.png)

As the war stretches on in Eastern Europe into its third year, Russian forces have made some important advances. Ukrainian forces have been replenished with a United States (US) aid package worth US$60 million and an additional US$225 million in ammunition, along with the new aid packages received from three European Union countries and the United States, worth US$1 billion and US$1.5 billion, respectively. The Geneva peace talks—to which Russia was not invited—have not yielded any considerable outcome. Along with the funds, Ukraine will receive 30 F-16 fighter jets from Belgium. This has resulted in the escalation of the conflict with Moscow, not ruling out the possibility of a nuclear escalation. Since the West cannot directly intervene in the defence of Ukraine by sending troops, economic warfare through sanctions has been employed by the West to drain the Kremlin coffers.

The potency of sanctions is directly proportional to Russian aggression in Ukraine. The European Union is rolling out its 14th round of sanctions, which, among other restrictions, outline sanctions on Russian Liquified Natural Gas, which is among Russia’s largest exports.

The potency of sanctions is directly proportional to Russian aggression in Ukraine. The European Union is rolling out its 14th round of sanctions, which, among other restrictions, outline sanctions on Russian Liquified Natural Gas, which is among Russia’s largest exports. Therefore, in light of the increasing number of sanctions against Russia, the question emerges: Are sanctions working against Russia?

Sanctions against Russia: An evolution

Russia is the most sanctioned country in the world, with more than 16,000 sanctions imposed against it. And over time, the intensity of sanctions has varied. The first set of sanctions since 2014, after the annexation of Crimea, included visa restrictions on individuals, travel bans, asset freezes on the Kremlin elite, and limited restrictions on the Russian economy's energy, defence, and financial sectors. Before the war in Ukraine, the compliance factor for these sanctions was not uniform and not easily enforceable. Not to mention discriminatory; for instance, in the US, non-American firms were slapped with hefty fines in cases of sanctions non-compliance. American firms violating sanctions were fined marginally lower sums and were often contested in American courts.

Since the invasion of Ukraine in February 2022, the sanctions slapped on Russia were much more intensive and aimed to financially cripple Russia from funding its war machine. Four major Russian banks, VTB, Sovcombank, Novikombank, and Otkritie Financial Group, were sanctioned. Over time, several major Russian banks and their subsidiaries were hit with sanctions and were excluded from the SWIFT payment system. Export bans were put in place on critical-industry technology, software, and equipment, and asset freezes on the Kremlin elite and oligarchs. By December 2022, the G7 set up a price cap of US$60 on Russian oil. With export revenue shrinking because of sanctions and increasing imports, the ruble devalued in the middle of 2023. This did not radically alter the living standard as wages and pensions were hiked.

Since the invasion of Ukraine in February 2022, the sanctions slapped on Russia were much more intensive and aimed to financially cripple Russia from funding its war machine.

The 11th round of EU sanctions included measures to prevent countries and companies from circumventing sanctions, which was strengthened in the following rounds, as companies partaking in the parallel import of electronic components were identified and sanctioned in the 13th round of sanctions in February 2024. The screws were further tightened as the EU even set minimum standards for criminal prosecution for the violation of sanctions. The death of Alexey Navalny in February this year resulted in the US imposing 500 additional sanctions on Russia.

Sanctions on Russian LNG

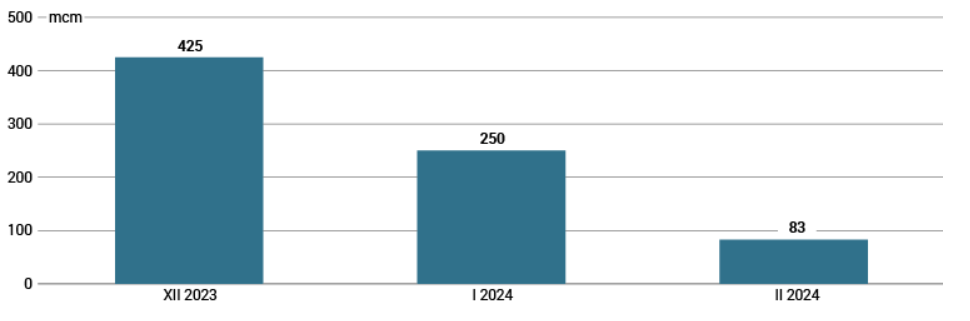

The proposed 14th round of EU sanctions would be another blow for Moscow as it not only aims to sanction the transhipment of Russian LNG but would ban EU countries from re-exporting LNG through European terminals. In November last year, the US sanctioned three LNG projects: Arctic LNG-2, Ust-Luga, and Murmansk. This led to foreign stakeholders pulling out of these projects. Further sanctions were imposed on the Zvezda shipyard to curtail Russia’s ability to build icebreaking LNG carriers to export LNG. Recently. The US treasury department recently proposed sanctioning Obsky LNG, Arctic LNG-1, Arctic LNG-3, and companies building pipeline infrastructure for Murmansk LNG and Vostok oil and considering Russia’s limitations in pipeline technology and its reliance on the Western companies, sanctions could have an impact on the future Russian LNG projects.

Since 2022, Europe has reduced natural gas consumption from Russia and now depends on LNG, which comes from Russia, Qatar, the US, and other sources. This has led to several European LNG terminal ports, such as Zeebrugge in the Netherlands, becoming the hub for receiving Russian LNG. Some European countries, such as Hungary, still purchase natural gas from Russia, whose energy value chains are embedded with Russia’s, as their domestic energy industry has heavily relied on Russia since Soviet times.

Figure 1.1: Arctic LNG 2’s monthly LNG production between December 2023 and February 2024

Source: OSW, Centre for Eastern Studies

Have sanctions worked?

Sanctions have impacted Russia but not in the way expected. The Russian economy was configuring itself to work under sanctions. The government divided the economy into sectors: Profit-generating sectors—hydrocarbons, metals, minerals, agriculture, etc. and rent-dependent sectors—automobiles, aviation, shipbuilding, pensions, and equipment-intensive sectors—these sectors are import intensive. In 2015, import substitution policies were introduced across the sectors with targets for 2030. The global energy demand and the threat of price inflation in the commodities markets resulted in the West overlooking nations buying and refining Russian oil. Russia was able to find markets for its goods, but the margin of profits has been declining. Some sectors have been hit worse than others. For instance, in aviation, a domestically produced aircraft, such as the Sukhoi Superjet 100 series, would require over 70 percent of its components to be imported from countries that have imposed sanctions on Russia. Despite these challenges, Russia has cushioned the impact of sanctions, as not all countries have joined the sanctions regime against Moscow. At the outset, all countries connected to the Western financial landscape comply with some forms of sanctions, such as financial sanctions or import restrictions on dual-use goods. Since early this year, Russia’s closest partner, Beijing, has stopped processing ruble transactions due to the threat of secondary sanctions. Despite sanctions, trade between Moscow and Beijing skyrocketed to US$240 billion last year. Similarly, with New Delhi, trade, which hovered around US$10-US$13 billion before the war, surged to US$65 billion in FY2023.

Role of the central bank

Secondly, the role of the central bank has been crucial in giving sanctions a soft landing in Russia. In the first months of the war, interest rates were temporarily hiked to 20 percent, and firms were restricted from transferring funds overseas, which arrested capital flight. Further, firms had to convert 80 percent of their foreign revenues into rubles. Such capital control laws led to the Ruble's ability to absorb the shocks. According to Alexandra Prokopenko, a fellow from the Carnegie Russia Eurasia Centre, Putin is faced with three major tasks: To continue financing the war while ensuring that the standard of living of the general population does not drop drastically, all while ensuring that the economy does not lose its macroeconomic balance. This is difficult to attain as these tasks contradict each other.

In the first months of the war, interest rates were temporarily hiked to 20 percent, and firms were restricted from transferring funds overseas, which arrested capital flight. Further, firms had to convert 80 percent of their foreign revenues into rubles. Such capital control laws led to the Ruble's ability to absorb the shocks.

Even though sanctions persist, employment levels in the country have been at an all-time high; this is due to Russia’s economic re-configuration as a war economy and increasing industrial demand due to the Ukraine war. However, the increasing spending on enhancing the capabilities of the military-industrial complex and rebuilding the new regions in Ukraine will not only increase inflation but spur a kind of economic growth that will eventually stagnate the economy. The increasing tranches of sanctions on Russian LNG certainly can cause worry for Moscow, as it can potentially shrink its export revenues as its imports increase.

Conclusion

On 13 June, Germany expressed their concerns about implementing this sanctions package as a few German companies could be held liable for violating sanctions. Global energy markets work on supply and demand factors. Even if sanctions are imposed on LNG, the production capacity would have to rise to meet the demand. Qatar, a major gas exporter, does not have additional capabilities to export LNG to new buyers till 2027, and given that energy security is a national priority, ways are often found to circumvent sanctions or gain exemptions. Sanctions against Russia are working, but unlike Iran or North Korea, the elements of national power; population size, resource basket, and wealth—are in favour of Russia, which sustains its role as a global energy exporter. This means that the 45 countries that sanctioned Russia would have to globally isolate the latter first to make sanctions work. Since it is not likely to happen in the short term, the lives of ordinary Russians may not radically change just yet.

Rajoli Siddharth Jayaprakash is a Research Assistant with the Strategic Studies Programme at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

.png)

PREV

PREV