Background

China leads the world in the export of honey. The second leading exporting country isn’t among the usual suspects of the United States (US), India, or Brazil. Ordinarily, countries which have plenty of arable land would have high agricultural exports. However, in honey, China’s closest competitor is New Zealand which exported US $265 million of honey in 2022 trailing just a little short of China’s US $277 million. While the export numbers are similar, the country strategies could not be more different.

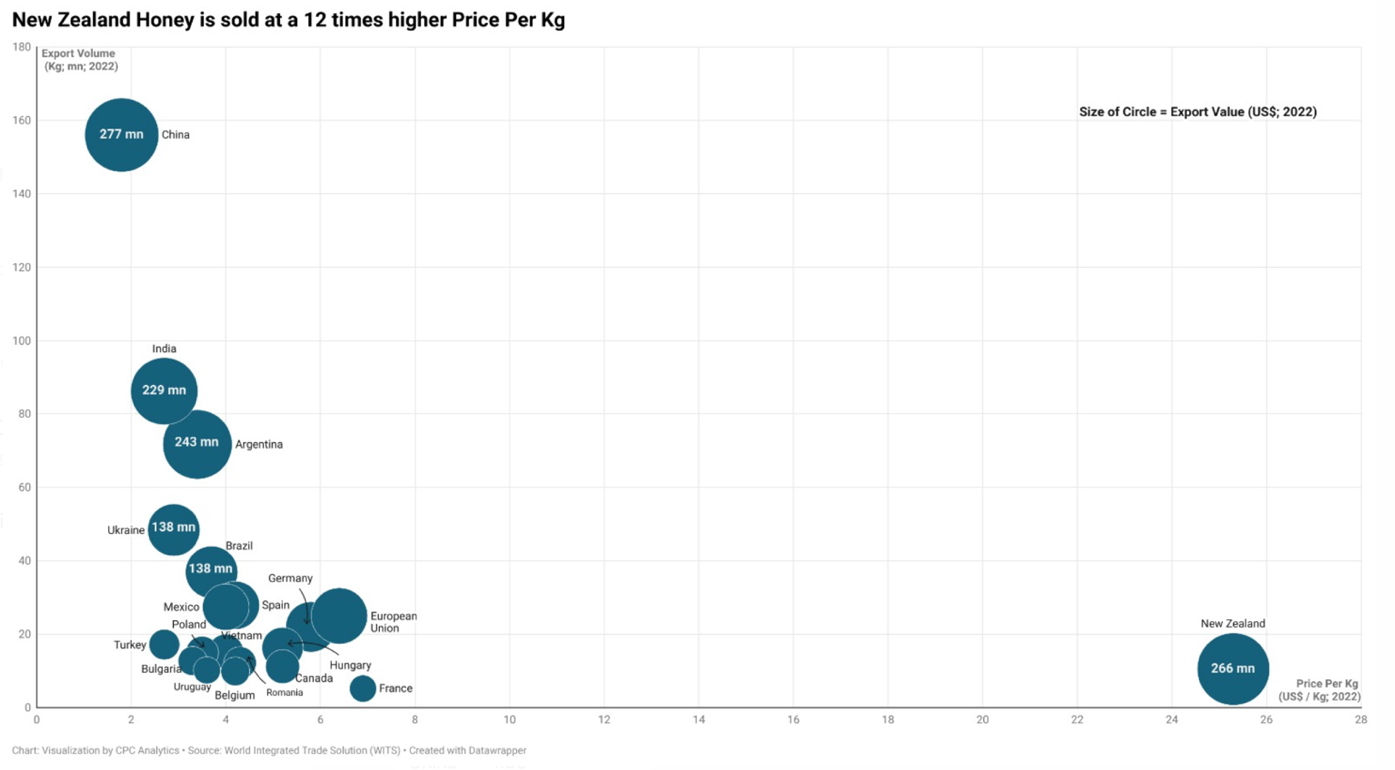

In 2022, China exported a whopping 156,000 MT of honey, at an average price of US $1.8/kg. In contrast, New Zealand exported a mere 10,400 MT of honey, at an average price of US $25.3/kg. This indicates that New Zealand honey sells at a 14 times higher price than Chinese honey. Thus, while China exports huge volumes of cheap honey, New Zealand exports much smaller volumes of luxury honey.

Figure 1: Export volumes and average prices of honey in 2022

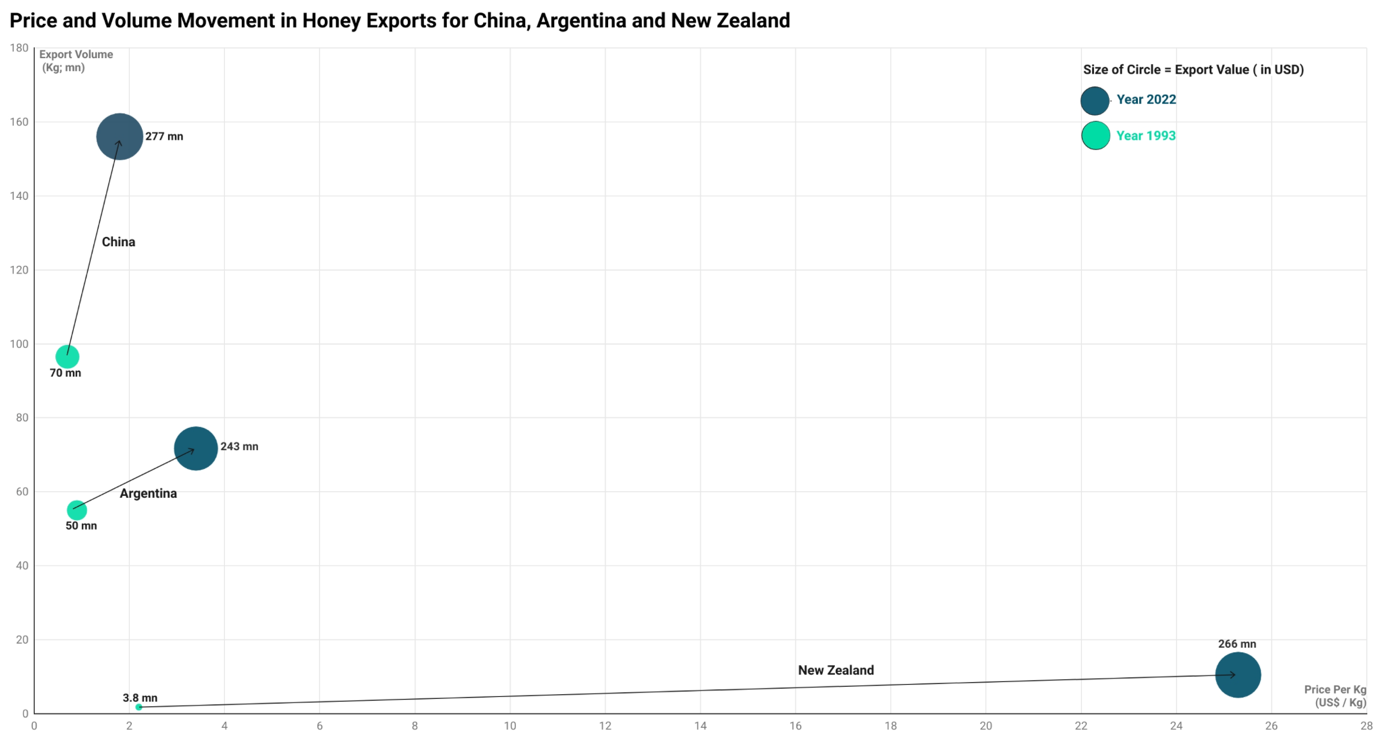

New Zealand was not always at the top when it came to honey exports. In the year 1993, China was exporting honey worth US $70 million while New Zealand was exporting a mere US $3.8 million. New Zealand honey was selling at a 3x premium to Chinese honey, but nowhere near the levels seen today.

New Zealand was not always at the top when it came to honey exports. In the year 1993, China was exporting honey worth US $ 70 million while New Zealand was exporting a mere US $3.8 million.

New Zealand’s success in premiumization can be understood by comparing it against another competitor—Argentina. In 1993, Argentina was second in honey exports, accounting for US $50 million worth of honey exports at a price premium of 1.25x of China. By 2022, its price premium only grew to 1.9x times that of China, as against New Zealand’s 14x. New Zealand’s successful premiumization is unique and has accounted for 80 percent of its export value growth. Multiple initiatives by the New Zealand government have supported the growth of this fragmented industry.

Figure 2: Price and Volume Movement in Honey Exports

Source: Natural Honey Exports by Country, World Integrated Trade Solution

Understanding New Zealand’s governmental initiatives

Leveraging a geographical advantage:

Honeybees were introduced to New Zealand in the year 1839. They feed on a plant called Leptospermum scoparium or Manuka. This plant is found only in New Zealand and Australia, and it flowers for only 2-6 weeks a year, making Manuka honey a scarce product. This scarcity and initial interest in its unique properties helped create the initial export successes for the industry in the 1980s and 1990s. The domestic industry’s success in international markets was noted and subsequently boosted through multiple governmental initiatives.

The stick:

New Zealand has adopted a ‘carrot and stick’ approach towards boosting the honey industry. On one hand, the production system is tightly regulated. All beekeepers and apiary sites are mandated to be registered with the government. The government maintains records for every apiary site rigorously, and every box of honey is expected to be traceable with unique beekeeper identification or other equivalent codes. Further, producers can only call their product ‘manuka honey’ if it meets meticulous quality standards. Each batch of honey in a consignment needs to be tested at an authorized laboratory for four chemical markers and a DNA test as well. Given that manuka honey is regarded as a luxury item, ensuring stringent control over its quality is paramount. Thus, while government licensing is ordinarily thought of as a ‘taboo’, in this specific context it makes sense to maintain the high standards expected from a luxury good.

The carrot:

The New Zealand government has actively partnered with industry players to grow the market for their honey. Through its ‘Trade and Enterprise’ division, the State championed the formation of an industry association to identify opportunities for Manuka honey in the late 1990s. Now known as ‘The Unique Manuka Factor Honey Association’, this organization has developed the Unique Manuka Factor (UMF™)—a quality mark and rating. These standards are higher than the minimum norms of the government. Producers who meet them can use the UMF trademark for branding purposes and can participate in government marketing promotions. In 2011, the government also funded a multi-year programme through the Private-Public Partnership model to increase yield, make supply more reliable, and move the industry towards a more scientific model. Starting in 2015, the New Zealand government provided financial aid and support to their industry to fight a legal case against Australian producers who were using the name ‘Manuka Honey’.

The New Zealand government has actively partnered with industry players to grow the market for their honey. Through its ‘Trade and Enterprise’ division, the State championed the formation of an industry association to identify opportunities for Manuka honey in the late 1990s.

Figure 3: Unique Manuka Factor

Source: Official Website of Unique Manuka Factor

Rigorous research:

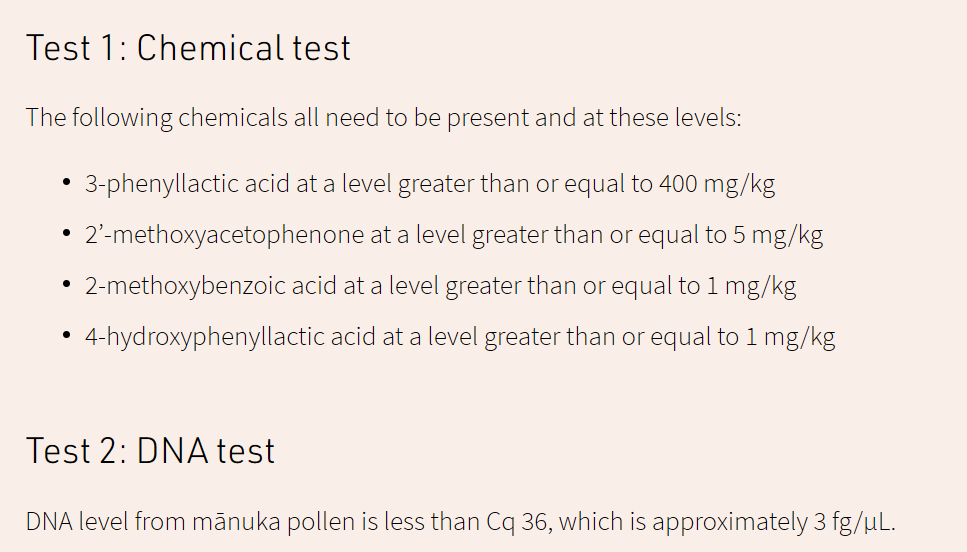

To protect the industry against adulteration, a government-funded research identified unique markers to authenticate Manuka honey. Honey adulteration is a pervasive global problem, and ensuring authenticity was crucial towards maintaining the image and quality of the product. The Ministry of Primary Industries in New Zealand undertook a three-year scientific programme to develop the criteria for the identification of genuine Manuka honey. The ministry consulted local and international experts, tested over 800 samples across 7 production years, tested 700 plants, utilised advanced statistical models, identified markers, and tested the markers for reliability and accuracy. This research led to the standards-setting for the Manuka honey we know today. Some of the current government programmes include the training of PhD-qualified scientists skilled in Manuka research and the funding of research projects at universities.

To protect the industry against adulteration, a government-funded research identified unique markers to authenticate Manuka honey. Honey adulteration is a pervasive global problem, and ensuring authenticity was crucial towards maintaining the image and quality of the product.

Figure 4: Tests and research

Source: Tests, research

Beyond scientific research, extensive market research has also been carried out through a government-industry partnership. This identified the major export markets that were under-tapped, as well as potential competitors in the ‘premium honey’ segment. Akin to private sector firms, the research garnered on-ground retail inputs including the price premium at retailers in export markets and the shelf presence at supermarkets, as well as the potential growth opportunities in linked consumer segments.

Long-term efforts:

For the long-term sustainability of the Manuka plantations, in 2020, the Manuka Charitable Trust was established with governmental support. In 2023-24, with a view towards the future, the government also funded the development of a strategic vision for and by the industry to take it to New Zealand US$1 billion by 2030.

Conclusion

In a world dominated by cheap and adulterated honey, New Zealand exports high-value honey. This strategy has helped them compete with China while having less than 1 percent of their arable land. Many learnings can be drawn from New Zealand’s strategies for promoting sectors that are fragmented and require common branding and investment. The New Zealand government invested aggressively in a sector that showed initial successes. Crucially, most initiatives were taken in partnership with the industry—from licensing, creating an industry trademark, market research and scientific research, to fighting for exclusive intellectual property rights.

Similarly, for sectors in India, where private players are not large enough to invest on their own, similar support could be provided in partnership with the industry. Investment in research and development for defining and maintaining the quality of the product, and providing support to the existing industries to meet these standards is necessary. Lastly, supporting high-quality producers through strategic marketing and trademarking can bring longer-term gains to those producers. This model of close partnership of the New Zealand government with their industry stakeholders, to enhance exports is worth studying and emulating.

Omkar Sathe is a partner at CPC Analytics.

The author would like to acknowledge the contributions of Atharv Shirode and Ovee Karwa for research and data visualisation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV

.png)

.png)