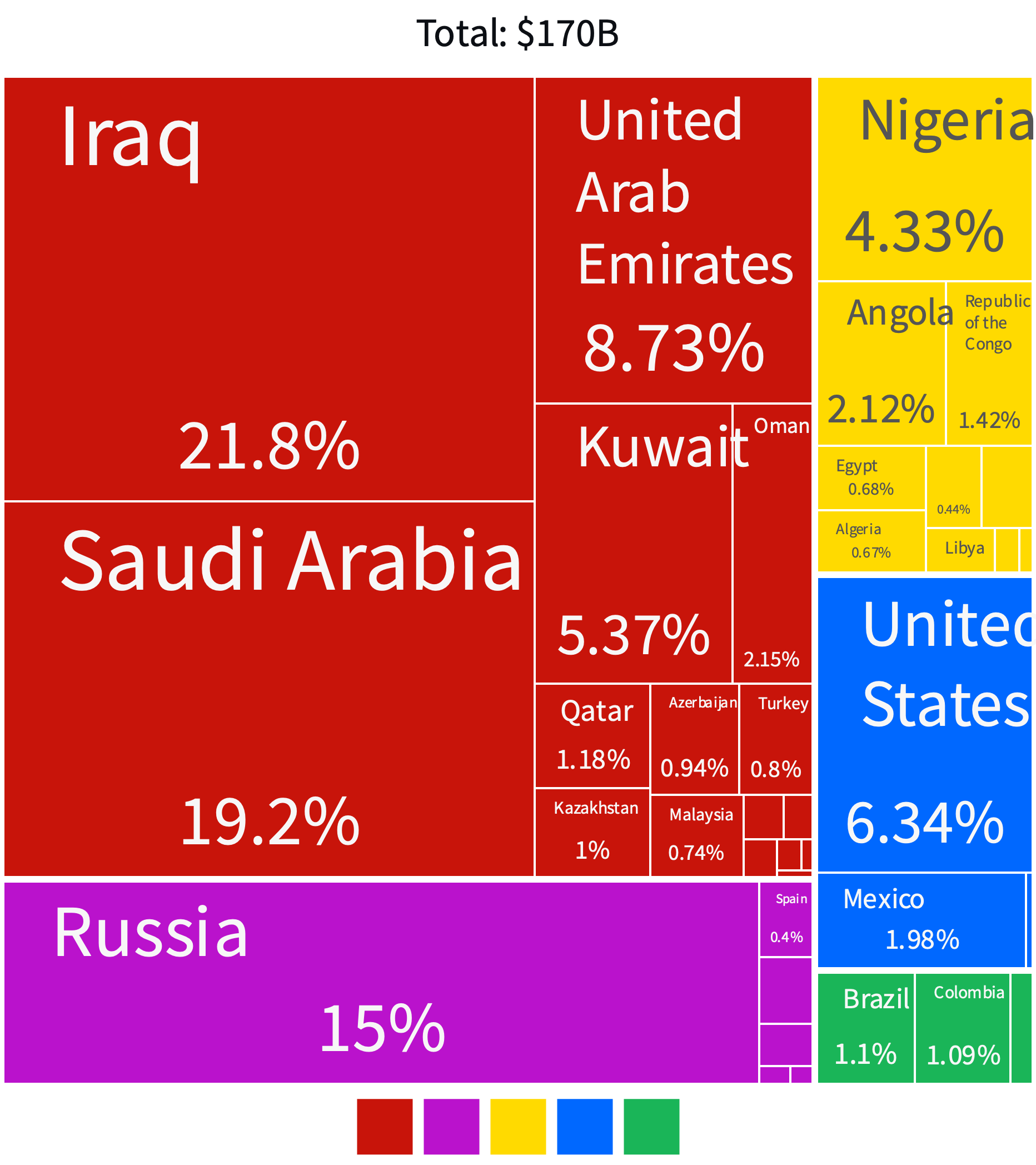

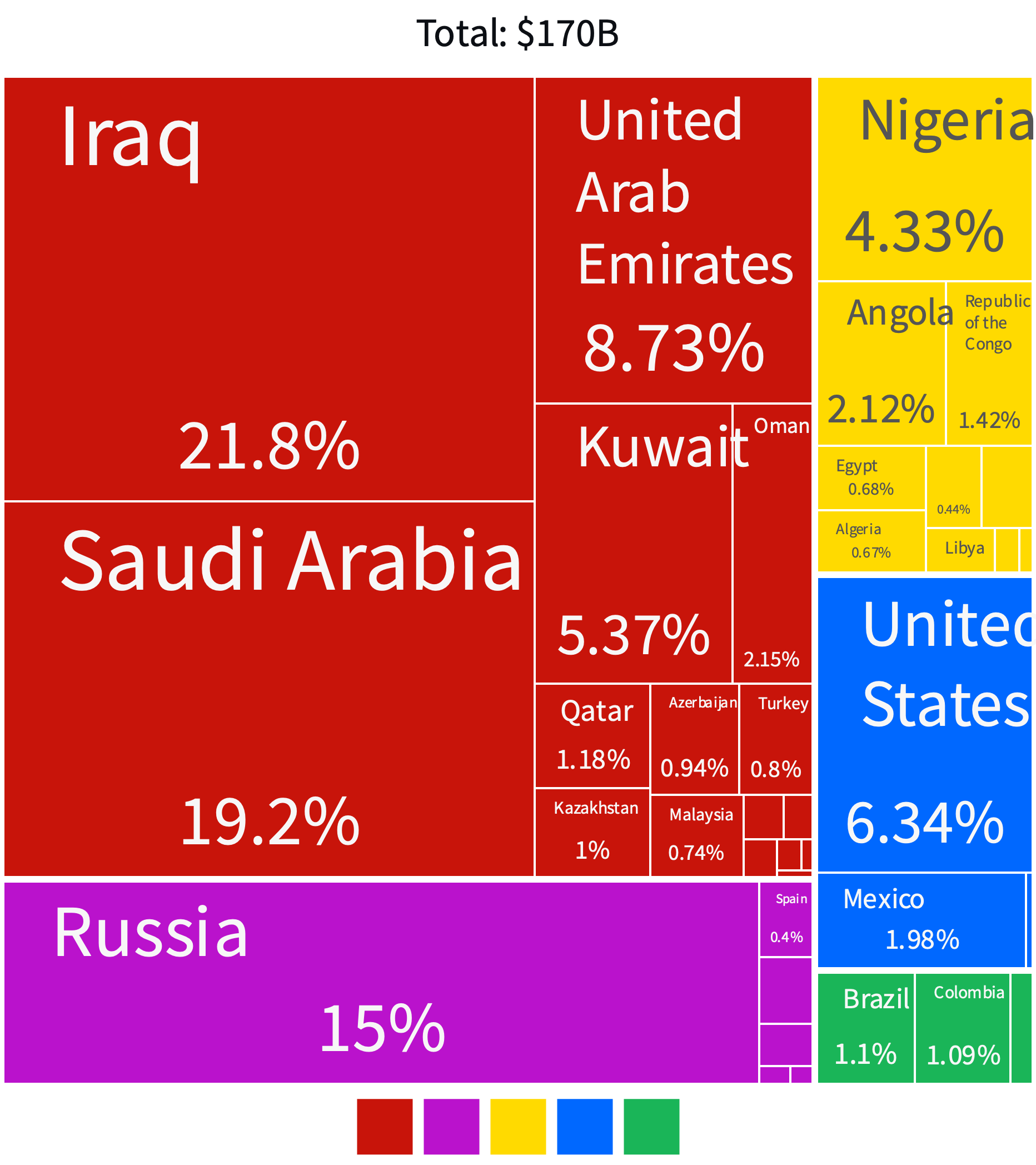

India is a pivotal player in global energy markets, often relying on strategic trade partnerships to fuel its growing economy. As the world's third-largest importer, India imported US$ 170 billion worth of crude petroleum in 2022, with 15 percent and 6.34 percent of these imports originating from Russia and the United States (US), respectively. However, amidst the tumultuous backdrop of the Russia-Ukraine conflict, India was at a crossroads, tasked with navigating the precarious balance between its energy security and global geopolitical tensions.

India's energy appetite is quite large, fuelled by its burgeoning population and rapid economic growth. With a significant portion of these energy needs reliant on imports, particularly oil and gas, has India's energy trade landscape witnessed a significant rewiring or stood relatively stable?

Situating India in the global energy landscape

The Russia-Ukraine war has cast a shadow over global energy markets. As two key players in the energy arena, any disruptions in the relationship between Russia and Ukraine reverberate worldwide, sending shockwaves through the delicate balance of supply and demand. India relies heavily on imported oil and gas to meet its energy needs, with a significant portion of these imports coming from Russia and Ukraine (and its Western allies).

As two key players in the energy arena, any disruptions in the relationship between Russia and Ukraine reverberate worldwide, sending shockwaves through the delicate balance of supply and demand.

The conflict between Russia and Ukraine has significantly impacted India's macroeconomic landscape and energy sector. This has been manifested primarily through fluctuations in oil and gas prices and concerns regarding the stability of energy imports. India witnessed a substantial increase in its imports of Russian oil, driven by discounted rates offered amidst the war. By the end of 2022, India had imported US$ 25.5 billion worth of crude oil from Russia, compared to a US$ 935 million import value for 2021.

Figure 1: India’s Crude Petroleum Import Partners for 2022 (in %)

Source: Observatory of Economic Complexity

For the fiscal year 2022-23, these imports had surged nearly 13 times compared to the previous fiscal year, making Russia India's second-largest crude oil supplier, contributing to approximately a third of India's oil imports by April 2023. While these discounted imports aided India in addressing its own macroeconomic challenges arising from escalating petroleum prices, they also bolstered the nation's export business, resulting in a notable increase in petroleum product exports. However, the reliance on Russian oil imports made India susceptible to the broader repercussions of the conflict on global energy markets.

The war exacerbated the volatility in global energy markets, particularly impacting oil and gas prices due to disruptions in the global supply chain. Any disruption in the supply chain due to geopolitical tensions can lead to volatility in oil and gas prices. With Russia's significant position as a major oil and gas supplier, its ability to influence markets by restricting supply led to a surge in prices worldwide.

India, heavily reliant on imported oil, faced immediate macroeconomic consequences. It experienced heightened inflation and energy costs due to these price hikes. Increased uncertainty prompted market speculation, causing prices to rise and straining India's fiscal budget and current account balance. The fluctuations in oil and gas prices also influenced the currency exchange rate. Depreciation of the Indian rupee against major currencies further exacerbated the cost of energy imports, potentially leading to inflationary pressures in the domestic economy.

With Russia's significant position as a major oil and gas supplier, its ability to influence markets by restricting supply led to a surge in prices worldwide.

Geopolitical tensions also often adds a risk premium to oil and gas prices, reflected in the market uncertainty and the perceived risk of supply disruptions. For example, Europe's transition away from Russian energy sources presented both opportunities and challenges in the global energy landscape, with European nations seeking alternative suppliers, including increased liquefied natural gas (LNG) imports from the United States.

However, the limited capacity to entirely replace Russian oil and gas due to infrastructure constraints contributed to sustained high prices, underscoring the intricate interplay of geopolitical dynamics and market forces on the energy sector's stability. Higher energy costs due to geopolitical factors then impact various sectors of the economy, including transportation, agriculture and manufacturing, bearing implications for India's GDP growth and employment levels.

Evolutions in India’s global trade dynamics

The Russia-Ukraine conflict has notably shaped India's trade relationships and economic engagements, particularly with the EU and the US, alongside its enduring connections with Russia. Traditionally, India has fostered robust ties with Russia, especially in the defence and energy sectors. However, the conflict's ripple effects, including Western sanctions on Russia, have indirectly impacted India's imports, particularly in defence and technology domains. Despite these hurdles, India has augmented its imports of discounted Russian oil, elevating Russia to a prime oil supplier by late 2022.

Concurrently, India's interactions with the EU and the US have undergone a nuanced evolution. Initially expecting a firm stance against Russia, these Western powers have acknowledged India's strategic imperatives, considering its reliance on Russian military hardware. Dialogues with EU officials and strategic military deliberations with the US signal a shift towards fortified defence collaborations, potentially reducing India's dependence on Russian military imports.

India's pragmatic stance, prioritising long-term peace and stability interests over wholesale alignment with any single bloc, underscores its commitment to navigating the pressures from traditional allies and emerging global partnerships.

India's foreign trade and economic strategy amid the Russia-Ukraine war reflect a delicate balancing act between historical affiliations, contemporary geopolitical exigencies, and future strategic positioning within the global arena. This approach is characterised by a cautious alignment aimed at preserving strategic autonomy amidst the complexities of regional dynamics, including relations with neighbouring China and broader Indo-Pacific strategies. India's pragmatic stance, prioritising long-term peace and stability interests over wholesale alignment with any single bloc, underscores its commitment to navigating the pressures from traditional allies and emerging global partnerships. Moreover, the conflict's impact on international trade dynamics, manifested through changes in commodity prices and trade volumes, accentuates India's need to navigate a shifting economic landscape while safeguarding its national interests amidst geopolitical upheavals.

India's energy trade landscape has undoubtedly been profoundly impacted by the undercurrents of the Russia-Ukraine war. The surge in discounted Russian oil imports, while initially alleviating India's macroeconomic challenges, also underscored the nation's vulnerability to fluctuations in global energy prices. Moreover, the ripple effect of the conflict on India's economic engagements with the rest of the world has further impressed that India must remain steadfast in its commitment to safeguarding its national interests while embracing the opportunities and challenges presented by evolving trade dynamics. In this balancing act, India's pragmatic approach to resilience and adaptability in the face of geopolitical upheavals positions it as a key player in shaping the future of global markets.

Debosmita Sarkar is a Junior Fellow with the Sustainable Development and Inclusive Growth Programme Centre for New Economic Diplomacy at Observer Research Foundation.

Soumya Bhowmick is an Associate Fellow at the Centre for New Economic Diplomacy, Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV

.png)

.png)