Background

China’s dominance of the electric vehicle (EV) value chain and EV adoption was unexpected. The West repeated the mistake it made with Japanese Internal Combustion Engine (ICE) cars and assumed that the technological and design inadequacies of Chinese EVs would pose no threat. Today, governments from across the world, including the Government of India, are struggling to respond to the quality and affordability of Chinese EVs, China’s dominance over EV production and EV adoption. China began its EV drive later than the United States (US). Both countries had similar policies to incentivise companies and consumers, but China surpassed the US EV industry within a decade. Government-led policies, incentives and subsidies played a big role in putting China ahead of its competition. However, copying China today is not likely to beat China in the future.

EV Value Chain Basic

There are three main types of electric vehicles (EVs). Battery EVs (BEVs) are “all-electric” vehicles whose batteries are recharged through a wall outlet. Plug-in hybrid EVs (PHEVs) can either use electric and internal combustion engines (ICEs). Hybrid electric vehicles (HEVs) are similar to PHEVs but they cannot operate on electricity alone and they cannot be plugged in for battery recharge. Lithium-ion batteries (LIBs) currently dominate the EV industry because they have relatively high energy density, have high tolerance for high and low temperatures, have a low self-discharge rate, and can withstand many charge cycles. LIBs are material-intensive and these materials (metals and minerals) are geologically dispersed.

The cathode chemistry of a battery determines both the battery performance and its material demand. In the context of cathode chemistry, three combinations are most relevant: lithium (Li) nickel (Ni) manganese (Mn) cobalt (Co) oxide (NMC); Li, Ni, Co aluminium oxide (NCA); and Li iron phosphate (LFP). NMC and NCA cathodes offer high energy density based on higher Ni content in the cathode. LFP is a lower-cost and more stable system, with a lower risk of catching fire and a longer cycle life. Ni-based cathodes, such as in NMC and NCA, were dominant in the electric car battery market until 2021. In the last two years, the cost advantages for LFP in China have become more significant as subsidies that favoured high-Ni chemistries were phased out. The typical component at the anode is natural graphite (Gr, crystallised carbon) which determines charging time.

The US Geological Survey (USGS) classifies 50 minerals as “critical”. Clean energy technologies rely on high volumes of 11 of these. Five of the eleven—Li, Co, Ni, Mn and Gr are critical for LIB technologies. These elements have to be individually mined and processed before being assembled for manufacturing batteries that go into EVs. Consequently, the exploration and mining of these minerals and production of raw material make up the first two segments of the upstream value chain in EV production. The midstream and downstream segments consist of cathode and anode production, battery manufacture, EV assembly, followed by recycling and reuse of batteries.

The mineral and metal resource endowment for batteries is geographically concentrated to some degree. More than 50 percent of Li and Co are in Chile and the Democratic Republic of the Congo (DRC), respectively; Mn reserves are concentrated in South Africa, Ukraine, and Brazil; Gr is concentrated in Russia, China, and Brazil; and Ni is concentrated in Indonesia, Australia, and Brazil.

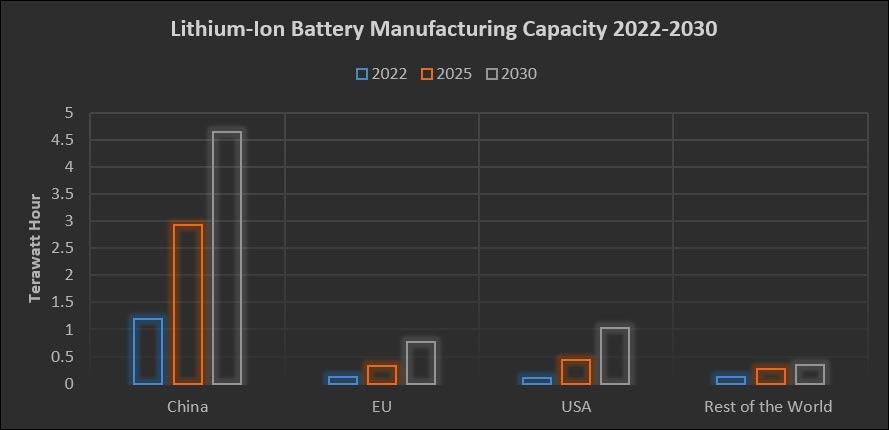

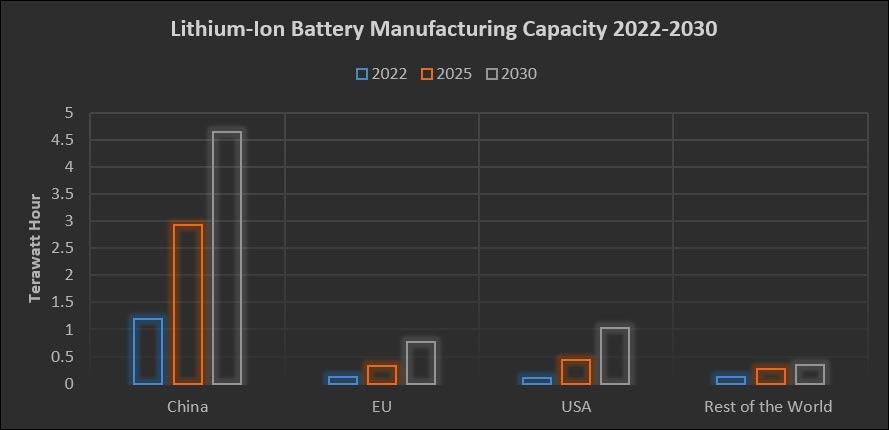

In mining for critical minerals required for EV manufacture, Australia dominated Li mining with over a 50 percent share while Indonesia dominated Ni mining with over a 35 percent share in 2023. Cobalt mining was dominated by the DRC with over 70 percent share, while natural Gr mining was dominated by China with over 75 percent of global total. In material processing, China dominated processing of all critical minerals with over 65 percent share for Li, over 35 percent for Ni, over 75 percent for Co, over 90 percent for high purity manganese sulphate (MnSo4), and almost 100 percent for Gr. China also dominated cell/battery production with over 83 percent of global total and close to 60 percent of EV manufacture in 2023. Europe and the United States together accounted for approximately 13 percent of global capacity. 70 percent of battery production capacity planned for 2030 is in China. The current global capacity for battery recycling is around 200 kilo tonnes/year with China accounting for about half. China’s dominant position is expected to be retained due to announced additional capacity but China’s share in the total is expected to decline to some extent.

China takes the wheel

The beginning of China’s EV initiative can be traced to 1986 when the 863 Program (March 1986), an applied research and development program was implemented to stimulate the development of advanced technologies in a wide range of fields. The key objective was to make China independent of financial obligations for foreign technologies and received 5 percent of total government spending that year. New energy vehicles (NEVs) were included as one of the focus areas of the programme around the early 2000s. BYD, one of the most successful Chinese EV manufacturers, entered the auto sector as a privately owned company in 2003.

Initially, China requested foreign automakers working in joint ventures with Chinese automakers to share their PEV technology with the Chinese companies. Though this appeared to violate World Trade Organisation (WTO) norms, complaints were not pursued as China claimed it was a voluntary policy. Foreign companies exporting PEVs to China were subject to high tariffs and were not eligible for PEV subsidies. Chinese banks, working closely with the Chinese government, enabled Chinese suppliers to acquire ownership interests in mines and processing facilities in Africa, Australia, Europe, North America, and South America. This led to Chinese battery and EV firms to indulge in a specialised vertical integration strategy to secure comparative advantage.

In 2001, EV technology was introduced as a priority science research project in China’s five-year plan, the country’s highest-level economic blueprint. In 2007, the industry got a significant boost when an auto engineer became China’s minister of science and technology. Since then, EV development has been consistently prioritised in China’s national economic planning. In 2009, the Chinese government started to provide considerable subsidies, at both central and local levels, for NEV production and purchase. According to the NEV policy, which introduced the catalogue of ‘Regulations on the Standards of Automotive Power Battery Industry’ commonly known as the ‘whitelist’, only battery models fully owned by domestic battery makers were listed, and hence eligible for government NEV subsidies. Since 2018, China replaced the direct subsidy with a market-based policy combining an NEV credit (increasing each year) and a trading system with the pre-existing fuel consumption requirements, known as CAFC. This meant manufacturers had to invest in research & development (R&D) to improve the fuel efficiency of their vehicles or buy credits from other manufacturers to avoid penalties.

China allowed Western EV firms like Tesla to build production facilities in the country. Favourable policies allowed Tesla’s gigafactory in Shanghai to be built quickly in 2019. The Shanghai Gigafactory is currently Tesla’s most productive manufacturing hub and accounts for over half of Tesla cars delivered in 2022. China benefitted from the presence of a pioneer in EV production initially as a role model and later as a competitor.

Chinese EV manufacturers initially focussed on electric buses and motorcycles which did not attract as much attention as cars in the industry. BYD’s entry product was the electric bus. Electric buses needed to be heavier than cars and required batteries that were operational for over 18 hours a day. This enabled BYD to push the boundaries for battery technology. Geely, another leading Chinese EV producer, focussed on motorbikes, which required lighter and more portable batteries than cars. With technologies for two extremes of battery technology covered, these two Chinese companies now lead EV production.

As part of incentives for demand, China offered subsidies for the purchase of EVs (including buses) from US$500 to US$ 8000 per vehicle. EV producers in China also collaborated with taxi companies to map locations for charging stations and tested scheduling options for battery charging that matched the current performance levels of EVs. EV taxi operators in China have two fleets of cars: one for the morning shift and one for the evening shift, with different charging times. This schedule not only addressed the battery constraints of EVs but also helped to flatten the consumption curve of a city’s power grid.

On technology, China’s focus on LFP batteries proved to be an advantage. High-Ni batteries, with higher energy densities and recycle values than LFP batteries, are preferred in markets with strict battery recycling requirements, such as Europe, the United States and Japan. However, in price-sensitive markets, LFP batteries are preferred as they have a longer lifespan, perform better at higher temperatures, have higher thermal stability and lower lifecycle emissions. In addition, the cost of minerals like Co and Ni, which are used in high-Ni batteries were rising. This made LFP batteries, which do not use these expensive minerals, a more cost-effective option. Moreover, a research consortium that owned the patents for LFP technology allowed Chinese manufacturers to use LFP technology without paying a license fee, as long as the batteries were only used in China. This made LFP batteries even more cost-effective for Chinese manufacturers and affordable for EV adopters. However, these patents and license fees expired in 2022, which means manufacturers outside of China can now also produce and sell LFP batteries without having to pay these fees. This has made the production and sales of LFP batteries outside China more attractive.

Sodium-ion batteries have begun to catch up with LIBs. Sodium-ion batteries have similar applications to LFP batteries, although they have a lower energy density. Sodium-ion batteries are increasingly seen as appealing alternatives to LFP batteries because they may use less expensive, more abundant materials, and need fewer toxic raw materials. As with LFP batteries, China is leading the development of sodium-ion batteries, with over 90 percent of the announced manufacturing capacity located there.

Issues

Countries that are alarmed by the dominance of China in the EV value chain (along with the solar and other low carbon technologies), are pursuing a “me-too” approach and adopting industrial policies used by China in the early days of its industrial development. These policies are not likely to beat China, because China is a moving target often advancing faster than competitors. Technology is advancing even faster and investment in the leading technology today may be irrelevant tomorrow. Even if policies are successful, China’s unique features in the political, geopolitical, economic and social realms that contributed to its industrial success cannot be replicated. “Me-too” strategies will add to overcapacity, squander scarce capital, fragment efforts to address climate change and decrease affordability of low carbon technologies.

Source: International Energy Agency

Lydia Powell is a Distinguished Fellow at the Observer Research Foundation.

Akhilesh Sati is a Program Manager at the Observer Research Foundation.

Vinod Kumar Tomar is a Assistant Manager at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV

.png)

.png)