to this especially the use of the old base load lignite power stations has grown significantly in recent years while gas’ share dramatically went down with even the most modern and efficient CCGT plants now seriously under-utilized, in cold reserve or even mothballed. As fuel switching is heavily influenced by the relative fuel costs and CO2 prices this unwanted development has been particularly determined by relative high gas prices compared to coal in combination with low carbon emission allowance prices at the EU Emissions Trading Scheme.[4] The high deployment of REN running at zero fuel costs and increased running of cost competitive coal power stations are actually overstocking the German wholesale trading market and has yielded a record (net) electricity export level, which is going to jeopardise even gas-fired power generation in neighboring countries like the Netherlands.

Germany’s temporary fallacious path towards cheap-black and expensive-green based power generation has as well yielded again in a rising carbon footprint of Germany. Figure 3 demonstrates that the carbon emissions linked to electricity generation are on the rise despite the continuously growing share of REN (the so called Energiewende Paradox). As a result the German Federal Environmental Agency (2014) has recently stated that overall CO2 emissions in Germany have increased by 1.2% in 2013 and are still more or less flat lining above the lows seen in 2009.

Figure 3: CO2 Emissions from German Power Generation

Source: Agora Energiewende (2014) based on data from the German Federal Environmental Agency (Umweltbundesamt).

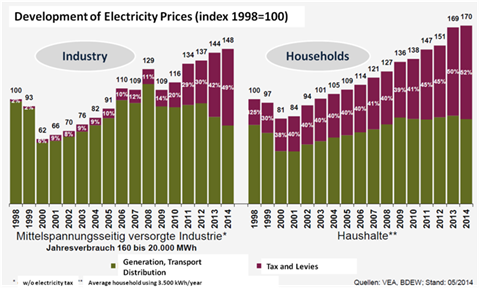

Besides structural displacements in power generation, the development of the electricity price is the most important outcome and benchmark one should bestow consideration upon. Although the costs of renewables have dropped substantially, the electricity price for end consumers has risen more or less continuously since the start of the restructuring program (Figure 4). Electricity prices for households as well as for industry have more than doubled between 2000 and 2013, which can mainly be attributed to the significant increase in taxes, charges and levies. Price rises in recent years have been particularly driven up by the surge of the levy for the EEG (German Renewable Energy Sources Act). The mere costs of electricity (generation, transport, distribution (green area in graph below)) have even been constant or slightly falling in recent years. According to the BDEW, the proportion of the end consumer price accounted for by state charges (presently more than 52%) has drastically increased since 1998. Since the surcharge is kept at a lower level for some industrial customers through increasing exemptions from the charge in order to survive the challenge of global competitiveness, the costs for private customers have been driven up more steeply (right hand figure in graph below). The overall burden required by the renewable surcharge in Germany (EEG-Umlage) has risen to more than 20 bn Euro per year by now.

Figure 4: Development of End Consumer Electricity Prices in Germany (Index 1998=100)

Source: BDEW German Association of Energy and Water Industries [www.bdew.de]; compiled by author.

However, in contrast to end user prices that are burdened by various taxes and duties (especially for households), wholesale prices are relatively low and internationally competitive due to the excess supply plus from REN and coal-fired power stations. Electricity prices at the EEX, the German Electricity Exchange, have been decreasing from over 80 Euro/MWh base load in 2008 (blue line in Figure 5) by more than 50%.

Figure 5: Wholesale Electricity Prices in Germany (EEX Future Base-/Peak load 2007-2014)

Source: BDEW German Association of Energy and Water Industries [www.bdew.de] based on EEX.

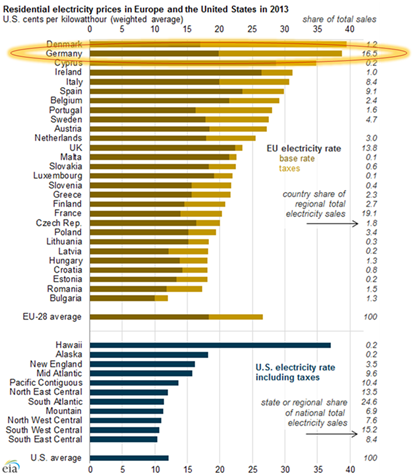

A recently published comparison of household electricity prices (incl. taxes and levies) reveals the large gap that has opened up between European prices in general and German prices in particular in contrast to American prices: In 2013, the average household price in EU countries was more than double the rates in the U.S. The German price was even more than triple the U.S. rate. Together with Denmark Germany exhibits the highest prices in Europe, both countries with ambitious goals in decarbonising their energy sectors.

Figure 6: Household Electricity Prices (incl. Taxes) in Europe and the U.S. (2013)

Source: EIA (2014)

The fundamental policy shift to launch the Energiewende in 2000 the German energy system has already undergone a considerable restructuring towards renewable energy. Nevertheless some goals clearly failed so far, first and foremost in the matter of the Energiewende Paradox that actually causes rising carbon emissions. On the other hand, there is an ongoing and rising discontent because of the overall cost burden associated with the higher than expected payouts through the Feed-in Tariff system (EEG-Umlage) and its allocation to different sectors. To tackle these weak spots of the restructuring process German lawmakers have initiated a reform of the German Renewable Energy Act that has entered into force on 1 August 2014. Furthermore, the German government has recently approved a renewed climate protection law. Both legislative reforms can be expected to have wide-reaching influence on the Energiewende progress and intentionally fix or correct the most severe flaws and undesirable developments in the time to come.

Sources

Agora Energiewende (2014), The German Energiewende and its Climate Paradox - An Analysis of Power Sector Trends for Renewables, Coal, Gas, Nuclear Power and CO2 Emissions 2010 – 2030.

BDEW (2014) [German Association of Energy and Water Industries], Various factors influence electricity prices, 10/15/2014, Berlin.

BDEW (2014) [German Association of Energy and Water Industries], BDEW-Strompreisanalyse Juni 2014, Haushalte und Industrie, 06/20/2014.

EIA (2014) [U.S. Energy Information Administration], European residential electricity prices increasing faster than prices in United States, Today in Energy November 18, 2014, http://www.eia.gov/todayinenergy/detail.cfm?id=18851

German Federal Environmental Agency (2014) [Umweltbundesamt], Treibhausgas-Emissionen in Deutschland, 11.08.2014, http://www.umweltbundesamt.de/daten/klimawandel/treibhausgas-emissionen-in-deutschland

ISE (2014) [Fraunhofer-Institut fuer solare Energiesysteme], Stromerzeugung aus Solar- und Windenergie im Jahr 2014, Prof. Dr. Bruno Burger, 07.07.2014.

Schuppe (2013), Brown cloud slooming on the green energy horizon in Germany, in: ORF Energy Monitor, Vol. X, Issue 17, 08 Oct. 2013; http://orfonline.org/cms/sites/orfonline/modules/enm-analysis/ENM-ANALYSISDetail.html?cmaid=58145&mmacmaid=58146 to be continued.......

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

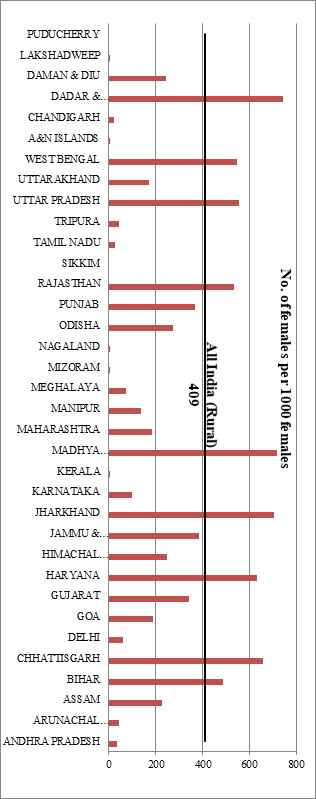

Energy for Cooking & Lighting in Rural India

Akhilesh Sati, Observer Research Foundation

Preparation of cow-dung cakes by rural women

|

STATE |

No. of Females* Per 1000 Rural Females |

|

ANDHRA PRADESH |

36 |

|

ARUNACHAL PRADESH |

42 |

|

ASSAM |

225 |

|

BIHAR |

489 |

|

CHHATTISGARH |

657 |

|

DELHI |

61 |

|

GOA |

189 |

|

GUJARAT |

344 |

|

HARYANA |

631 |

|

HIMACHAL PRADESH |

250 |

|

JAMMU & KASHMIR |

387 |

|

JHARKHAND |

703 |

|

KARNATAKA |

99 |

|

KERALA |

7 |

|

MADHYA PRADESH |

716 |

|

MAHARASHTRA |

185 |

|

MANIPUR |

137 |

|

MEGHALAYA |

72 |

|

MIZORAM |

1 |

|

NAGALAND |

6 |

|

ODISHA |

276 |

|

PUNJAB |

369 |

|

RAJASTHAN |

533 |

|

SIKKIM |

0 |

|

TAMIL NADU |

27 |

|

TRIPURA |

42 |

|

UTTAR PRADESH |

554 |

|

UTTARAKHAND |

172 |

|

WEST BENGAL |

548 |

|

A&N ISLANDS |

1 |

|

CHANDIGARH |

22 |

|

DADAR & NAGAR HAVELI |

745 |

|

DAMAN & DIU |

246 |

|

LAKSHADWEEP |

2 |

|

PUDUCHERRY |

0 |

*Females of age 5 yrs and above.

Source: NNS 68th Round (Report No. 559)

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC targets gas production by mid-2018 from east coast block

December 8, 2014. Oil and Natural Gas Corp (ONGC) said it was aiming to start natural gas production by mid-2018 and oil production a year after that from its block off India's east coast. ONGC said it had initiated field development at its block in the Krishna-Godavari basin, which it plans to develop in four clusters. ONGC, which has struggled to maintain production from its ageing wells off India's west coast, is counting on the potentially large reserves of oil and gas from the KG-D5 block to boost future profits. Estimated reserves for the block are 121 million metric tonnes of oil in place and 78.8 billion cubic metres (bcm) of initial gas in place for the northern discovery area and 80.8 bcm for the southern discovery area, ONGC said. The company won the block in a government auction in the year 2000 and has been hurt by delays in reaching production. The company's D5 Block (KG-D5) in the Bay of Bengal sits adjacent to Reliance Industries Ltd's producing D6 block, and ONGC has accused Reliance of drawing gas from fields owned by it. (economictimes.indiatimes.com)

ONGC to spend ` 162 bn to drill 45 wells in KG-basin

December 7, 2014. Oil and Natural Gas Corp (ONGC) is set to develop 45 drilling wells at a block in Krishna-Godavari basin at an estimated cost of over ` 16,000 crore. ONGC will begin production in 2019, with a peak output of 4.5 million tonnes a year, 20 per cent more than the previous estimates. The oil discovery in Krishna Godavari basin block KG-DWN-98/2 or KG-D5 will be the first large oil production from the east coast. The block also has 10 gas discoveries, ONGC had earlier said. KG-D 5 sits next to Reliance Industries' producing KG-DWN-98/3 or KG-D6 area. KG-D5 is divided into a Northern Discovery Area (NDA) and Southern Discovery Area (SDA). Investment in NDA may be at least $ 9 billion, the company had said. It holds an estimated 92.30 million tonnes of oil reserves and 97.568 billion cubic metres of in place gas reserves spread over seven fields. ONGC bought 90 per cent interest in Block KG-DWN-98/2 from Cairn Energy India Ltd in 2005. Cairn subsequently relinquished its remaining 10 per cent interest in favour of ONGC. (economictimes.indiatimes.com)

RIL signs pact with Mexican firm PEMEX for O&G hunt

December 5, 2014. Reliance Industries Ltd (RIL) has signed an agreement with Mexican state-owned company, Petroleos Mexicanos (PEMEX) for cooperation in upstream oil and gas (O&G) production as well as in refining business. RIL and PEMEX will also share expertise and skills in the relevant areas of oil and gas industry, including for deep-water oil and gas exploration and production. RIL will also provide technical support and share experience with PEMEX for refining value maximisation and other technical optimisation strategies. (economictimes.indiatimes.com)

ONGC to acquire stake in two Siberian oilfields

December 4, 2014. Oil and Natural Gas Corp (ONGC) will sign a deal to acquire stake in two Siberian oilfields, including the strategic Vankor, during Russian President Vladimir Putin's visit to India. ONGC Videsh Ltd (OVL) will sign a memorandum of understanding (MoU) for acquiring the stake in Vankor and Yurubcheno-Tokhomskoye fields. The MoU is part of Putin's energy engagement as he seeks to expand trade links with Asian nations to counter sanctions from the US and its allies. Russia's biggest oil company Rosneft has offered to sell 10 per cent stake in the strategic Vankor oilfield in Siberia to OVL. Besides Vankor, Rosneft has also made a proposal to OVL for joint development of Yurubcheno-Tokhomskoye oilfield in eastern Siberia. The field is estimated to hold 991 million barrels of oil equivalent reserves and is planned to start production in 2017. Yurubcheno-Tokhomskoye will reach a production plateau of up to 5 million tonnes a year (100,000 barrels per day) in 2019. Russia and Rosneft are courting China and India after EU and US slapped sanctions on them for Moscow's involvement in Ukraine. OVL is interested in expanding its presence in Russia as it looks to source one million barrels per day of oil and oil-equivalent gas from Russia. OVL already has 20 per cent stake in Sakhalin-1 oil and gas field in Far East Russia and in 2009 acquired Imperial Energy, which has fields in Siberia, for $2.1 billion. (economictimes.indiatimes.com)

Downstream………….

BPCL to invest over ` 45.8 bn in petrochemicals push

December 3, 2014. Bharat Petroleum Corp Ltd (BPCL) said it will invest ` 4,588 crore ($741.44 million) to diversify into the petrochemicals business, a move that will help the state refiner expand beyond refining and retailing and boost margins. BPCL will produce niche petrochemical products, that are predominantly imported into the country, at its Kochi refinery using propylene that will be available once the ongoing refinery expansion is completed, the company said. The company plans to boost capacity at its Kochi refinery in southern India to 310,000 barrels per day (bpd) from the current 190,000 bpd by May 2016. The project proposal will be submitted for obtaining environmental clearance and the petrochemical unit is expected to come on stream during financial year 2018-2019, BPCL said. (economictimes.indiatimes.com)

Transportation / Trade…………

Oil Minister dials Korea to rescue GAIL LNG ship tender

December 9, 2014. India has sought the Korean government's intervention in sorting out technology transfer hurdles faced by Korean companies to clinch GAIL India's deal, which is one of the biggest global tenders for shipbuilding. Oil minister Dharmendra Pradhan told Ambassador of Republic of Korea Joon-gyu Lee that Korean government should relax its technology transfer policy as this was "a very good opportunity for the Korean shipbuilders to expand their business to India", the oil ministry said. GAIL has invited global bids for nine specialised carriers for importing gas worth $2.5 billion annually from the US and made it conditional to build three out of nine ships in India. While four Korean firms have the required technical qualification, the companies say the Korean government prohibits technology transfer, the oil ministry said. Korean shipyards have citied government restrictions such as technology of LNG ship design and construction, which is registered as Korea's National Core Technology and is handled at the national level. The meeting between Pradhan and the Korean Ambassador was held to apprise that GAIL's shipbuilding tender has a mandatory provision of building three ships in partnership with Indian shipyards. (economictimes.indiatimes.com)

Major transporters against zonal tariff for Gas

December 8, 2014. Major gas transporters such as GAIL India are seeking a uniform pipeline tariff for all customers independent of their distance from the gas field at a time when the downstream regulator is considering various options for major projects including the 1,375 km east-west pipeline of Reliance Gas Transportation Infrastructure Ltd (RGTIL). RGTIL is currently charging a provisional tariff determined by the Petroleum & Natural gas Regulatory Board (PNGRB) since June 2010. This is based on the principle of "zonal" tariff, in which the tariff rises every 300 km down the line. The other system called "postalised tariff ", favoured by GAIL, is akin to a postcard, which costs the same for any address in the country. GAIL has argued that the current system of zonal tariffs puts a huge burden on customers located far from the source of gas, and will encourage investments near gas fields, although gas is so scarce in the country that many factories are ready to use LNG that is four times cost of local supply. Gail India says postalised tariff is better because the market in India is not mature. RGTIL wants the regulator to make zonal tariff system more flexible. Another tariff system called "truing up" has been proposed by Gujarat State Petronet Ltd (GSPL). This is similar to the power sector where companies apply to the regulator for a tariff on the basis of actual capacity utilization and costs. (economictimes.indiatimes.com)

SCI awaits fruition of GAIL's LNG project tender

December 7, 2014. Shipping Corporation of India (SCI) is awaiting the outcome of GAIL's tender for nine LNG vessels which sought poor response from bidders. SCI said the reason for the poor response was because GAIL had put in a rider in the tender that out of the three batches of three vessels each, one in each batch would have to be built in an Indian shipyard. SCI said that most of the shipbuilders are either Japanese or Koreans. SCI said that neither the Japanese nor the Koreans were convinced with the quality of Indian shipyards. (economictimes.indiatimes.com)

RIL charters smaller vessel to ship diesel to Singapore

December 5, 2014. Reliance Industries Ltd (RIL) has chartered a medium-range vessel to carry diesel from India to Singapore in December, a rare move for the refiner that typically uses larger vessels for the route, traders said. Medium range vessels can carry about 35,000 to 40,000 tonnes of diesel. Reliance usually ships diesel to Singapore in long-range 2 sized vessels, or Aframaxes, that can carry about 80,000 to 100,000 tonnes of fuel, or in a long-range 1 sized vessel, or Panamaxes, that can carry about 50,000 to 60,000 tonnes. As much as possible, Reliance ships diesel to Europe or Africa when arbitrage economics are viable and moves the fuel to Singapore only when demand in Europe is weak, traders said. It is unclear if Reliance plans to store the oil product in Singapore or sell it directly to a customer in the region. India shipped about 94,000 tonnes of diesel to Singapore in the week to December 3, data from International Enterprise shows. Reliance operates the world's biggest refining complex in India's western state of Gujarat, where its two adjacent plants can process about 1.4 million barrels per day of oil. In the past, it has sold diesel to countries like Australia, which is Asia's top diesel importer and where import demand is growing due to closures of its ageing refineries, traders said. (economictimes.indiatimes.com)

India receives its biggest shipment of LNG

December 3, 2014. India has received its biggest shipment of liquefied natural gas (LNG) by ship as it looks to diversify supplies and economise parcel size to meet growing energy demand. A Q-Max LNG vessel, the largest LNG carrier in its class, with a capacity of about 261,000 cubic meters, was received at Petronet LNG Ltd's Dahej import terminal in Gujarat. The receipt of the ship, carrying cargo from Ras-Laffan, Qatar, has set another benchmark, the company said. Petronet had successfully unloaded 1,000th cargo at Dahej in a short span of about 9 years. In April, Petronet had signed a short-term contract with Qatar's Ras Laffan Liquefied Natural Gas Co to import 800,000 tonnes of LNG over 12 months to supply to refineries.

Petronet currently imports 7.5 million tonnes a year of LNG from RasGas on a long-term contract that was signed in 2004. RasGas will load its 1,000th cargo destined to Dahej in mid-December. Petronet currently has two operational LNG import terminals - 10 million tonnes a year Dahej facility in Gujarat and 5 million tonnes per annum facility at Kochi in Kerala. The firm, which meets about 30 per cent of the country's gas demand, has so far sourced over 1,250 cargoes at its Dahej LNG terminal. (economictimes.indiatimes.com)

Policy / Performance………

UP to set up panel for single window node to GAIL pipeline

December 9, 2014. GAIL India Ltd said the Uttar Pradesh (UP) government has agreed to constitute a high power committee to provide single window clearance for construction of Jagdishpur-Haldia gas pipeline. The setting up of the panel will give a "boost to the speedy implementation" of the pipeline that originate in Uttar Pradesh and ends in West Bengal, the company said. The long-delayed Jagdishpur-Haldia pipeline is one the projects that form part of Prime Minister Narendra Modi's vision of adding 15,000 km of pipeline network in the country in five years. Also, new City Gas Distribution networks for retailing CNG to automobiles and piped cooking gas to households are expected to come up in Varanasi, Allahabad, Azamgarh and Gorakhpur.

The committee will help in securing various statutory clearances like forest, environments, PWD, irrigation, industries, and also give administrative support for the pipeline construction activities. GAIL's 2,050 km Jagdishpur-Haldia natural gas pipeline will serve as the 'Energy Highway' to carry the efficient and environment-friendly fuel to Uttar Pradesh, Bihar, Jharkhand and West Bengal. (economictimes.indiatimes.com)

Oil marketing companies sell 5 kg LPG cylinder at ` 150

December 9, 2014. State oil marketing companies are quietly selling mini cooking gas cylinders of 5-kg across the country at subsidized rates of about ` 150 each to over 2.75 lakh consumers. These cylinders are also sold in select petrol pumps at market price of about ` 350 per unit. Oil Minister Dharmendra Pradhan said that the government was working an efficient and pro-poor subsidy regime where a customer would get cooking gas subsidy on per kilogram basis without losing his current entitlement, which is equivalent to 12 subsidised cylinders in a year. According to the government's policy, in a year a customer is entitled to consume 12 LPG cylinders of 14.2-kg each at subsidized rate.

Oil ministry said the move will also check diversion of subsidized cylinders for commercial use. Market price of a 14.2-kg cylinder in New Delhi is ` 752, which is sold at a subsidized rate of ` 417 for the domestic use. Oil ministry said there is a difference in subsidy entitlement for consumers of 5-kg LPG cylinders. Only one Bharat Petroleum Corp Ltd (BPCL) outlet in Delhi sells subsidized mini cooking gas cylinder. The largest number of such customers are in Jharkhand, followed by Uttar Pradesh and Maharashtra. (economictimes.indiatimes.com)

` 100 bn lost due to under-payment of oil royalty: Assam CM

December 8, 2014. Assam has incurred a cumulative loss of more than ` 10,000 crore since 2008-09 due to under-payment of crude oil royalty from oil exploration companies, said state's chief minister (CM) Tarun Gogoi. He said though the state government had asked the Centre several times in past to ensure the upstream oil companies paid crude oil royalty on 'well head price' to the state government, the demand still remained unaddressed. Gogoi has urged the prime minister to "see to it" that companies engaged in exploration of crude oil in Assam are "made to pay" royalty on production of crude oil at 20 percent on well head price and not on the basis of heavily discounted price. Gogoi had earlier referred to a Gujarat High Court verdict on a petition filed by the government of Gujarat where the court asked that royalty on crude oil be made on fair market price and not on discounted price. (www.business-standard.com)

Oil Ministry to cut subsidy burden of ONGC, adjust its cess payment

December 8, 2014. In a big boost to Oil and Natural Gas Corp (ONGC), the Oil Ministry is reworking the fuel subsidy sharing formula to cut its payout by a quarter through adjustment of statutory oil cess against its share. According to a new subsidy sharing formula, the payout of upstream oil producers like ONGC is to be reduced to the extent of ` 4,500 per tonne oil development cess they pay to the government. The move to lessen the subsidy burden will give a flip to government's plan to sell 5 per cent stake in ONGC to garner about ` 17,000 crore. The cess in current fiscal will total ` 10,500 crore and after accounting for ` 31,926 crore that upstream firms ONGC and Oil India Ltd (OIL) have already paid in fuel subsidy in first half, their payout in remainder of the current fiscal will be no more than ` 8,000 crore. Upstream producers like ONGC met nearly half of the revenue loss or under-recoveries that fuel retailers incurred on selling cooking fuel and diesel until recently at government controlled rates. This dole, which was in the form of deep discounts on oil ONGC sold to refineries, had strained its balance sheet as its net realisation fell below the economic cost of oil. Subsidy burden on upstream oil companies has increased from ` 32,000 crore or 30 per cent of the total under-recovery in 2008-09 to ` 67,021 crore (48 per cent of the total under-recovery) in 2013-14. (economictimes.indiatimes.com)

Oil Ministry may dip into RIL incremental gas price hike revenue account

December 7, 2014. Government may dip into Reliance Industries' incremental gas price hike revenue, accruing in a pool account, to recover its dues in the wake of the contractor failing to meet certain KG-D6 output targets. While announcing a 33 per cent hike in natural gas price to USD 5.61, the government had said that Reliance Industries Ltd (RIL) will continue to get the old rate of USD 4.2 for the main D1&D3 gas field in KG-D6 block. The incremental USD 1.41/unit will go into a gas pool account, managed by GAIL India, till the dispute over fall in output is settled. In its gas price hike proposal, the Oil Ministry however also proposed to the Cabinet to use the revenue accruing into this account to recoup USD 195.341 million of additional 'profit petroleum'. The Ministry says this is the additional profit petroleum that the contractor is liable to pay to government, after USD 2.376 billion out of USD 10.441 billion cost incurred on KG-D6 fields was disallowed because of output from D1 and D3 fields not meeting the targets in past four years. Oil Minister Dharmendra Pradhan said that his Ministry has instructed GAIL and Chennai Petroleum Corp Ltd (CPCL) to deduct the profit petroleum due to government from the money they pay to RIL for buying gas and crude oil from KG-D6 block respectively. They, however, expressed inability to do so because GAIL had not been buying gas since June 2013 and CPCL lost on a tender to buy oil in April this year. Pradhan said that the possible alternatives for effecting the recovery of additional profit petroleum from the contractor were being worked out. The Ministry plans to recover the dues from the gas pool account. The gas pool account, where about USD 4 million accrues every fortnight, started functioning when first bill at revised gas price was raised. The Ministry may wait for the account to swell to at least USD 20-25 million before dipping into it. No operational details of the gas pool account have so far been announced. RIL and its partners --UK-based BP plc and Canada's Niko Resources -- want the money accruing to them in the account to be paid with market interest rate if and when they win the arbitration. However, with the accruals being used to settle profit dues, it remains to be seen if the government will dip into its budget to pay for the due sum along with interest, they said. (economictimes.indiatimes.com)

GAIL India inks agreement to buy 2.5 mn tonnes of LNG from US-based firm

December 5, 2014. GAIL India Ltd has signed an agreement with US-based WGL for buying about 2.5 million tonnes of gas for 20 years. GAIL Global USA LNG LLC, a subsidiary of the state-owned firm, signed a sourcing agreement with US-based WGL Midstream Inc for "procurement of natural gas required to produce about 2.5 million tonnes a year of LNG at the Cove Point Terminal located in Maryland, US," the company said. WGLM is a subsidiary of WGL Holdings Inc, a prominent natural gas company of the United States. GAIL had previously signed deals to buy 3.5 million tonnes of LNG a year for two decades from Cheniere Energy Inc's Sabine Pass terminal in Louisiana. It had also booked 2.3 million tonnes a year capacity in the Cove Point LNG liquefaction terminal in Maryland. The shipments are expected to start by 2017-18. GAIL said the pact was part of the company's efforts to source liquefied natural gas (LNG) to meet the country's rising energy demand. (economictimes.indiatimes.com)

ONGC sell-off stuck on subsidy share to help fetch better price in stock market

December 5, 2014. Amid falling global crude prices, subsidy-sharing formula for oil is holding up disinvestment of government stake in ONGC, a key element of the finance ministry's plan to meet the fiscal deficit target for the current financial year. Bankers to the issue as well as the disinvestment department are keen that the government immediately deal with the subsidy bill for the current financial year and how it will be distributed, so that ONGC can fetch a good price when its shares are auctioned on the stock market. The issue was discussed as well and a decision is expected soon. With a fall in international crude prices to less than $70 a barrel, ONGC's revenue will be impacted as it is linked to global prices. At the same time, the country's largest public sector company has to contend with a large subsidy burden. ONGC and Oil India Ltd offer discounts to help state refiners cover a part of their losses from selling diesel and kitchen fuel at government-capped rates. This discount has risen from 30% in 2008-09 to 48% in 2013-14. The discount is estimated at $56 on a barrel of crude, which is in addition to levies of $18-19 paid to the government. As a result, the companies take home around $30 when the international price is around $100 a barrel. (economictimes.indiatimes.com)

State probing Centre’s decision on gas pricing is absurd: RIL to HC

December 4, 2014. The Reliance Industries Ltd (RIL) told the Delhi High Court (HC) that the Delhi government’s decision to probe the Centre’s policy on gas pricing was a “peculiar” and “absurd” situation. The submission was made before Justice V K Shali by senior advocate Abhishek Manu Singhvi who appeared for RIL which has challenged the then Arvind Kejriwal-led Delhi government’s decision to lodge an FIR relating to alleged irregularities in raising the price of gas from the company’s KG-D6 basin. UPA ministers M Veerappa Moily and Murli Deora, RIL Chairman Mukesh Ambani and others were named in the FIR. Delhi government had also alleged that the UPA government “favoured” RIL with an eye on the 2014 general elections and BJP maintained “silence” hoping to gain corporate funding for the polls. The charges have been denied by RIL and others. Advocate Prashant Bhushan, appearing for the persons on whose complaint the FIR was lodged, had said the July 23, 2014, the notification on the powers of the Anti-Corruption Branch (ACB) amounted to diluting its powers. The July 23 notification has limited the ACB’s powers to probe graft cases to the extent that it can investigate only city government officials and not those of the Centre. Delhi government, on its part, opposed RIL’s submission saying it was only investigating a criminal complaint and central government officials may come in the sweep of its probe. The Centre, meanwhile, said it is still awaiting instructions on whether the notification will have prospective effect. After hearing the brief arguments, the court listed the matter for further hearing on January 21, 2015. (indianexpress.com)

Govt mulls ways to recover $195.3 mn from RIL

December 4, 2014. The government is considering ways to recover $195.3 million from the contractor of the KG-D6 Block because it has disallowed development costs of $2.376 billion, oil minister Dharmendra Pradhan said. The block is operated by Reliance Industries Ltd (RIL) and its partners BP Plc that holds 30% interest and Niko Resources which has 10%. The government penalised the contractor for the steep fall in gas output, for which Reliance blames the complex geology. Reliance has already initiated arbitration against the government decision to disallow costs and argued that there is no contractual provision for such action by authorities. The total disallowed development costs as on March 31 this year amounts to $2.376 billion. (economictimes.indiatimes.com)

No exemption to ONGC from fuel subsidy payout: Oil Minister

December 3, 2014. The government is not considering exempting Oil and Natural Gas Corp (ONGC) from payment of fuel subsidy, Oil Minister Dharmendra Pradhan said. Fuel retailers sell domestic cooking gas (LPG), kerosene and until recently diesel at government controlled rates which are way below cost to control inflation. The losses they thus incurred were met through a combination of cash subsidy from Union Budget and dole out from oil and gas producers like ONGC. With government deregulating diesel, the most consumed fuel in India, and international oil rates slumping to five year low leading to almost halving of the losses, there is a demand for exempting ONGC from subsidy payouts. Last fiscal, when retailers lost ` 139,869 crore on fuel sales, ONGC chipped in ` 56,384.29 crore. In the first half of current fiscal, it paid ` 26,841 crore. The revenue loss or under-recovery on fuel sales this fiscal is estimated around ` 79,000 crore, of which over ` 51,000 crore has already been accounted for in the first six months. Pradhan said the government was considering reworking the subsidy sharing formula for ONGC. Any move to lessen the subsidy burden of ONGC will help the government realise a better price for its planned 5 per cent share sale this fiscal. (economictimes.indiatimes.com)

Crude oil prices at 5 year low

December 3, 2014. The government raised basic excise duty on petrol and diesel for the second time in roughly two weeks to mop up gains made by fuel retailers from a sharp fall in global crude prices, a benefit that was supposed to be passed on to consumers under a much touted decontrol of prices in the sector. Basic excise duty was raised by ` 2.25 per litre and ` 1 on a litre of diesel. The duty was raised by ` 1.50 on both fuels in mid-November, which the fuel retailers offset against their gains to leave retail prices unchanged. The government is estimated to mop up ` 20,000-21,000 crore per year from the two rounds of excise duty revisions. In a true market pricing regime, this benefit should be going to consumers by way of hefty reduction in prices. The paltry price cuts announced and the move to raise excise duty have dashed the hopes of consumers eyeing a substantial reduction in their fuel bill. The last trading day of that fortnight, the cost of India's crude purchase stood at $70.29 per barrel. This declined to $67.72 a barrel, December 1, the first day of this fortnight, a drop of $2.57 per barrel in two days. With global benchmarks at five-year low, this gain is expected to widen in the days to come as $60 a barrel price looms. It is this gain that the government is mopping up to garner additional resources for containing the fiscal deficit in the face of a sluggish economy and tepid revenues. Petrol pricing has been deregulated since January 2013 and diesel was deregulated in October. Global crude prices have been declining since June-July, coming down some 36% since then. While petrol price has been reduced seven times since August, diesel price has been reduced thrice since its deregulation. The government has reasons to revise the basic excise duty. The second reason is that the government is creating a cushion to protect consumers from a crude shock in future as and when global oil prices rebound. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

BHEL commissions hydro power plant in Rwanda

December 8, 2014. State-run power equipment maker BHEL said it has commissioned a hydro power project in African country Rwanda. With the commissioning of this plant, the installed generation capacity of Rwanda has gone up by 24% from 119 MW to 147 MW. Nyaborongo Hydro Electric project is owned by the Government of Rwanda and has been financed under the Government of India's Line of Credit. BHEL's scope of work in the contract included turnkey execution for the Nyaborongo hydro power project comprising two hydro generating units of 14 MW each.

BHEL's hydro installations are working in India, Azerbaijan, Bhutan, Malaysia, Nepal, New Zealand, Taiwan, Tajikistan, Thailand and Vietnam. The company is also currently executing hydro power projects in Afghanistan, Democratic Republic of Congo and Bhutan. The company has already established presence in other African countries namely --Sudan, Libya, Ethiopia, Egypt, Zambia, Tanzania, Uganda, Nigeria. (www.business-standard.com)

Dabhol power plant will be revived: NTPC

December 6, 2014. The Dabhol power plant, which is grappling with gas shortage and debt woes, will be revived and many options are being considered for the facility in Maharashtra's Ratnagiri district, NTPC said. The Dabhol project, comprising 1967 MW of power generation capacity, a regasification plant and other facilities, is operated by Ratnagiri Gas and Power, owned by NTPC and GAIL India. According to NTPC, gas pooling might be one of the solutions for the revival of the Dabhol plant, but such a move would depend on the decision of states that benefit from the project. NTPC said the company's tiff with Coal India over the quality of fuel has been resolved and any gap in quality between the coal supplied and received is now unlikely. The two state-run companies had been at loggerheads over the quality of fuel, with NTPC accusing Coal India of supplying inferior quality coal while billing it for higher grades. NTPC had also withheld its payment to Coal India. After government intervention, the companies agreed for third-party sampling. NTPC was in the process of appointing third-party sampling agents for coal. (economictimes.indiatimes.com)

BHEL commissions sixth unit of 412 MW Rampur hydro plant

December 4, 2014. Bharat Heavy Electricals Ltd (BHEL) said it has commissioned the sixth unit of 412 MW Rampur hydel power project in Himachal Pradesh. The state-owned equipment maker has completed commissioning all the six units - each having 68.67 MW generation capacity of the plant, operated by Sutlej Jal Vidyut Nigam (SJVN). The project is located on the Satluj river. BHEL said the plant can generate about 1,770 GWh in a 90 per cent hydrological dependable year when all the units are operating. BHEL's scope of work included supply, erection and commissioning of six Francis turbines. At present, BHEL is executing hydro power projects of around 5,000 MW capacity. During 2013-14 financial year, the company commissioned nine hydro sets having total capacity of 641 MW. (economictimes.indiatimes.com)

Cost of units 3, 4 surpasses `390 bn: KNPP

December 3, 2014. Due to liability issues, the cost of units 3 and 4 of Kudankulam Nuclear Power Plant (KNPP) has shot up to ` 39,747 crore, more than twice the cost of units 1 and 2, which will lead to an increase in per unit cost of power. The approved cost of unit 1 and 2 is ` 17,270 crore while the approved cost of unit 3 and 4 is ` 39,747, Minister of State for Department of Atomic Energy, Jitendra Singh, said. All the four reactors, with a capacity of 1000 MW each, have been built with Russian assistance. The unit, which was shut down due to technical reasons, is expected to start generating power. It was connected to southern grid in October 2013 when then Prime Minister Manmohan Singh visited Russia. The approved cost of Prototype Fast Breeder Reaactor at Kalpakkam is ` 5,677 crore, while units 7 and 8 of Rajasthan Atomic Power Station (RAPS) is ` 12,320 crore. For units 3 and 4 of Kakrapar 11,459 have been approved. Unit 1 of Kudankulam achieved full power in June 2014 and has so far generated 2825 MW electricity. While the Unit 2 in at commissioning stage. (economictimes.indiatimes.com)

NTPC plans expansion of power plants in Telangana

December 3, 2014. NTPC has approached the Ministry of Environment and Forest seeking amendments to Terms of Reference (TOR) for its proposed expansion of Telangana's Ramagundam power plant to 2x800 MW. NTPC is presently operating a coal based 2600 MW (Stage-I, II & III) Thermal Power Station at Ramagundam in Karimnagar District of Telangana. The cost of project would be between ` 5.5 crore to ` 6 crore per MW and the Board has already approved the proposal. It is proposed to allocate 100 per cent power to Telangana state subject to approval by Ministry of Power. Considering the location and optimisation of available space at both locations to accommodate 4000 MW, 800 MW units have been proposed. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Haryana discom DHBVN proposes 15 per cent hike in power tariff

December 8, 2014. Haryana's power distribution company DHBVN has estimated cumulative revenue gap of ` 5,809.47 crore, seeking at least 15 per cent hike in power tariff to recover this "whopping" gap. In its petition for annual performance review for 2014-15 and revised annual revenue requirement (ARR) for 2015-16 filed with power regulator HERC, Dakshin Haryana Bijli Vitran Nigam Ltd (DHBVN) has proposed 15 per cent increase in power tariff across all categories. DHBVN undertakes power distribution and retail supply business in southern Haryana districts, including Bhiwani, Faridabad, Gurgaon, Hisar, Narnaul, Mahendragarh, Palwal, Rewari, Sirsa and Jind. The power utility has estimated gap of ` 2,852.71 crore for financial year 2013-14, ` 1,302.77 crore for FY15 and ` 1,653.99 crore for FY16, as per petition. The other Haryana discom Uttar Haryana Bijli Vitran Nigam Ltd (UHBVN) has also proposed 15 per cent hike in power tariff across all categories to recover the cumulative revenue gap of ` 3,898.72 crore in its petition filed with Haryana Electricity Regulatory Commission (HERC).

DHBVN has projected net ARR of Rs 16,528 crore for 2015-16 and after deducting revenue generation from sales, income from FSA and subsidies, the revenue gap was worked out at ` 1,653.99 crore. The discom has projected overall energy sales of 19,025 million units (MUs) to all categories of customers in 2015-16, as against 18,091 MUs in 2014-15. As far as capex plan is concerned, DHBVN has estimated to undertake capital expenditure of ` 1,334.22 crore which will be spent on procurement of single phase meter, erection of new power lines, etc during 2015-16. HERC had approved capex plan of ` 959.39 crore for FY15. DHBVN has projected power purchase cost of ` 12,951 crore, 11 per cent up from estimated cost for 2014-15. The power discom has projected per unit power purchase cost at ` 4.40 for 2015-16, up from ` 4.13 per unit in 2014-15 fiscal. (economictimes.indiatimes.com)

NTPC to bid for coal blocks

December 8, 2014. NTPC, the country's biggest power generator and thermal coal consumer, will bid for coal blocks due to be auctioned in January as it seeks to expand capacity and secure fuel to run its power stations. The company will bid for the mines even if the government allocates some of the blocks to it. NTPC, which imported 9.5 million tonne (mt) of coal last fiscal, is looking to import 12-13 mt of the fuel in the current fiscal. NTPC will bid for the coal blocks as it wants to reduce its dependence on coal imports. NTPC said that the company expects to start the first phase of its 4,000 MW Telangana power plant in 2015. (economictimes.indiatimes.com)

Govt to clear $2 bn transmission projects in South

December 7, 2014. The government will soon clear transmission projects worth $2 billion in the Southern region and has sought greater private participation to meet its target of $50 billion investments in the segment over the next five years. The Ministry of Power has estimated investments to the tune of $50 billion in the power transmission sector for which it has sought participation of the private sector. The government is also encouraging more private sector participation in the transmission sector as there is remarkable opportunity and going forward it will certainly be a robust business proposition. Power Minister Piyush Goyal has maintained that with the existing 2.50 lakh installed generation capacity the electricity output can be doubled by improving efficiency of the transmission networks. The Cabinet cleared two schemes - Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and Integrated Power Development Scheme (IPDS). DDUGJY aims to separate agriculture and non-agriculture feeders facilitating judicious rostering of supply rural areas. The estimated cost of the scheme is ` 43,033 crore. IPDS has been launched with the objective of strengthening of sub-transmission and distribution network in the urban areas. The estimated cost of the scheme is ` 32,612 crore. (economictimes.indiatimes.com)

Engineers demand blueprint of 24 hr power supply in UP

December 4, 2014. Following claims by the Uttar Pradesh government that it would ensure uninterrupted power supply in Uttar Pradesh by 2017, the All India Power Engineers Federation (AIPEF) asked the state to release its blueprint. UP chief minister Akhilesh Yadav had met union minister of state for power and coal Piyush Goyal in New Delhi to discuss vital issues pertaining to power generation, transmission and distribution. Terming the meeting as mere formality, AIPEF chairman Shailendra Dubey expressed doubts if real issues facing the state energy sector were discussed. In backdrop of energy crisis, Dubey reiterated that faulty energy policies and over dependence on private sector were responsible for the "deterioration" in the last two decades. He maintained the power situation would improve only if the energy policy was overhauled. Dubey said in the last nine years, the private sector had been awarded power projects totalling 17,000 MW in UP, but there was little development on this front. On the contrary, the state sector was assigned projects of 1,000 MW, which would be functional by 2015. He censured Gadgil formula that guides the allocation of power to the states as redundant and irrelevant in present context. UP is faced with perennial power shortage owing to yawning demand and supply gap that widens to almost 3,000 MW during peak hours. (www.business-standard.com)

ABB bags ` 3.3 bn worth orders from state power utilities

December 3, 2014. ABB, a supplier of power and automation technologies, has won orders worth ` 334 crore from public utilities, Bihar Grid Corporation Ltd (BGCL) and West Bengal State Electricity Transmission Company Ltd (WBSETCL), to build new transmission and distribution substations that will boost power supplies in the region. As part of a turnkey contract in Bihar, ABB will design, supply, install and commission 220/132/33 kV (kilovolt) gas-insulated switchgear (GIS) substations across four locations. These substations will deploy ABB's compact high-voltage GIS technology which can reduce the substation footprint by up to 70 per cent compared with conventional air-insulated switchgear (AIS) substations, ABB said. In West Bengal, ABB will design, supply, install and commission a 220/132/33 kV AIS substation to help meet the growing demand for electricity in the Sadaipur region. (www.business-standard.com)

Policy / Performance………….

SC asks Centre to find 'acceptable solution' on Uttarakhand power projects

December 9, 2014. Rapping the Centre for not moving forward on Hydroelectric power projects in Uttarakhand for 18 months, the Supreme Court (SC) asked it to find an "acceptable solution" to the problem and not to come out with "knee-jerk" reaction. The Court's observation came after Centre warned that greenlighting power projects in the state may trigger another disaster like last year and their cumulative effect needs to be studied before allowing them. The Centre expressed reservation in allowing the projects despite getting forest and environment clearance which was given before the disaster hit the state last year, saying that their design was not acceptable. The apex court had granted four more weeks to the Centre for filing "comprehensive" environment and ecological impact report of 24 hydroelectric power projects, including six which was earlier cleared by the government, to be established on Alaknanda and Bhagirathi river basins in Uttarakhand. The court had ticked off Ministry of Environment and Forest (MoEF) for sleeping like 'Kumbhakarna' and had made clear that it is not going to lift the stay on setting up of hydroelectric power projects in the state unless the Ministry comes out with a detailed report on the impact of 24 ventures on ecology and environment. The court wanted to know why the Ministry was not acting on its orders requiring placement before it of the report of the 13-member expert committee, which was asked to study environmental degradation caused by such projects. The apex court by its August 13, 2013 verdict had expressed concern over the climate tragedy in Uttarakhand that year and prohibited setting up of any new hydroelectric power project in the state till further orders. (economictimes.indiatimes.com)

Centre, AP ink MoU to provide 24x7 power in the state by Oct 2016