-

CENTRES

Progammes & Centres

Location

Much has been written about the crisis-hit Infrastructure Leasing and Financial Services (IL&FS) after the entity came across a liquidity crunch in recent times. According to the company’s 2018 Annual Report, total indebtedness (including outstanding interest) of IL&FS at the end of the last financial year stood at a staggering INR 164.68 billion. The company’s unexpected default on part of its debt has been subsequently followed by a take-over by the Union Government. Naturally, several questions are now being asked about the current state of affairs in the non-banking finance companies (NBFCs).

However, it seems that the resultant panic in the capital and money market impacted the credit channel of the economy adversely. Scheduled commercial banks (SCBs) are, in a way, the principal suppliers of all kinds of credit in the Indian economy, and a closer scrutiny of the trends in total credit disbursed by these SCBs is showing symptoms of a temporary choking of credit channel. Are we staring at a possible credit moratorium situation in the banking system?

Before delving into that macro-economic question, it will be prudent to look at the recent chain of events to gain a perspective and background of the problem.

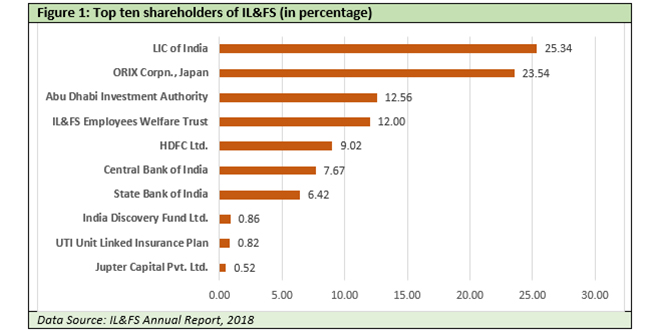

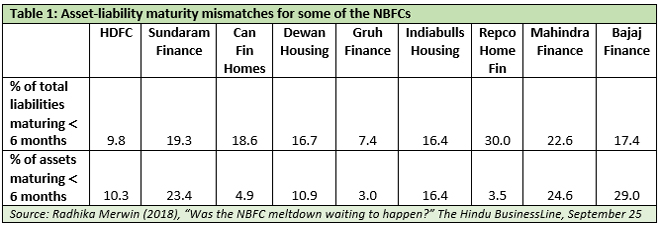

In the case of IL&FS, stalled infrastructure projects presumably played a role in blocking the cash inflows and precipitating the crisis, but there is a general trend among Indian NBFCs to have an asset-liability maturity mismatch in their balance sheets – as can be observed in Table 1. So, even if a full-fledged liquidity crisis does not materialise the NBFCs with wider mismatches will find it difficult to raise money from the debt or bond market as short term borrowing rates are on the rise under the current circumstances. And that has the potential to impact profitability of some of these NBFCs adversely. When market valuations of the NBFCs are widely expected to correct from its earlier “bubble levels”, raising short term funds from market for these NBFCs (to wither away short term payments problem) will be more difficult. In turn, the SCBs and/or their various financial subsidiaries will also get affected to a certain extent – depending upon their overall exposure to these NBFCs.Interestingly, shareholding pattern of IL&FS confirms the participation of state entities like LIC and State Bank of India (SBI) in ownership of NBFCs. Ironically, even a year back, NBFCs were being lauded as the “better managed financial institutions” compared to the public sector banks (PSU banks) – as PSU banks’ mounting NPA projected them as “badly managed” financial institutions. But, the reality is that the PSU banks and their financial services arms, along with other government owned entities like LIC, hold certain percentage of shares in the top NBFCs (in terms of turnover). Amount of these shareholdings may not be major in terms of percentage, but the ownership exposure of the SCBs and their group financing companies in these top NBFCs is quite substantial.

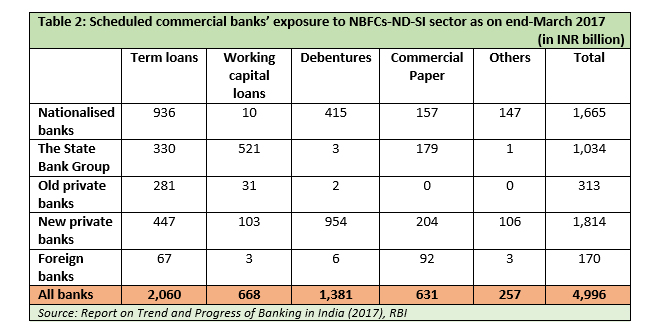

Second component of this dynamics between the banking sector and NBFCs is the SCBs’ exposure in debts of these NBFCs. According to the RBI Report on Trends and Progress of Banking in India, borrowings from the banks accounted for 21 percent of non-deposit taking systemically important NBFCs (NBFCs-ND-SI). These are the NBFCs which have an asset size of INR 5 billion or more. To put things into perspective, NBFCs-ND-SI constitute 86 percent of the total assets of the entire NBFC sector. Obviously, any liquidity crisis in the NBFC sector is likely to induce a panic in the banking sector even in terms of debt exposure – as can be seen from Table 2.

Therefore, the banking system has genuine reasons to worry about any possible fund crunch in the NBFC sector – due to both its contribution in ownership in many of these companies and its exposure in the debt component of these NBFCs. Moreover, quite a few banks – particularly the PSU banks – also contributed heavily to the individual infrastructure projects floated by these NBFCs in the past. As more infra projects get stalled in the economy, those contributions produce a third element of stress in the banking sector.

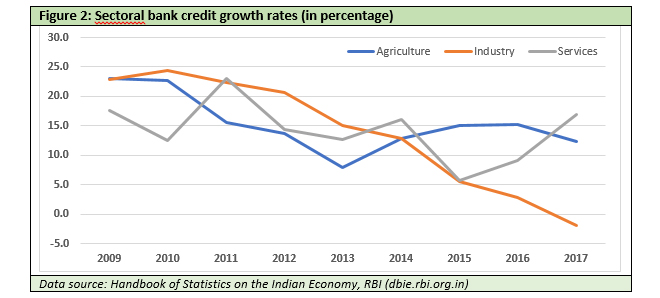

These three principal elements of stress, in all probability, created a nervousness in the banking system while disbursing credit. In any case, there has been a prevalent lack of credit demand persisting even earlier and that resulted into slowdown in industrial credit growth – as can be seen from Figure 2. But, the possibility of a fund crunch in the NBFC sector might have further aggravated the matter. Given the mounting non-performing assets (NPAs) already existing in the system, banks possibly are very apprehensive about disbursing substantial amount of credit to any economic agent.

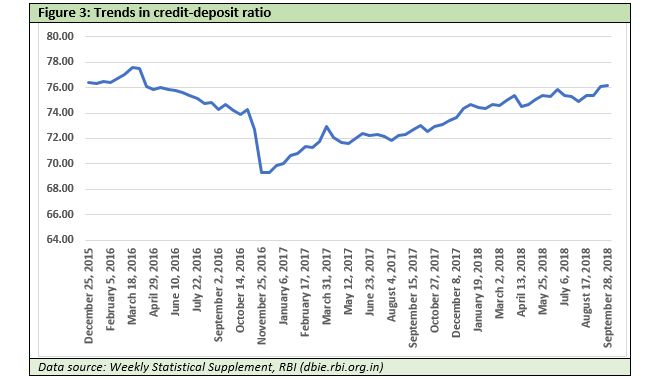

General trend in fortnightly movement in credit-deposit ratio of the SCBs broadly corroborates this contention, as can be seen in Figure 3. Credit-deposit ratio of the banking system had fallen down to its lowest at 69.29 in December 2016 – immediately after demonetisation hit the economy. Later, only by September 2018 it has clawed back roughly to the same level as on December 2015.

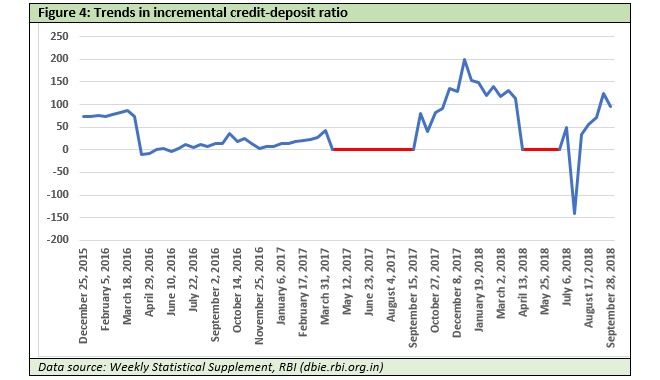

But the symptoms of credit choking become more clear if we look into the trends in the fortnightly incremental credit-deposit ratio of the banking system. A very low level movement during the period between December 2016 and September 2017 is of course signified by the imposition of demonetisation and GST implementation, after which incremental credit hit a real rough patch. But more alarming is repeat of the same trend in very recent times, particularly after April 2018. Normally September onwards is the festive season in the country and historically overall credit picks up healthily from this time till the calendar year-end, like it happened in 2017. Instead, we can see quite volatile movements in the incremental credit-deposit ratio, substantial part of it in the negative zone, till September 2018. By the way, the red lines in Figure 4 represent the figures where both numerator and denominator are negative. In other words, both incremental credit and incremental deposit were in negative. So, the ratios are positive in these red regions in spite of fall in both incremental credit and incremental deposit. That is why these ratios are omitted from the time-series for obvious reason. However, during a time when GDP figures are showing healthy trends – incremental total credit showing negative values and a simultaneous volatility in the trends are indeed red flags.

Needless to say, close monitoring of short term movements in incremental credit has become imperative under the current circumstances. Postponing the resolution of the NPAs in the banking system has already put enough burden on the banking system, and a credit moratorium triggered by NBFC liquidity crisis or some other reason has the potential to break the backbone of the economy. Since credit channel is the lifeline of any economy, any choking in that pipeline is going to have seismic effect across all sectors. Instead of adopting an ostrich-like stance, time has possibly arrived to acknowledge this monumental problem. Only then a resolution will follow. Otherwise, a credit moratorium in the banking system remains a distinct possibility.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Abhijit was Senior Fellow with ORFs Economy and Growth Programme. His main areas of research include macroeconomics and public policy with core research areas in ...

Read More +