This is the 159th in the China Chronicles series.

China’s economic rise has often been described as an economic miracle. The country experienced an average annual growth rate of 10 percent from 1979 to 2018 and lifted over 800 million people out of poverty. The World Bank described China’s economic success as “the fastest sustained expansion by a major economy in history”. China’s rise also had far-reaching impacts on other developing regions, notably Africa, a region which occupied a marginal position in the global economy. Between 2000 to 2015, Africa, witnessed unparalleled growth in trade, investment, and development finance flows from China.

Chinese demand for primary commodities had a huge quantitative impact on African countries and was significant enough to affect world commodity prices, thereby leading to dramatic improvements in the terms of trade for African countries as well.

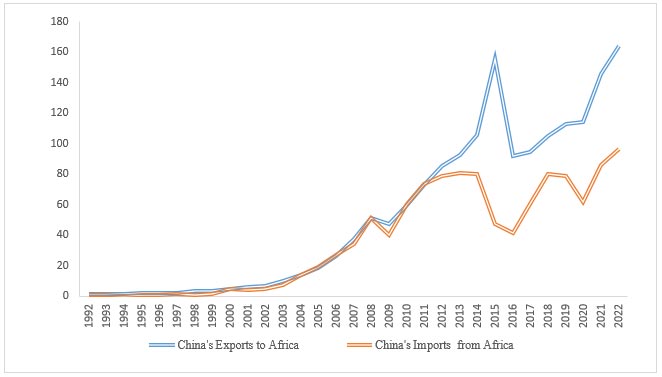

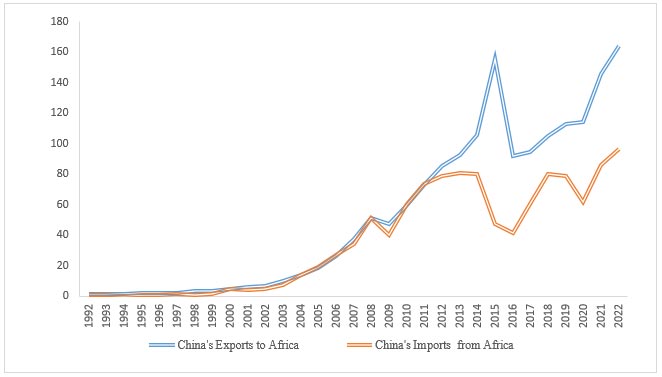

Trade links between China and Africa expanded rapidly from 2000 onwards and China emerged as Africa’s largest trading partner replacing the continent’s traditional economic partners—Europe and the United States (US). The value of goods trade between China and Africa grew at a compound annual growth rate of 16.1 percent from about US$ 9.9 billion in 2000 to US$ 260.8 billion in 2022 (Figure 1). According to a report by the International Monetary Fund (IMF), China accounts for about 13 percent of the region’s goods exports and 16 percent of its total goods imports. African countries mainly export primary commodities (crude oil, copper, natural gas, sesame, etc.) and import Chinese manufactured goods and machinery. Chinese demand for primary commodities had a huge quantitative impact on African countries and was significant enough to affect world commodity prices, thereby leading to dramatic improvements in the terms of trade for African countries as well. Increased export revenues led to high rates of economic growth in Africa and some countries like Angola, Ethiopia, and Nigeria became the fastest-growing countries in the world. Chinese demand also helped African countries weather the impacts of the global recession in 2008-09.

Figure 1: China's trade with Africa from 1992 to 2022 (in US$ billion)

Source: China-Africa Research Initiative

During this period, Chinese Overseas Direct Investment (ODI) flows to Africa also grew steadily but Chinese ODI stock in Africa is modest and the region still accounts for only about 3 percent of the country’s total ODI flows. The most controversial aspect of the China-Africa relationship was the huge flows of Chinese official financial resources to Africa for infrastructure development. China emerged as the largest official creditor for Africa, financing critical energy and transport infrastructure and mining activities in the region. China also received intense criticism because of its lending programme due to its confidentiality clauses, lower grant element and grace period, lack of data on Chinese lending, and even violation of environmental and labour laws in Chinese projects. However, notwithstanding these criticisms, often quite valid, China did offer African countries an opportunity to develop critical infrastructure, an area neglected by Western donors and multilateral development banks due to high costs and risks.

Things have changed remarkably. China is no more the global growth engine that it once was. As the world economy stares at another recession, a Chinese-led recovery is highly unlikely. Its economy has slowed down and its appetite for commodities also decelerated. The country experienced a modest growth of 3 percent in 2022. Further, it is rebalancing its economy, away from an export and investment-led growth strategy of yesteryears, to higher domestic consumption and ‘better quality growth’ through a focus on sustainability and high-tech sectors. Its rapidly ageing and declining population also clouds its future economic prospects. Given China’s enormous economic weight, its economic slowdown and transition would have profound global impacts. But what would this mean for Africa’s growth trajectory?

China emerged as the largest official creditor for Africa, financing critical energy and transport infrastructure and mining activities in the region.

African countries were hit hard by the commodity price crash in 2015 when the region’s exports and imports from China plummeted (Figure 1). However, while African imports from China have recovered substantially recording a compound annual growth of 12 percent between 2017 and 2022, African exports to China have decelerated, widening its trade deficit with China (Table 1). The pandemic and the Ukraine-Russia war have further weakened Africa as most African countries are currently burdened with huge debt burdens and are facing heighted food insecurity. Given Africa's economic dependence on China, its slowdown and reduced demand for commodities as it rebalances its economy towards green and high-tech sectors do not bode well for Africa’s economic prospects, particularly its commodity exporters. According to IMF estimates, a 1 percentage point decline in China’s GDP growth causes a 0.25 percentage point decline in Sub-Saharan Africa’s GDP growth within a year. African oil and resource exporters are most vulnerable to a Chinese slowdown and rebalancing in favour of green and digital infrastructure and a percentage point decline in China’s GDP is likely to cause a 0.5% decline in their GDP growth within a year.

Table 1: Growth of African exports and imports from China

| |

African exports to China(%) |

African imports from China (%) |

| 1992-1997 |

28% |

14% |

| 1997-2002 |

23% |

24% |

| 2002-2007 |

49% |

40% |

| 2007-2012 |

18% |

18% |

| 2012-2017 |

-5% |

2% |

| 2017-2022 |

10% |

12% |

Source: China Africa Research Initiative

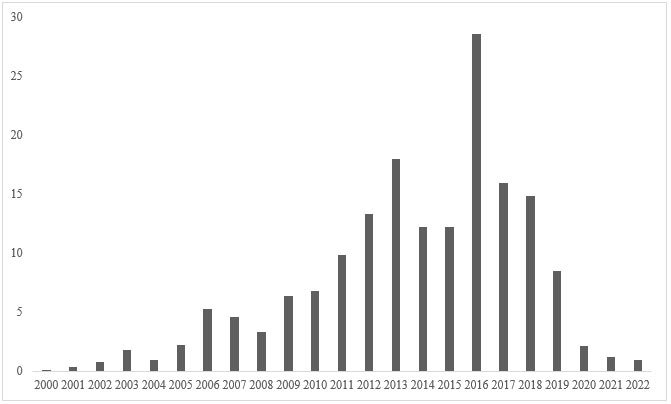

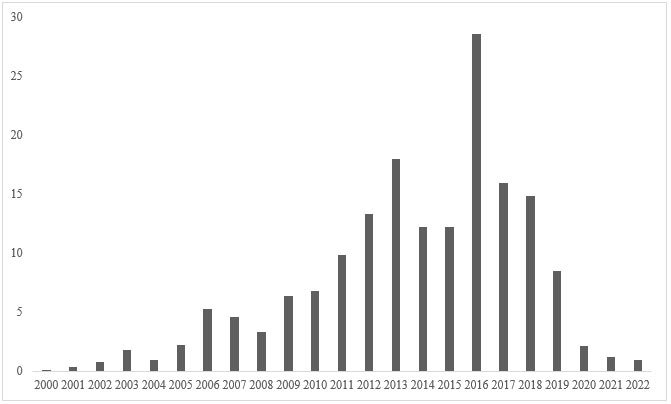

The era of easy Chinese money is also over for Africa. China’s loan disbursements to Africa, which peaked in 2016, have declined steadily (Figure 2). The country has adopted a more cautious approach to external lending on account of debt sustainability concerns and the desire to focus on higher quality and well-targeted projects. China’s nominal financial pledges at the Forum for China-Africa Cooperation (FOCAC) also declined. Declining Chinese lending coupled with increasingly tight international financial conditions will make it tougher for African countries to refinance their public debt, meet debt obligations, and finance essential development projects. In short, a Chinese economic slowdown and its transition presents significant challenges for Africa, a region which is currently grappling with the economic consequences of the pandemic and the Ukraine-Russia war. To put its economic growth back on track, Africa will need reduce its dependence on China and diversify its economic partners. Forging close partnerships with other countries of the Global South will also help the continent use the African Union’s seat at the G20 for economic revival and global financial reforms for a more equitable allocation of international finance.

Figure 2: Value of Chinese loans to Africa from 2000 to 2022 (in US$ billion)

Source: Global Development Policy Centre

Malancha Chakrabarty is a Senior Fellow and Deputy Director (Research) at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV

.png)

.png)